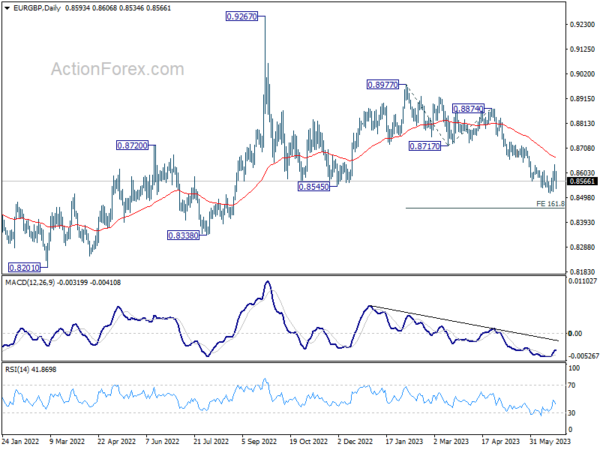

EUR/GBP’s rebound was limited at 0.8635 last week and quickly reversed. The development keeps near term outlook bearish. Initial bias stays neutral this week first. Break of 0.8517 will resume the fall from 0.8977 to 161.8% projection of 0.8977 to 0.8717 from 0.8874 at 0.8453. Nevertheless, decisive break of 0.8635 will confirm short term bottoming, and bring stronger rebound to 55 D EMA (now at 0.8666) and above.

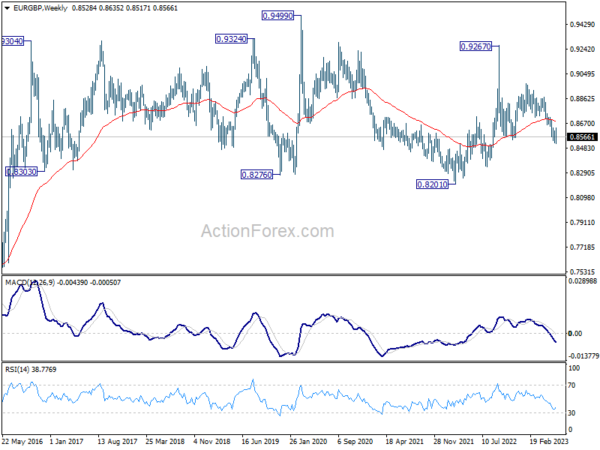

In the bigger picture, the down trend from 0.9267 (2022 high) is still in progress. It’s seen as part of the long term range pattern from 0.9499 (2020 high). Deeper fall would be seen towards 0.8201 (2022 low). But strong support should be seen from there to bring reversal. This will now remain the favored case as long as 0.8717 support turned resistance holds.

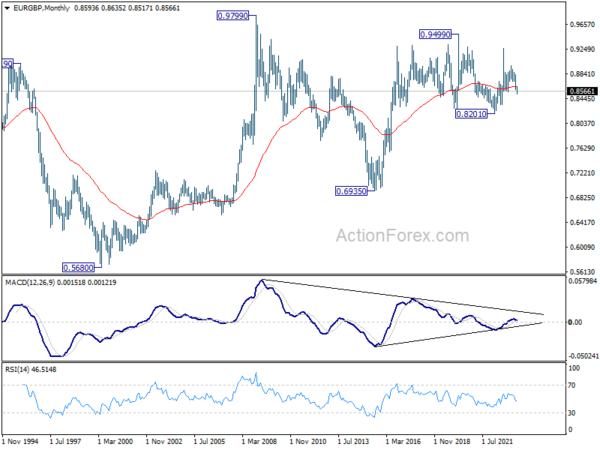

In the long term picture, long term range pattern is extending. But rise from 0.6935 (2015 low) is expected to extend at a later stage, to 0.9799 (2009 high).