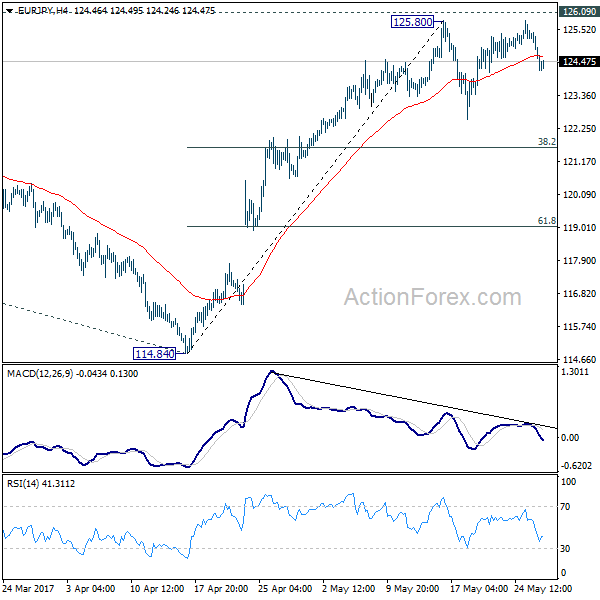

EUR/JPY’s rally attempt was limited at 125.80 last week and retreated since then. The development suggests that consolidation from 125.80 is still in progress and is starting another falling leg. Initial bias stays neutral this week first. Deeper fall could be seen but downside should be 38.2% retracement of 114.84 to 125.80 at 121.61 to bring rise resumption. We’re staying mildly bullish in the cross. And, break of 126.09 key resistance will extend the whole rebound from 109.03 to 100% projection of 109.03 to 124.08 from 114.84 at 129.89.

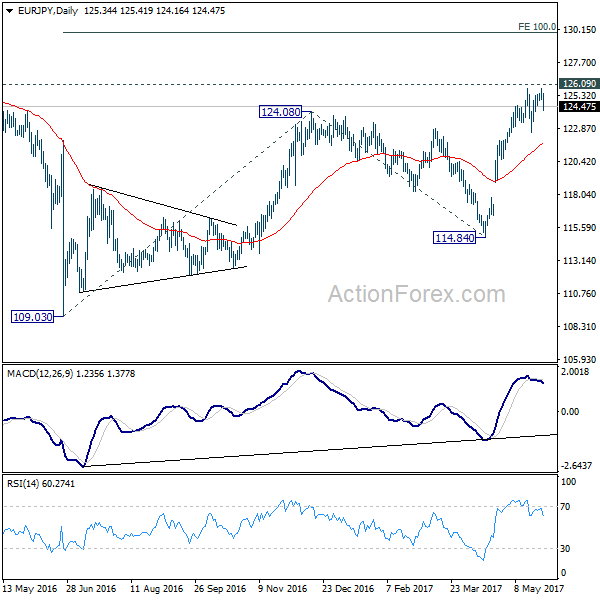

In the bigger picture, focus is back on 126.09 support turned resistance. Decisive break there will confirm completion of the down trend from 149.76. And in such case, rise from 109.20 is at the same degree and should target 141.04 resistance and above. Meanwhile, rejection from 126.09 and break of 114.84 will extend the fall from 149.76 through 109.20 low.

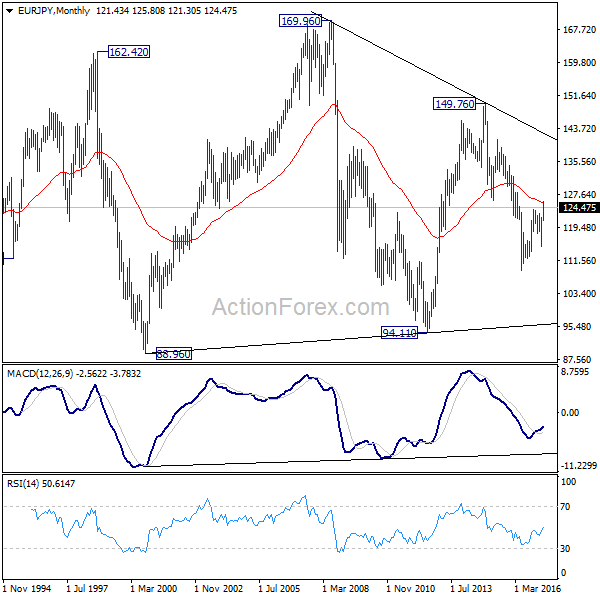

In the long term picture, medium term decline from 149.76 is seen as part of a long term sideway pattern from 88.96. We’re not seeing any sign of an established long term trend yet. Hence, we’ll be cautious on strong support at 94.11 in case of another fall. Also, there could be strong resistance at 149.76 in case of a medium term rise.