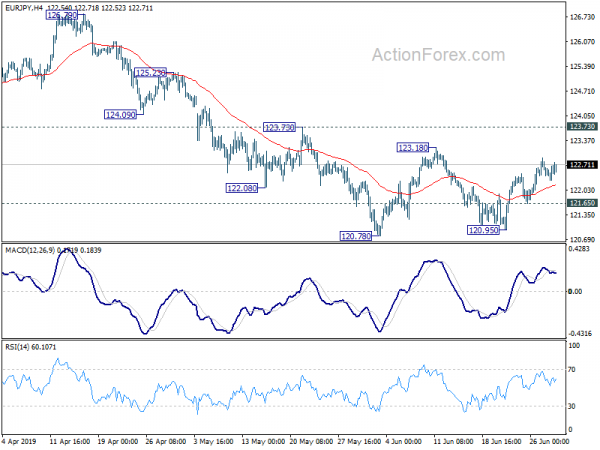

EUR/JPY recovered further last week as consolidations from 120.78 extended. Further rise could be seen initially this week. But upside should be limited by 123.73 resistance to bring larger fall resumption. On the downside, below 121.65 minor support will turn bias to the downside for 120.78 low. Decisive break there will resume the decline from 127.50 and target 118.62 low next.

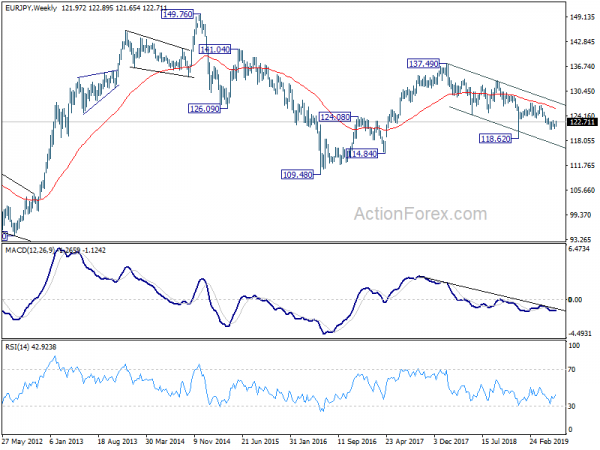

In the bigger picture, down trend from 137.49 is still in progress with the cross staying inside long term falling channel. Break of 118.62 will extend the fall to 109.48 (2016 low). On the upside, break of 127.50 resistance is needed to be the first sign of medium term reversal. Otherwise, outlook will remain bearish in case of strong rebound.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Fall from 137.49 is seen as a falling leg inside the pattern. Break of 118.62 will extend this falling leg through 109.48 (2016 low). With EUR/JPY staying below 55 month EMA, this is now the preferred case.