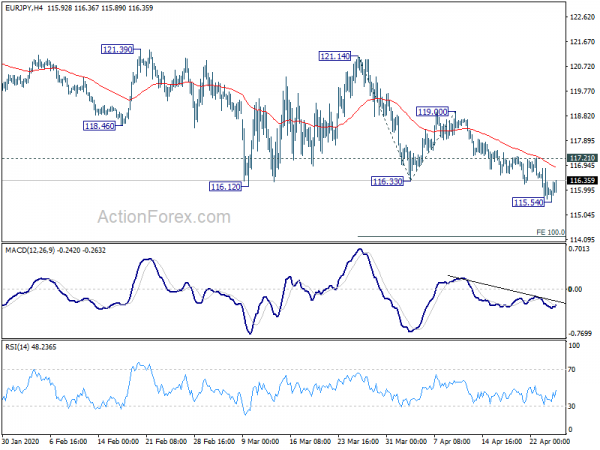

EUR/JPY dropped to as low as 115.54 last week and the break of 116.12 support confirms resumption of fall from 122.87. More importantly, break of 115.86 low suggests larger down trend resumption. Nevertheless, as a temporary low was formed with subsequently, initial bias is neutral this week for consolidations first. Upside should be limited by 117.21 resistance to bring fall resumption. Break of 115.54 will target 100% projection of 121.14 to 116.33 from 119.00 at 114.19 next.

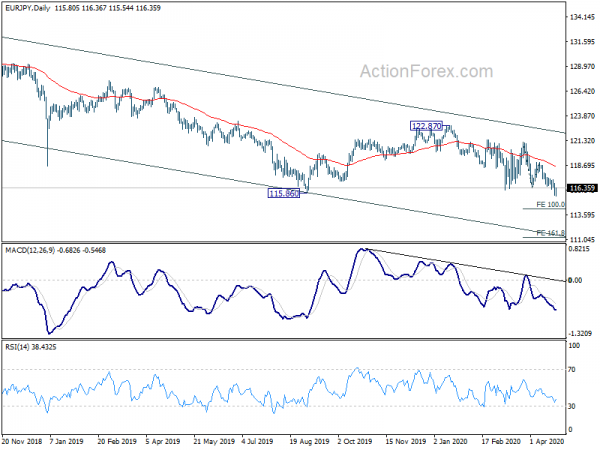

In the bigger picture, down trend from 137.49 (2018 high) is possibly resuming. Medium term bearishness is maintained with the cross staying well inside falling channel established since 137.49 (2018 high), as well as below falling 55 week EMA. Next downside target will be 109.48 (2016 low). In any case, outlook will remain bearish as long as 122.87 resistance holds, in case of rebound.

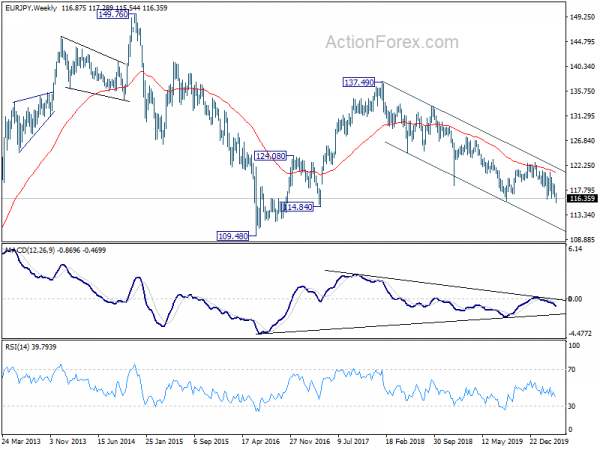

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Fall from 137.49 is seen as a falling leg inside the pattern. This falling leg would target 109.48 (2016 low). With EUR/JPY staying below 55 month EMA (now at 124.80), this is the preferred case.