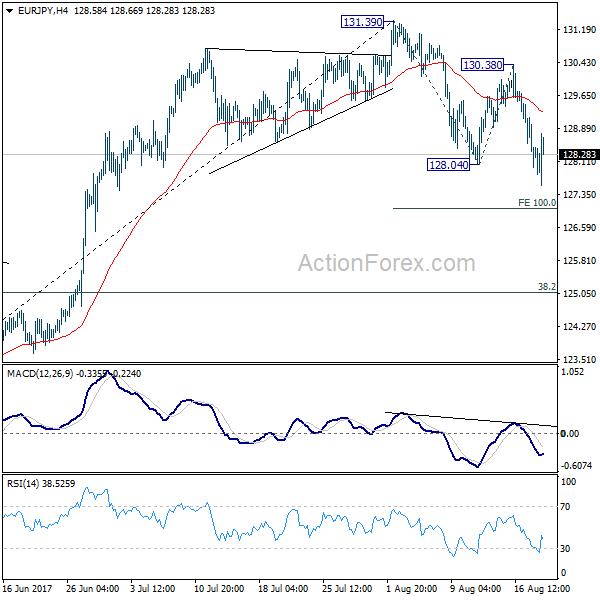

EUR/JPY’s correction from 131.39 resumed last week and reached as low as 127.55. While it is drawing support from 55 day EMA, the break of channel support argues that fall from 131.39 is correcting whole rise from 141.84. Initial bias remains on the downside this week for deeper decline. The fall from 131.39 might now target 38.2% retracement of 114.84 to 131.39 at 125.05 before completion. On the upside, break of 130.38 resistance is needed to confirm completion of the pull back. Otherwise, deeper decline is expected even in case of recovery.

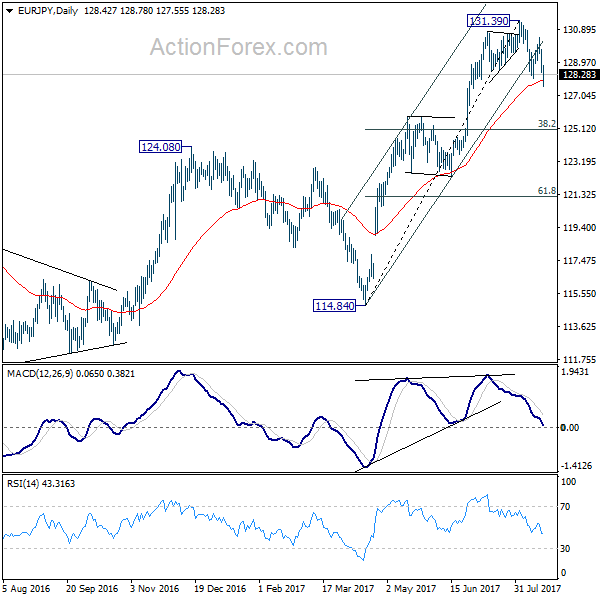

In the bigger picture, the down trend from 149.76 (2014 high) is completed at 109.03 (2016 low). Current rally from 109.03 should be at the same degree as the fall from 149.76 to 109.03. Further rise is expected to 61.8% retracement of 149.76 to 109.03 at 134.20. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. Medium term outlook will remain bullish as long as 124.08 resistance turned support holds. However, firm break of 124.08 will argue that rise from 109.03 is completed and turn outlook bearish.

In the long term picture, at this point, there is no clear indication that rise from 109.03 is resuming that from 94.11. Hence, we’d be cautious on topping below 149.76 to extend range trading. Nonetheless, firm break of 149.76 will indicates strong underlying buying. In such case, EUR/JPY will target 100% projection of 94.11 to 149.76 from 109.03 at 164.68.