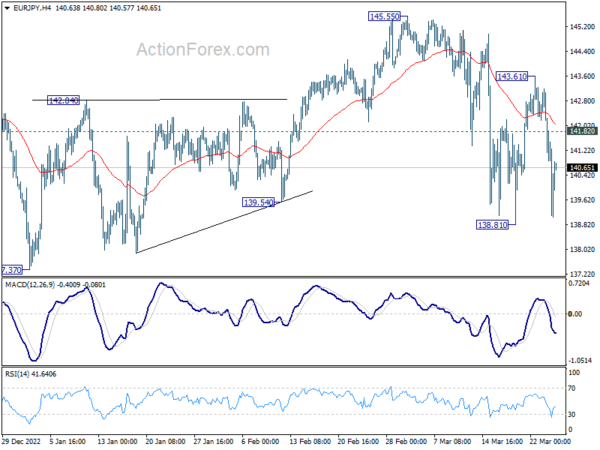

EUR/JPY’s rebound from 138.81 was stronger than expected. But subsequent steep decline from 143.61 affirmed the bearish case. That is, fall from 145.55 is a leg inside the whole corrective decline from 148.38. Risk will now remain on the downside as long as 143.61 resistance holds. Below 138.81 will target 137.37 low, and then 135.40 fibonacci level.

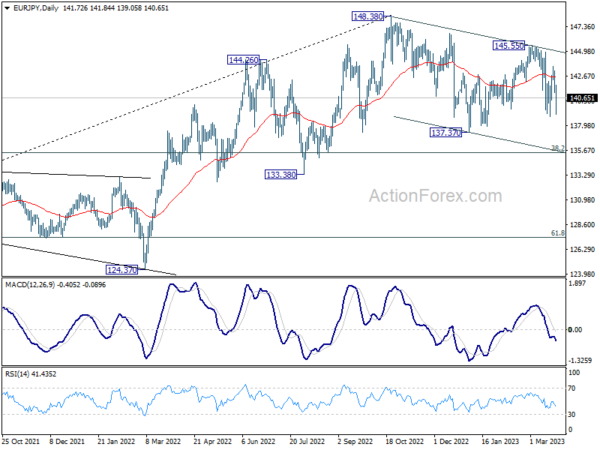

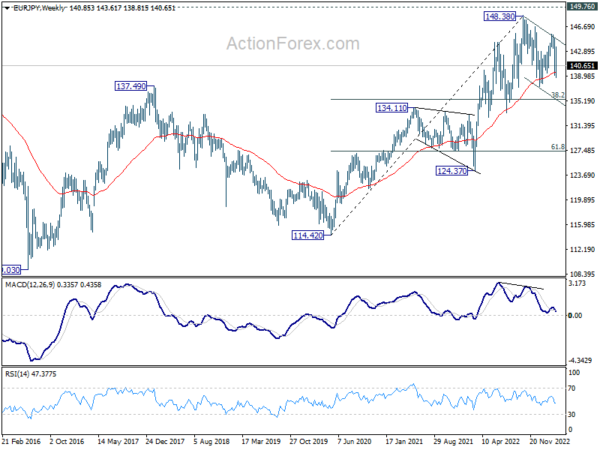

In the bigger picture, as long as 55 week EMA (now at 139.58) holds, larger up trend from 114.42 (2020 low) is still in progress for 149.76 long term resistance. However, sustained break of 55 week EMA will bring deeper fall to 38.2% retracement of 114.42 to 148.38 at 135.40. Decisive break there will raise the chance of trend reversal, and target 61.8% retracement at 127.39.

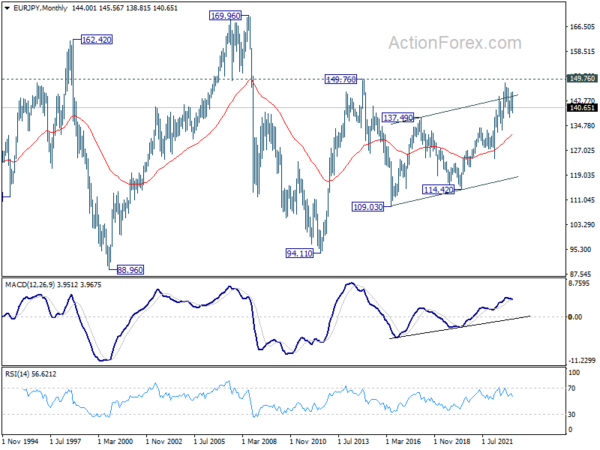

In the long term picture, outlook will stay bullish as long as 134.11 resistance turned support holds (2021 high). Sustained break of 149.76 (2014 high) will open up further rally, as resumption of the rise from 94.11 (2012 low), towards 169.96 (2008 high).