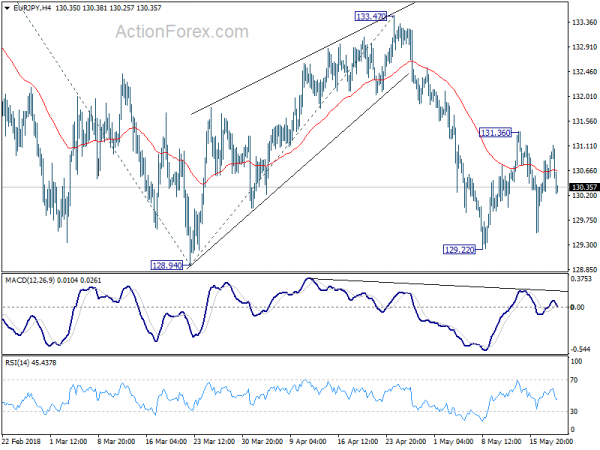

EUR/JPY stayed in consolidation above 129.22 last weekend outlook is unchanged. Initial bias remains neutral this week first. With 131.36 resistance intact, further fall is expected in the cross. Below 129.22 will target 128.94 first. Break will resume whole fall from 137.49 and target 61.8% projection of 137.49 to 128.94 from 133.47 at 128.18, and possibly further to 126.61 medium term fibonacci level. Nonetheless, break of 131.36 will turn focus back to 133.47 resistance instead.

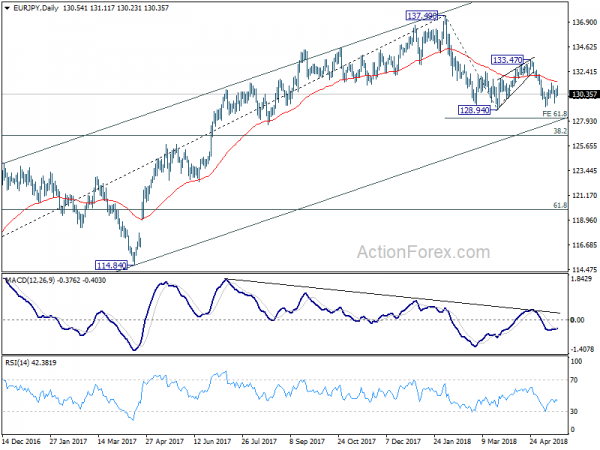

In the bigger picture, for now, price actions from 137.49 are viewed as a corrective pattern only. Hence, while deeper decline would be seen, strong support is expected at 38.2% retracement of 109.03 to 137.49 at 126.61 to contain downside and bring rebound. Up trend from 109.03 (2016 low) is expected to resume afterwards. Though, sustained break of 126.61 will be an important sign of trend reversal and will turn focus to 124.08 resistance turned support.

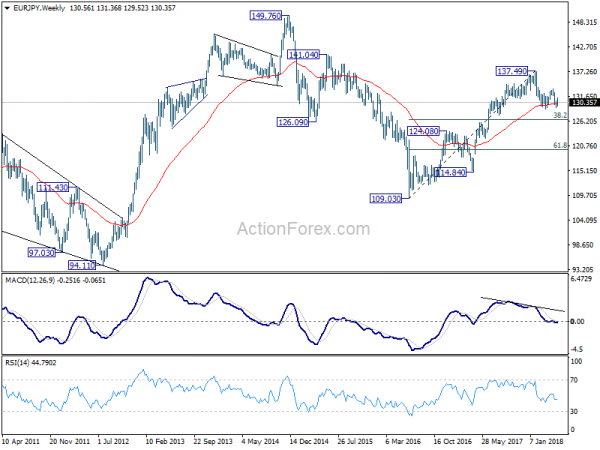

In the long term picture, at this point, EUR/JPY is staying in long term sideway pattern, established since 2000. Rise from 109.03 is seen as a leg inside the pattern. As long as 124.08 support holds, further rally is in favor in medium to long term through 149.76 high. However, break of 124.08 could extend the fall through 109.03 low instead.