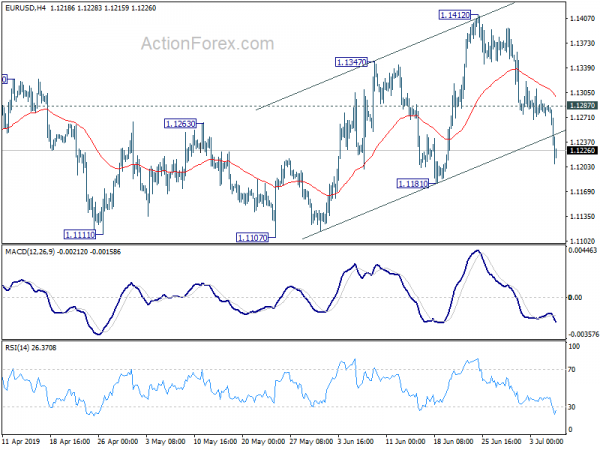

EUR/USD’s sharp fall last week argues that corrective recovery from 1.1107 has completed way earlier than expected at 1.1412. Initial bias stays on the downside this week for 1.1181 support. Firm break will confirm this case and target retest of 1.1107 low. On the upside, above 1.1287 minor resistance will turn intraday bias back to the upside for 1.1412 instead.

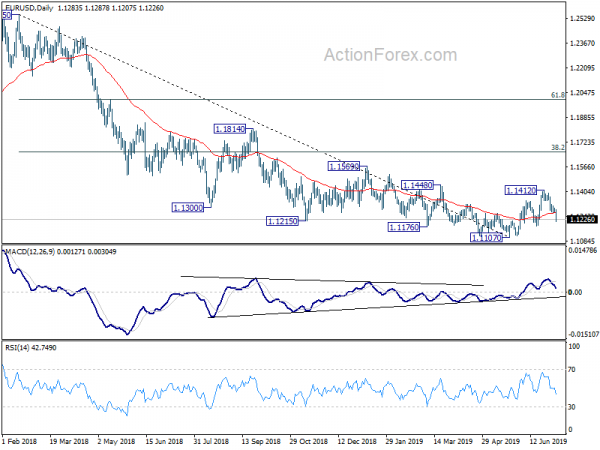

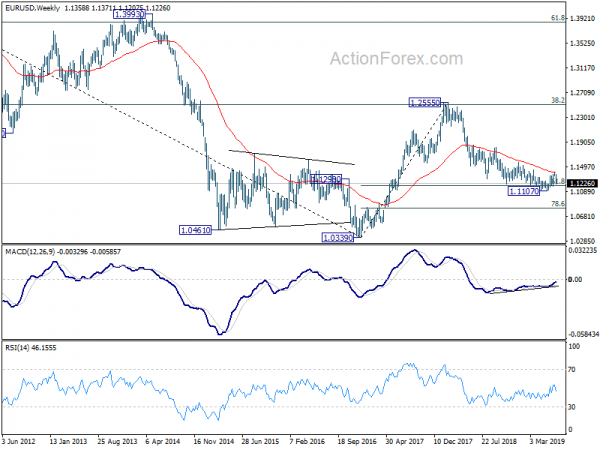

In the bigger picture, bullish convergence condition in daily and weekly MACD suggests that 1.1107 is a medium term bottom. However, rejection by 55 EMA retains medium term bearish. Outlook will be neutral for now. On the downside, break of 1.1107 will resume the down trend from 1.2555 (2018 high) to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Meanwhile, break of 1.1412 will resume the rebound to 38.2% retracement of 1.2555 to 1.1107 at 1.1660

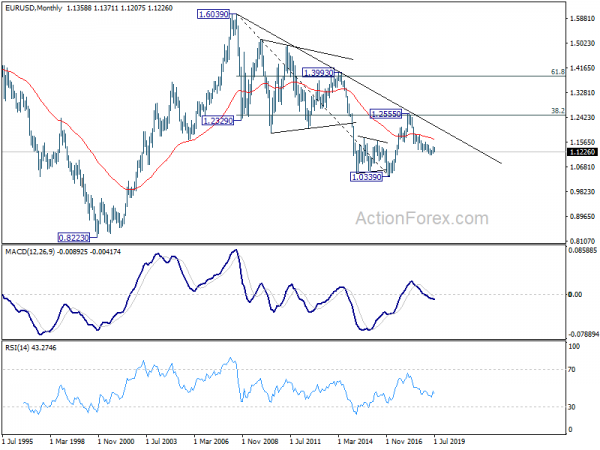

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. A break of 1.0039 low will remain in favor as long as 55 month EMA (now at 1.1658) holds).