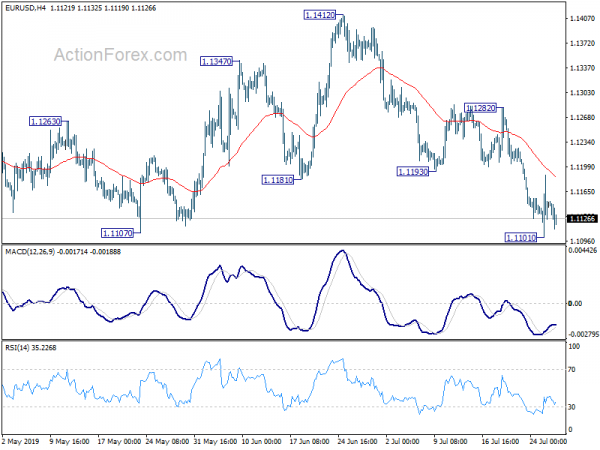

EUR/USD dropped to as low as 1.1101 last week but failed to sustain below 1.1107 low and recovered. Initial bias remains neutral this week for consolidations first. But as long as 1.1282 resistance holds, further decline is expected. Sustained break of 1.1107 low will resume larger down trend from 1.2555. Though, firm break of 1.1282 will bring stronger rise to 1.1412 resistance.

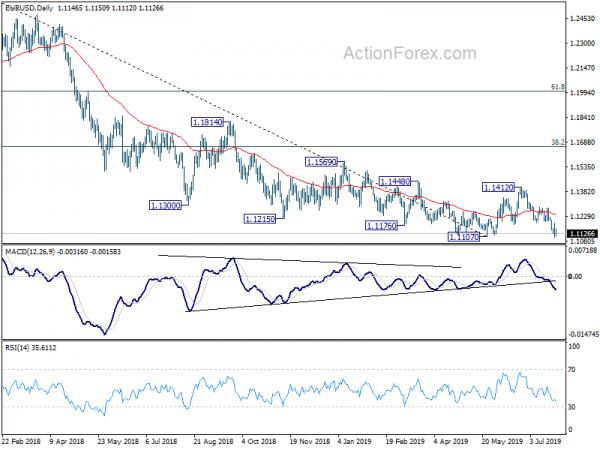

In the bigger picture, on the one hand, 1.1107 is seen as a medium term bottom on bullish convergence condition in weekly MACD. On the other hand, rejection by 55 week EMA retains medium term bearishness. Outlook stays neutral for now. On the downside, break of 1.1107 will resume the down trend from 1.2555 (2018 high) to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Meanwhile, break of 1.1412 will resume the rebound to 38.2% retracement of 1.2555 to 1.1107 at 1.1660.

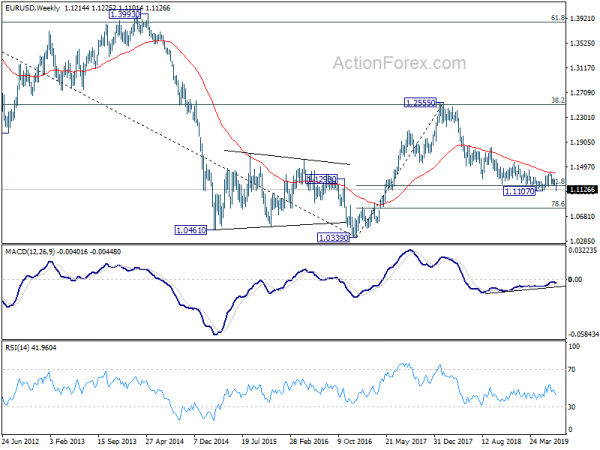

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. A break of 1.0039 low will remain in favor as long as 55 month EMA (now at 1.1658) holds).