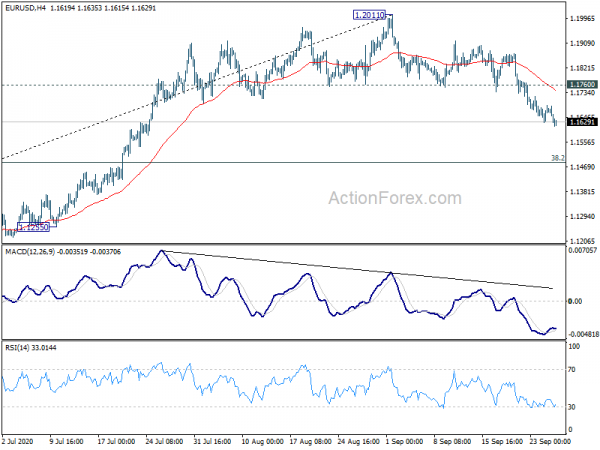

EUR/USD’s decline from 1.2011 accelerates to as low as 1.1612 last week. The development suggests that it’s now in correction to whole rise from 1.0635. Deeper fall is expected this week as long as 1.1760 resistance holds, to 38.2% retracement of 1.0635 to 1.2011 at 1.1485. As it’s seen as a corrective move, strong support should be seen at 1.1485 to contain downside to bring rebound. On the upside, above 1.1760 will turn intraday bias back to the upside for retesting 1.2011 instead. However, sustained break of 1.1485 will pave the way to 61.8% retracement at 1.1161.

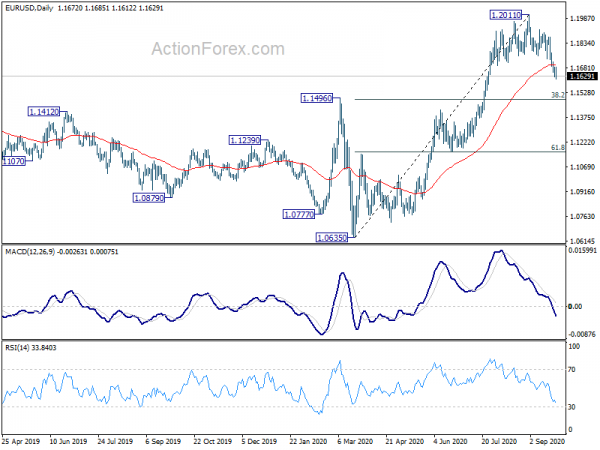

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

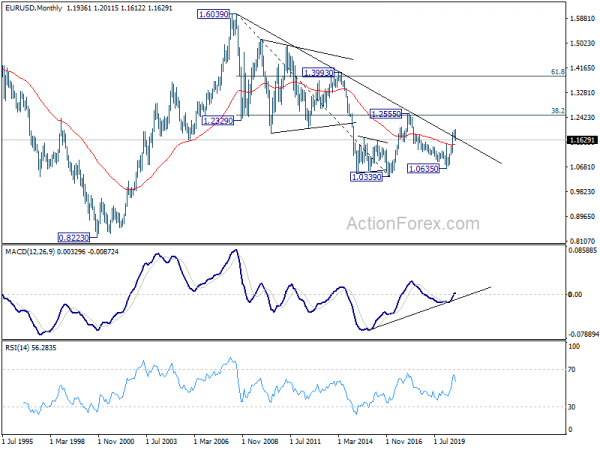

In the long term picture, the strong break of 55 month EMA is taken as a sign of long term trend reversal. Immediate focus will be on decade long trend line resistance (now at 1.1700). Sustained trading above there will add more credence to the case that down trend from 1.6039 (2008 high) has finished at 1.0339. Further break of 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ) will confirm and target 61.8% retracement at 1.3862 and above.