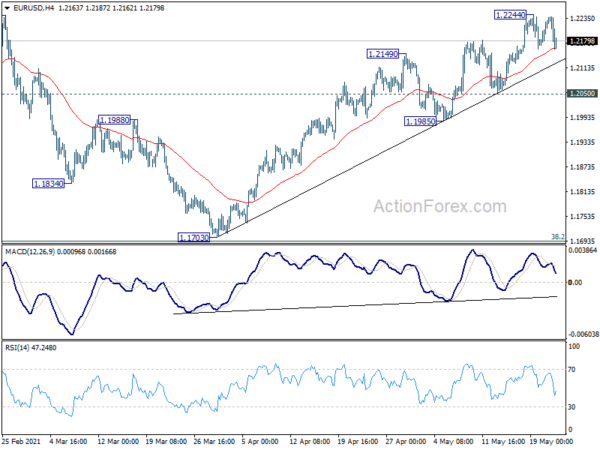

EUR/USD rose further to 1.2244 last week but lost momentum again and retreat. Initial bias remains neutral this week first. Further rise is expected as long as 1.2050 support holds. Break of 1.2244 will resume the rise from 1.1703 to retest 1.2348 high. However, break of 1.2050 will delay the bullish case. Intraday bias will be turned back to the downside to extend the consolidation pattern from 1.2348 with another falling leg.

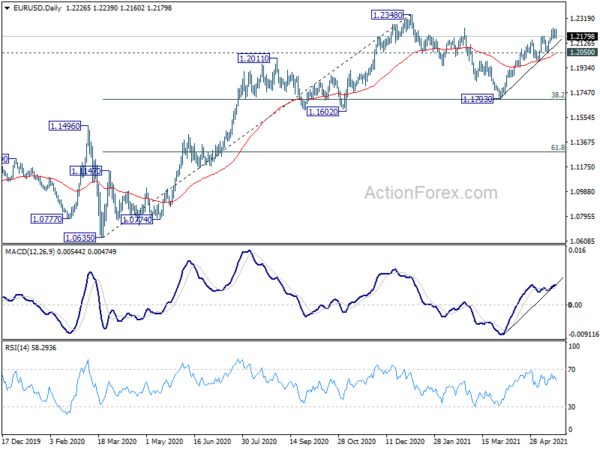

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair.

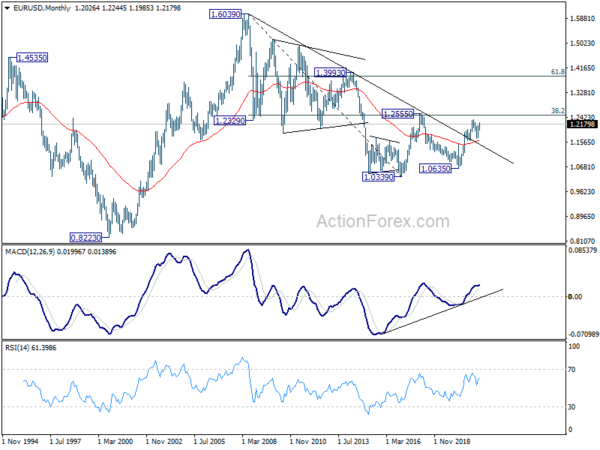

In the long term picture, the case of long term bullish reversal continues to build up, with bullish convergence condition in monthly MACD, sustained trading above 55 month EMA and long trend falling trend line. Focus is now on 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). Decisive break there will confirm and target 61.8% retracement at 1.3862 and above.