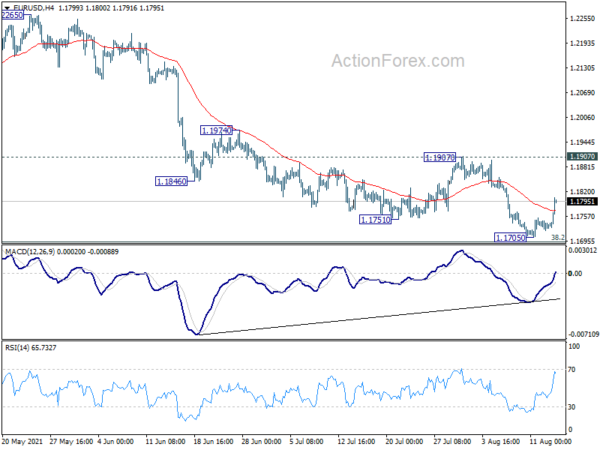

EUR/USD’s late rebound last week suggests short term bottoming at 1.1705, on bullish convergence condition in 4 hour MACD. That also came just ahead of 1.1602/1703 key support zone. Initial bias is now on the upside this week for 1.1907 resistance first. Decisive break there will suggest that fall from 1.2265, as well as consolidation pattern from 1.2348, have completed. Near term outlook will be turned bullish for retesting 1.2265/2348 resistance zone. However, below 1.1705 will turn focus back to 1.1602/1703 key support zone again.

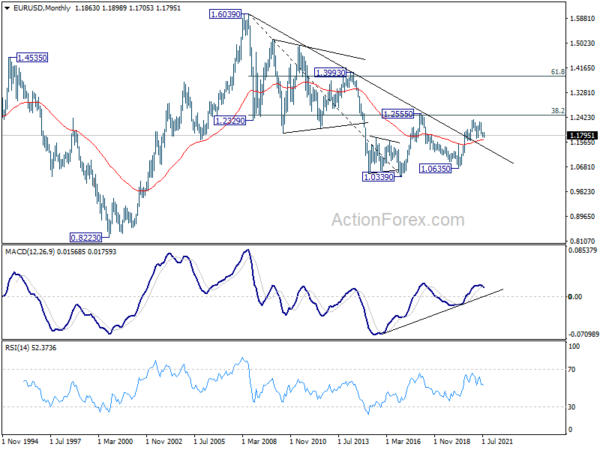

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

In the long term picture, focus remains on 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516). Sustained break there should confirm long term bullish reversal and target 61.8% retracement at 1.3862 and above. However, rejection by 1.2555 will keep long term outlook neutral first, and raise the prospect of down trend resumption at a later stage.