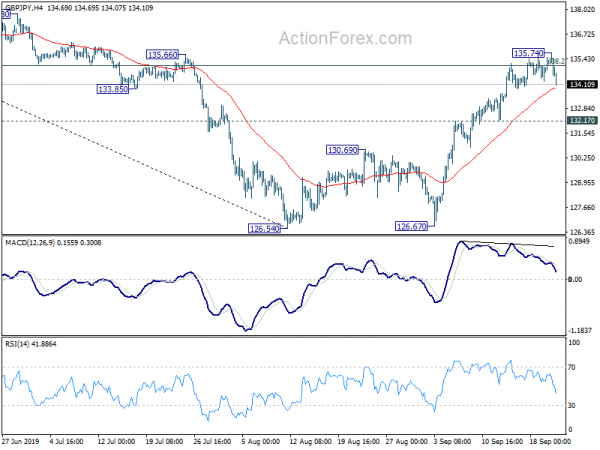

GBP/JPY edged higher to 135.74 last week but failed to sustain above 38.2% retracement of 148.87 to 126.54 at 135.07 and retreated. Initial bias remains neutral this week first. On the upside, sustained break of 135.07 will extend the rebound from 126.54 to 61.8% retracement at 140.33 next. However, break of 132.17 support will suggest rejection by 135.07 and turned bias back to the downside for retesting 126.54 low.

In the bigger picture, consolidation pattern from 122.75 (2016 low) is possibly still in progress. Strong rebound from 126.54 argues that it may be the third leg of the pattern. Further rise could be seen to 148.87/156.59 resistance zone before completion. On the downside, though, sustained break of 122.75 low will extend 116.83 (2011 low).

In the longer term picture, for now, we’re treating price actions from 122.75 (2016 low) as a corrective pattern. Hence, strong support could be seen at 122.75 to bring rebound before the pattern completes. However, sustained break will raise the chance of resuming long term down trend from 251.09 (2007 high). Next downside target will be 61.8% projection of 195.86 to 122.36 from 156.59 at 111.16.