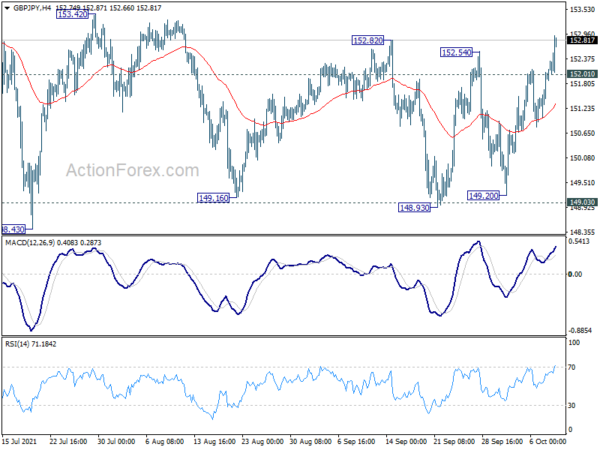

GBP/JPY’s strong rally and break of 152.54 resistance last week argues that corrective pattern from 156.05 has completed already. Initial bias is mildly on the upside this week first. Further rally would be seen back to retest 156.05. On the downside, below 152.01 minor support will dampen the bullish case and turn intraday bias neutral again.

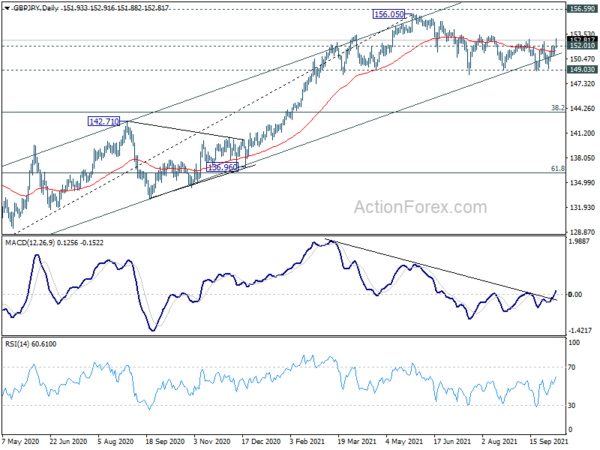

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). As long as 149.03 support holds, such rise would still resume at a later stage. However, sustained break of 149.03 support will indicate rejection by 156.59 (2018 high). Fall from 156.05 would at least be correcting the whole rise from 123.94 (2020 low). Deeper fall would be seen back 38.2% retracement of 123.94 to 156.05 at 143.78 first.

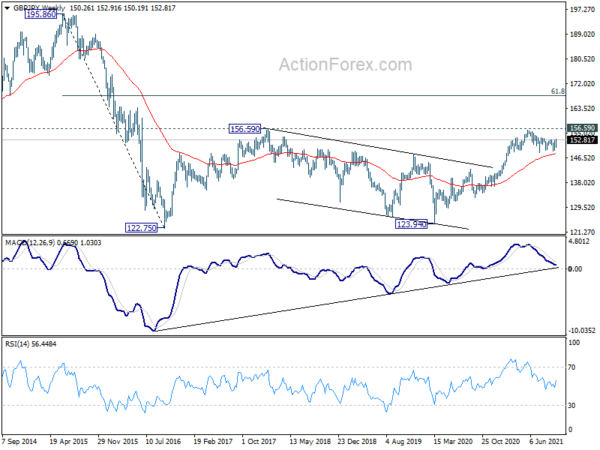

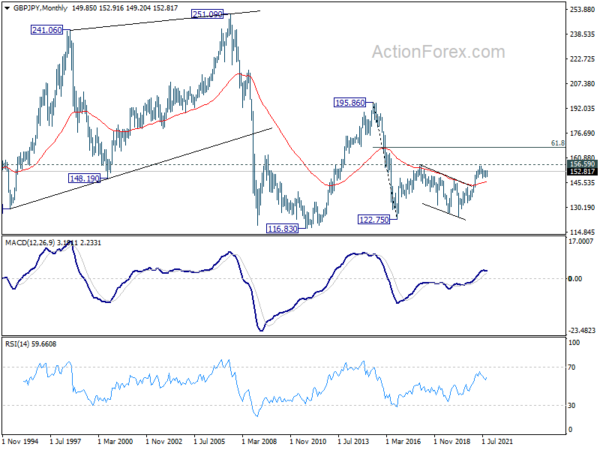

In the longer term picture, the strong break of 55 months EMA was an early sign of long term bullish reversal. Firm break of 156.69 resistance should now confirm the start of an up trend for 195.86 (2015 high). However, rejection by 156.69 will invalidate the bullish signal and keep long term outlook neutral first.