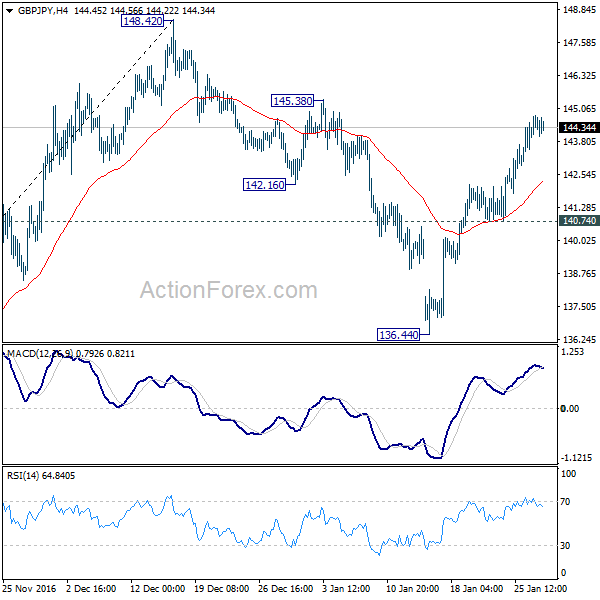

GBP/JPY’s rebound from 136.44 extended higher last week and the development suggests that corrective fall from 148.42 has completed at 136.44 already. Initial bias stays on the upside this week for retesting 148.42. Break there will resume whole rise from 122.46 and target 150.42 long term fibonacci level next. On the downside, below 140.74 will turn bias to the downside to extend the pattern from 148.42 with another falling leg.

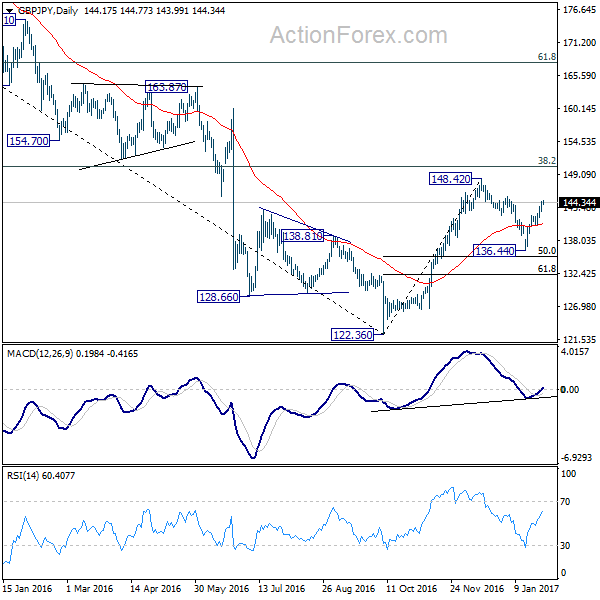

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern even. Main focus is on 38.2% retracement of 195.86 to 122.36 at 150.42. Rejection from there will turn the cross into medium term sideway pattern. Though, sustained break will extend the rebound towards 61.8% retracement at 167.78.

In the longer term picture, while price actions from 122.36 would develop into a medium term correction, fall from 195.86 is still seen as resuming the down trend from 251.09 (2007 high). Hence, after the correction from 122.36 completes we’d expect another fall through 116.83 low.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box