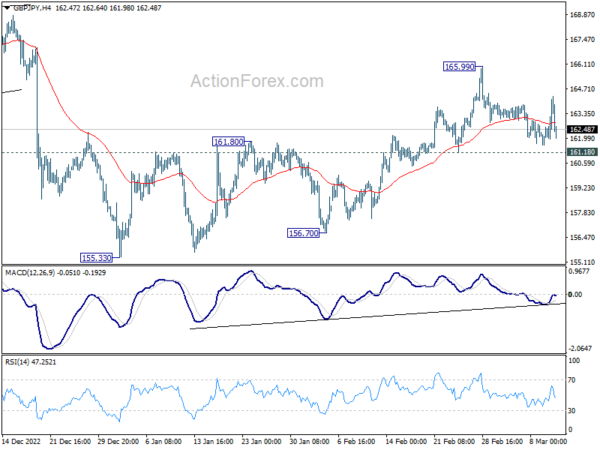

GBP/JPY stayed in consolidation below 165.99 last week and outlook is unchanged. Initial bias remains neutral this week first. Further rally is still expected as long as 161.18 support holds. As noted before, corrective fall from 172.11 should have completed at 155.33 already. Break of 165.99 will target 169.26 resistance first, and then 172.11 high. However, break of 161.18 support will dampen this view and turn bias to the downside for 156.70 support instead.

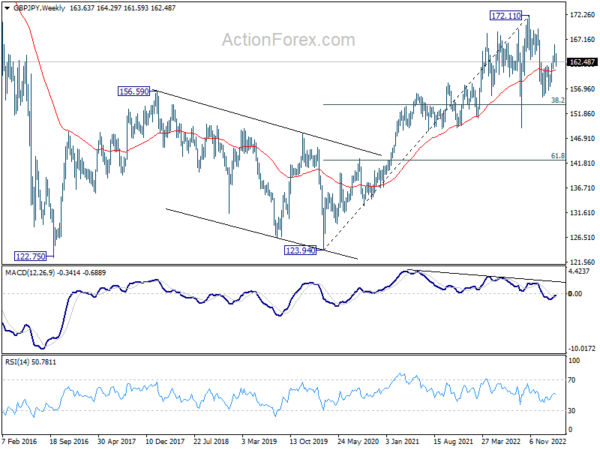

In the bigger picture, corrective decline from 172.11 medium term should have completed at 155.33. With 38.2% retracement of 123.94 (2020 low) to 172.11 (2022 high) at 153.70 intact, medium term bullishness is retained. That is, larger up trend from 123.94 (2020 low) is still in progress. Break of 172.11 high to resume such up trend is expected at a later stage.

In the longer term picture, as long as 55 month EMA (now at 153.17) holds, rise from 122.75 could still extend higher at a later stage to 195.86 (2015 high).