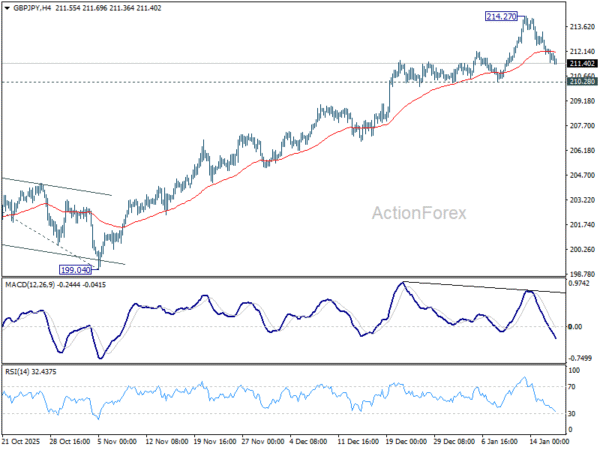

GBP/JPY edged higher to 214.27 last week but quickly retreated. Initial bias remains neutral this week and further rise is in favor. Break of 214.27 will resume larger up trend to 100% projection of 184.35 to 205.30 from 199.04 at 219.99 next. Nevertheless, considering bearish divergence condition in 4H MACD, firm break of 210.28 will confirm short term topping, and turn bias to the downside for deeper pullback to 55 D EMA (now at 207.97).

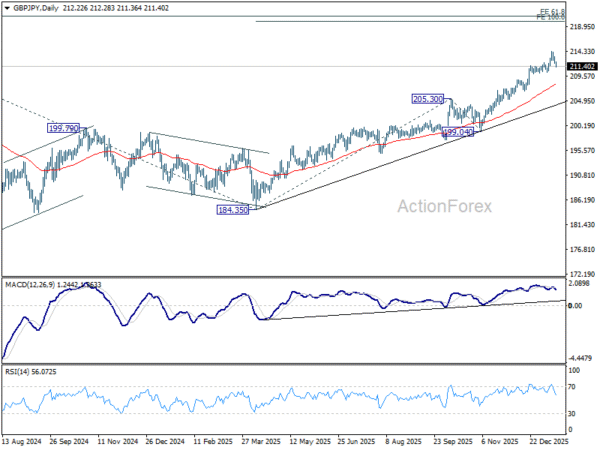

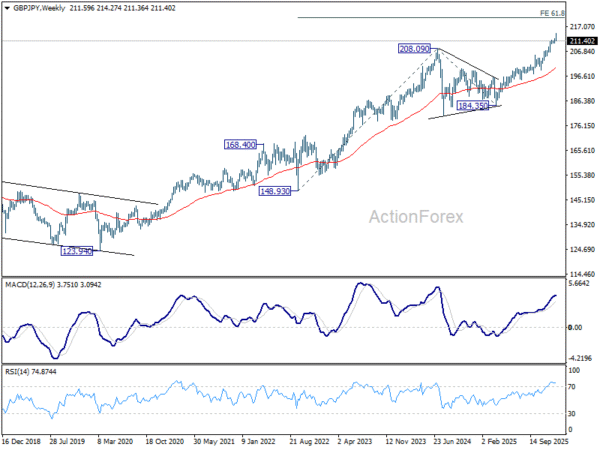

In the bigger picture, up trend from 123.94 (2020 low) is in progress. Next target is 61.8% projection of 148.93 (2022 low) to 208.09 (2024 high) from 184.35 at 220.90. On the downside, break of 205.30 resistance turned support is needed to indicate medium term topping. Otherwise, outlook will stay bullish even in case of deep pullback.

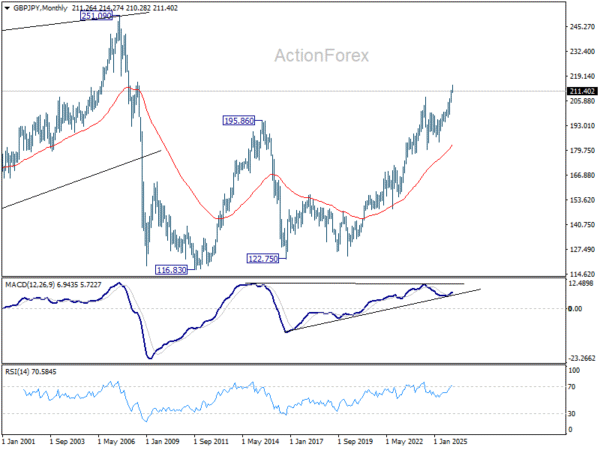

In the long term picture, up trend from 116.83 (2011 low) is resuming. Next target is 251.09 (2007 high). This will remain the favored case as long as 55 M EMA (now at 182.91) holds.