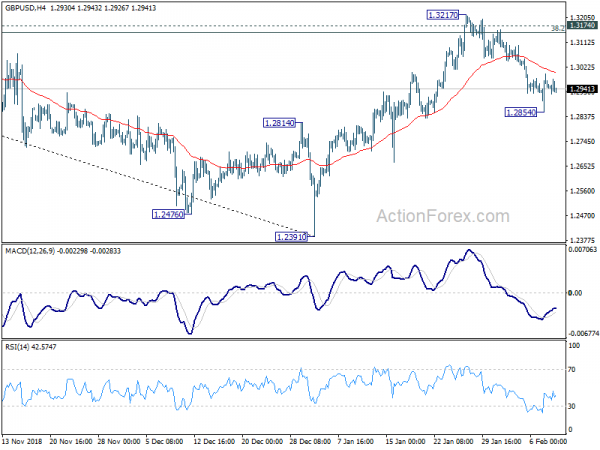

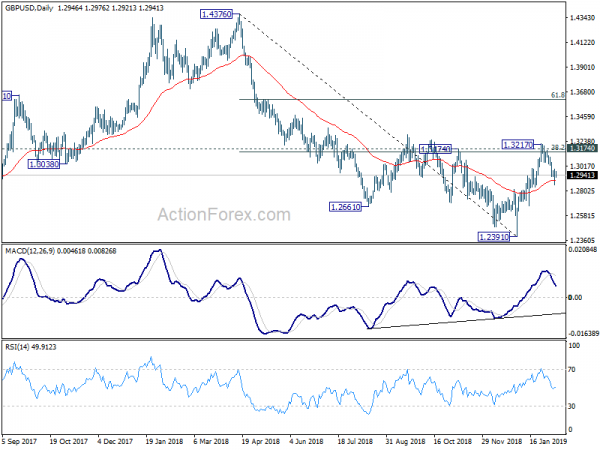

GBP/USD’s dropped to 1.2854 last week but formed a temporary low there and recovered. Initial bias is neutral this week first. Current development suggests that rebound from 1.2391 has completed at 1.3217 already, after rejection by 1.3174 key resistance. Hence, risk will stay on the downside as long as 1.3217 resistance holds. On the downside, break of 1.2854 will turn bias to the downside for retesting 1.2391 low.

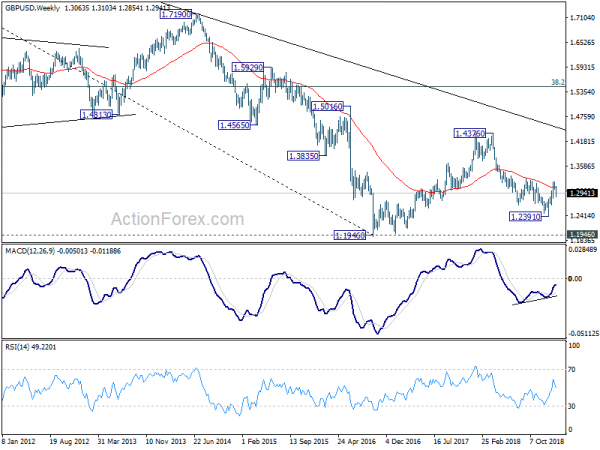

In the bigger picture, the rejection by 1.3174 key resistance revived the original view on GBP/USD. That is, decline from 1.4376 is possibly resuming long term down trend from 2.1161 (2007 high). Firm break of 1.2391 will solidify this bearish case and target 1.1946 (2016 low). However, decisive break of 1.3174 will invalidate this bearish case again and turn outlook bullish.

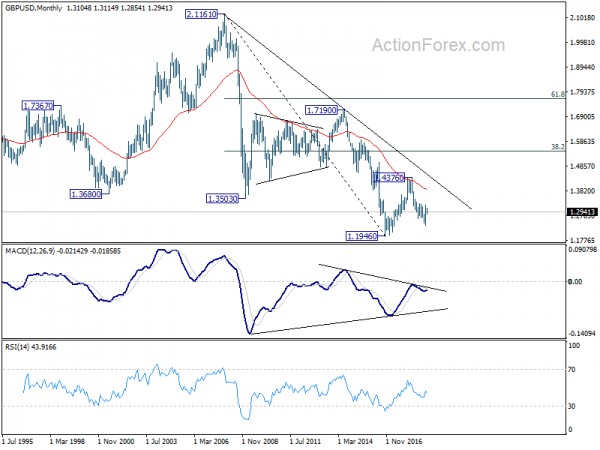

In the longer term picture, current development argues that corrective pattern from 1.1946 (2016 low) is extending with another rise. But there is no change in the long term bearish outlook as long as 38.2% retracement of 2.1161 (2007 high) to 1.1946 at 1.5466 holds. An eventual downside breakout through 1.1946 is still in favor in the long term.