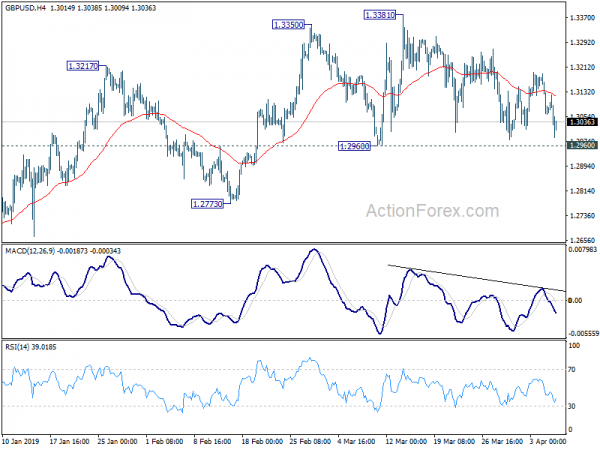

GBP/USD’s consolidation from 1.3381 extends last week and outlook remains unchanged. Initial bias remains neutral this week first. Further rise is still mildly in favor as long as 1.2960 support holds. On the upside, decisive break of 1.3381 will extend the rise from 1.2391 and target 61.8% retracement of 1.4376 to 1.2391 at 1.3618 next. However, on the downside, sustained break of 1.2960 will indicate that rebound from 1.2391 has completed earlier than expected. Deeper fall would then be seen to 1.2773 support for confirmation.

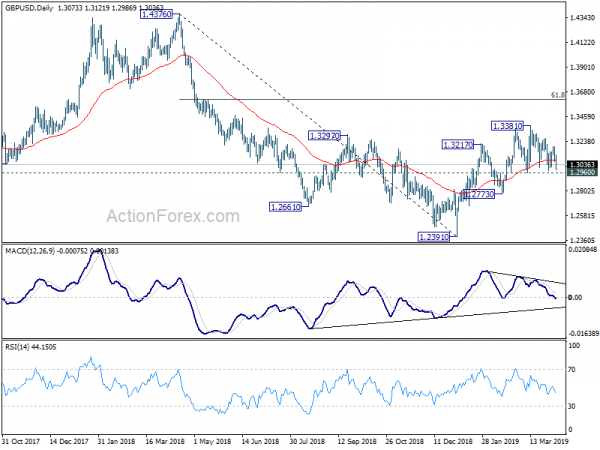

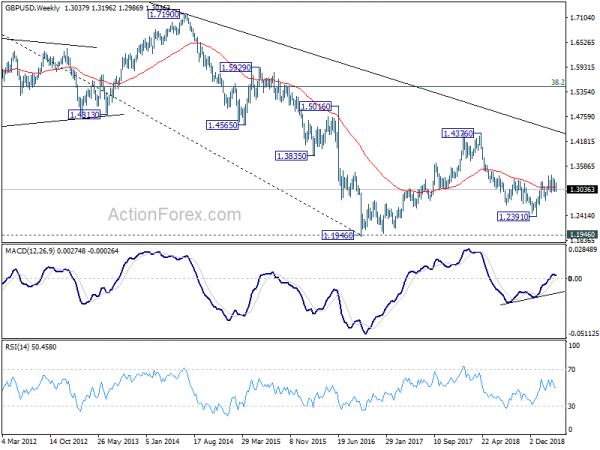

In the bigger picture, medium term decline from 1.4376 (2018 high) should have completed at 1.2391. Rise from 1.2391 is seen as the third leg of the corrective pattern from 1.1946 (2016 low). Further rise could be seen through 1.4376 in medium term. On the downside, though, break of 1.2773 support will dampen this view. Focus will be turned back to 1.2391 low and break will resume the fall from 1.4376 to 1.1946.

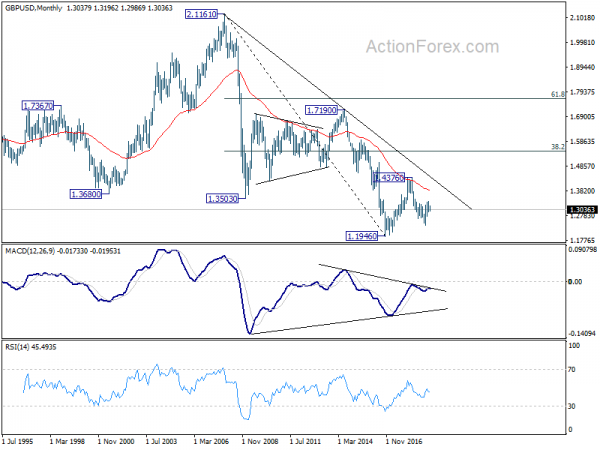

In the longer term picture, current development argues that corrective pattern from 1.1946 (2016 low) is extending with another rise. But there is no change in the long term bearish outlook as long as 38.2% retracement of 2.1161 (2007 high) to 1.1946 at 1.5466 holds. An eventual downside breakout through 1.1946 is still in favor in the long term.