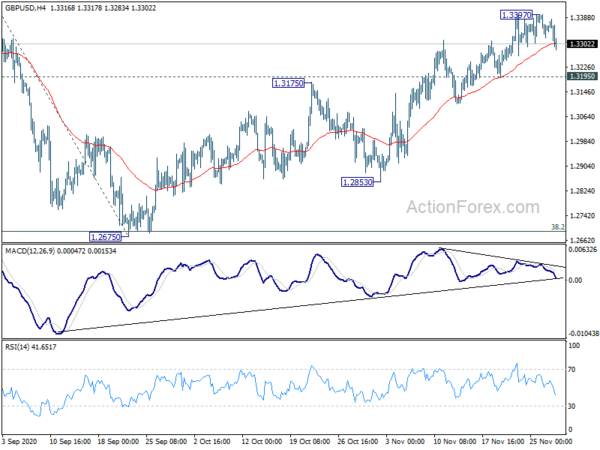

GBP/USD’s rise form 1.2675 extended to as high as 1.3397 last week but retreated since then. Initial bias is neutral this week first. On the upside, above 1.3397 will target 1.3482 high. Decisive break of 1.3482 high will resume whole rise from 1.1409. Further rally should then be seen to 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next. On the downside,break of 1.3195 support will turn bias back to the downside, to extend the consolidation from 1.3482 with another falling leg.

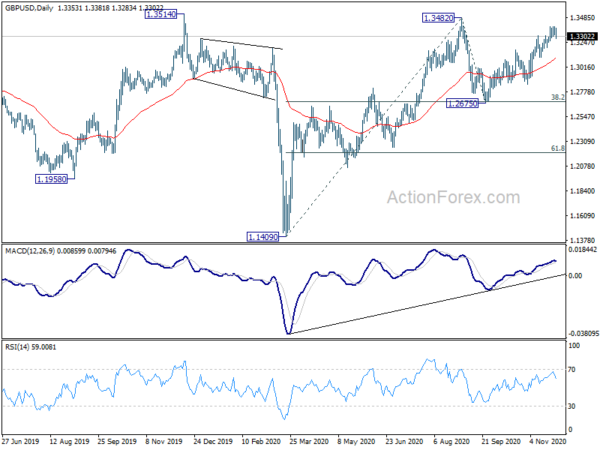

In the bigger picture, focus stays on 1.3514 key resistance. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3308). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

In the longer term picture, GBP/USD is staying below decade long trend line from 2.1161 (2007 high). It also struggles to sustain above 55 month EMA (now at 1.3308). Long term outlook stays bearish for now, despite bullish convergence condition in monthly MACD.