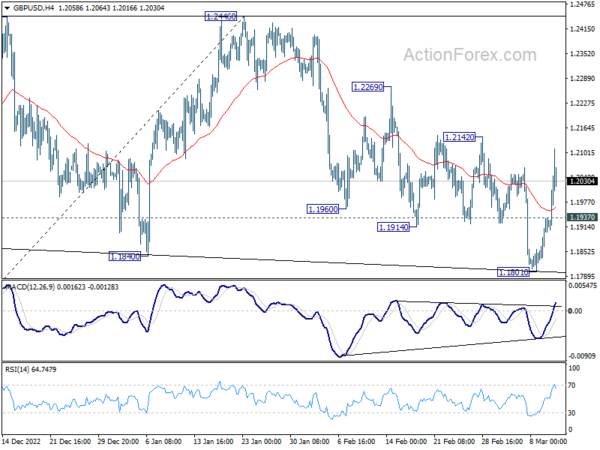

Despite dipping to 1.1801, GBP/USD quickly quickly rebounded after drawing support from 1.1840. Initial bias stays mildly on the upside this week. Sustained trading above 55 day EMA (now at 1.2052) will argue that consolidation pattern from 1.2445 has complete. Further rally would be seen back to retesting 1.2445/6 resistance. Nevertheless, below 1.1937 minor support. will turn bias neutral first.

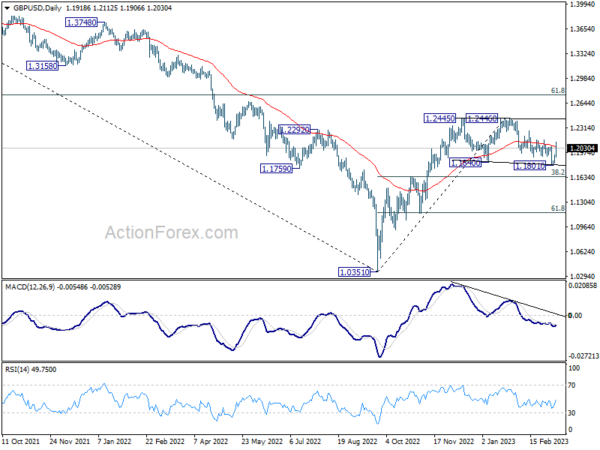

In the bigger picture, price action from 1.2445 are seen as a corrective pattern to rise from 1.0351 medium term bottom (2022 low). Resumption is expected as a later stage and firm break of 1.2446 will target 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. This will remain the favored case as long as 38.2% retracement of 1.0351 to 1.2445 at 1.1645 holds.

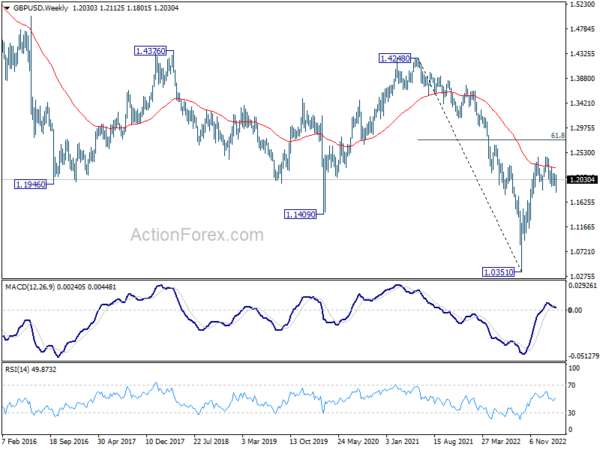

he longer term picture, as long as 1.4248 resistance holds (2021 high), long term outlook will remain neutral at best. Down trend from 2.1161 (2007) could still resume for another low through 1.0351 at a later stage.