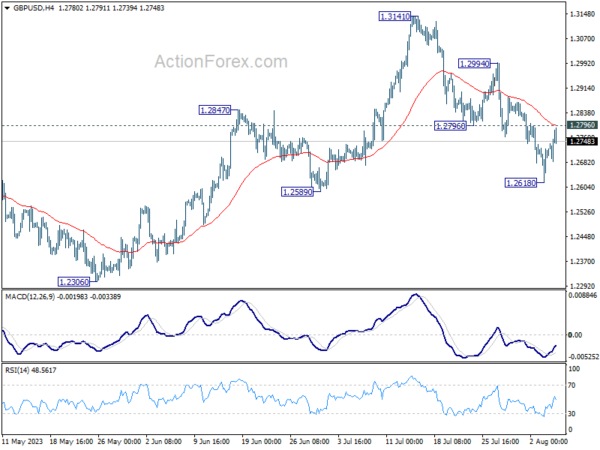

GBP/USD fall further to 1.2618 last week but recovered since then. Initial bias is neutral this week first. On the downside, below 1.2618, and sustained trading below 1.2678 resistance turned support will argue that it’s already in a larger correction. Deeper decline would then be seen to 1.2306 support next. Nevertheless, firm break of 1.2796 will indicate that the pull back has completed, and turn bias back to the upside for stronger rebound.

In the bigger picture, a medium term top could be in place at 1.3141 already, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.2724) should confirm this case, and bring deeper fall to 38.2% retracement of 1.0351 to 1.3141 at 1.2075, as a correction to up trend from 1.0351 (2022 low). For now, rise will stay mildly on the downside as long as 1.3141 resistance holds, in case of strong rebound.

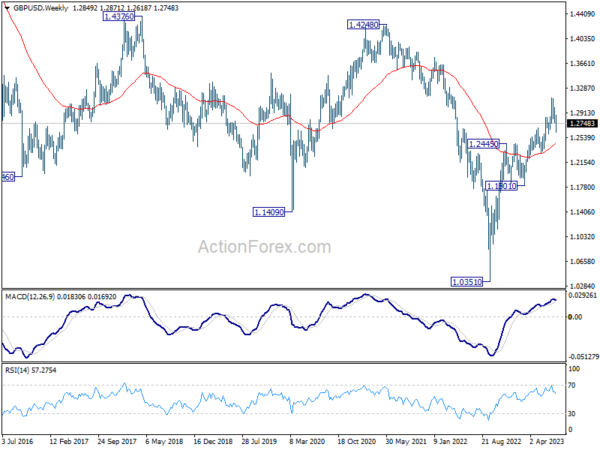

In the long term picture, sustained trading above 55 M EMA (now at 1.2902) will add to the case of long term bullish reversal, and target 1.4248 cluster resistance (38.2% retracement of 2.1161 (2007 high) to 1.0351 at 1.4480) for confirmation. Nevertheless, rejection by 55 M EMA will maintain long term bearishness for downside resumption at a later stage.