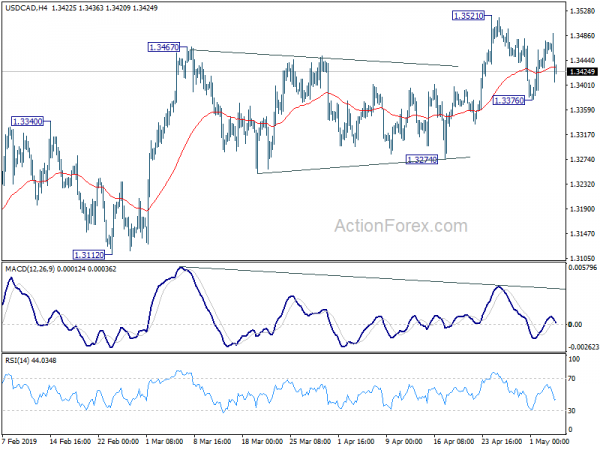

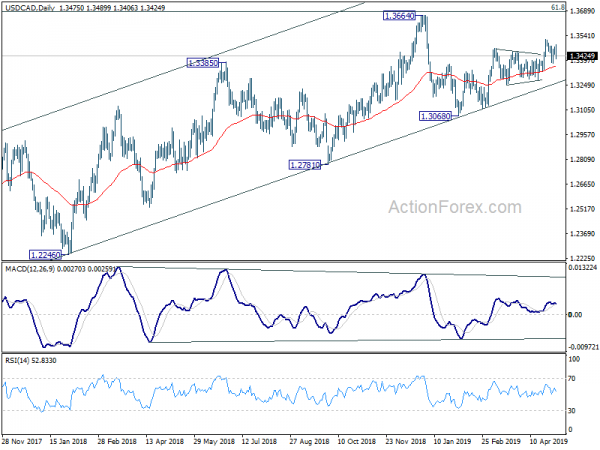

USD/CAD was bounded in consolidation below 1.3521 last week and downside was contained at 1.3376. Initial bias stays neutral first as more consolidative trading could be seen. For now, further rally remains mildly in favor despite relatively weak upside momentum as seen in daily MACD. On the upside, break of 1.3521 will resume the whole rise from 1.3068 to retest 1.3664 high. On the downside, below 1.3376 will turn bias to the downside for 1.3274 support. Break will indicate that choppy rebound from 1.3068 has completed at 1.3521. Near term outlook will be turned bearish for retesting 1.3068 support.

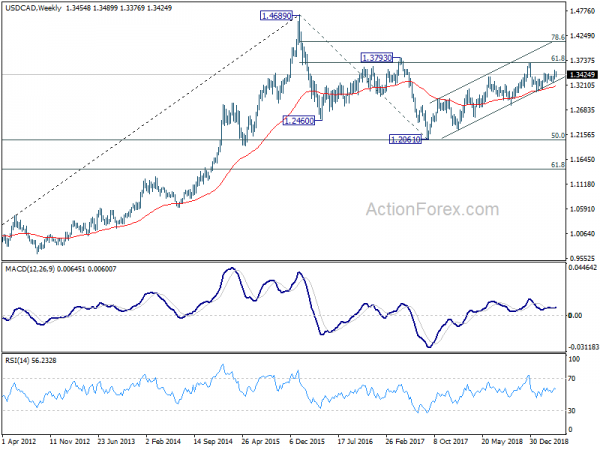

In the bigger picture, USD/CAD is staying well inside medium term rising channel (support at 1.3272). Thus, the up trend from 1.2061 (2017 low) should be in progress. On the upside, decisive break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will pave the way to 78.6% retracement at 1.4127 next. This will remain the favored case as long as 1.3068 support holds. However, sustained break the channel support will be the first sign of medium term reversal. Firm break of 1.3068 would confirm.

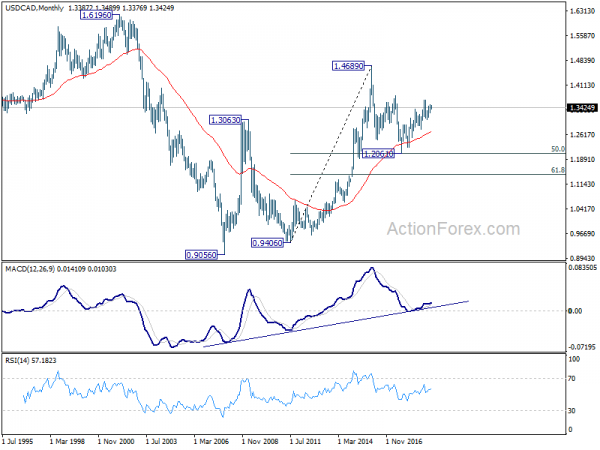

In the longer term picture, corrective fall from 1.4689 (2015 high) should have completed with three waves down to 1.2061, just ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. The development keeps long term up trend from 0.9406 and that from 0.9056 (2007 low) intact. For now, there is still prospect of extending the long term up trend through 1.4689.