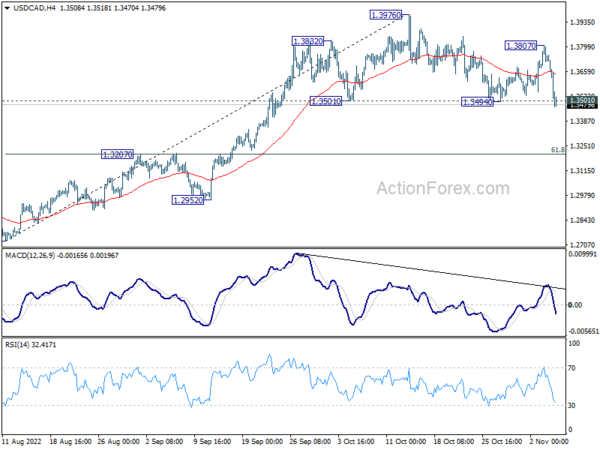

USD/CAD’s break of 1.3494 support last week completes a head and should top pattern (1.3832; h: 1.3976; rs: 1.3807). Initial bias is now on the downside this week for deeper correction, to 1.3207 cluster support (61.8% retracement of 1.2726 to 1.3976 at 1.3204. Strong support should be seen there to bring rebound. But for now, risk will stay on the downside as long as 1.3807 resistance holds, in case of recovery.

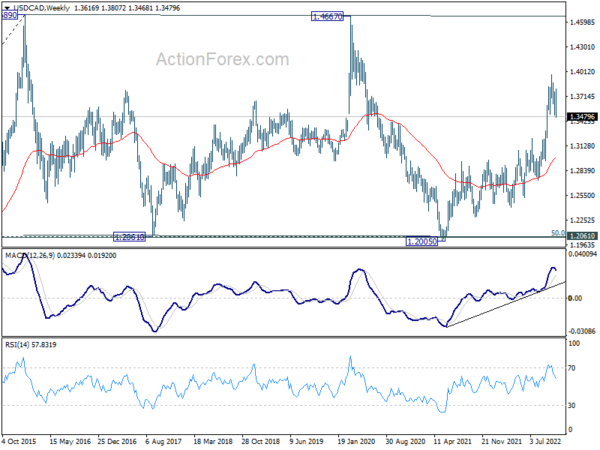

In the bigger picture, up trend from 1.2005 (2021 low) is still in progress. Based on current impulsive momentum, it could be resuming long term up trend from 0.9056 (2007 low). Whether it is or it isn’t, retest of 1.4689 (2016 high) should be seen next. This will now remain the favored case as long as 1.3222 resistance turned support holds.

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern only, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as long as 1.2061 support holds, which is close to 50% retracement of 0.9406 to 1.4689 at 1.2048.