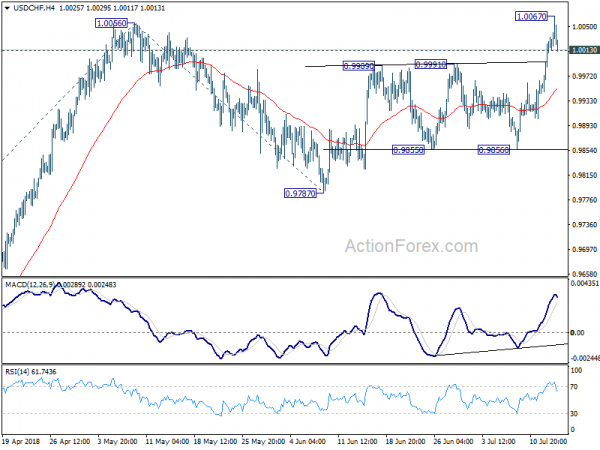

USD/CHF surged to as high as 1.0067 last week but formed a temporary top there and retreated. Initial bias is neutral this week for consolidations first. Downside of retreat should be contained by 4 hour 55 EMA (now at 0.9950) to bring another rally. The rise from 0.9186 should have just resumed. Above 1.0067 will target 61.8% projection of 0.9186 to 1.0056 from 0.9787 at 1.0325, which is close to 1.0342 key resistance.

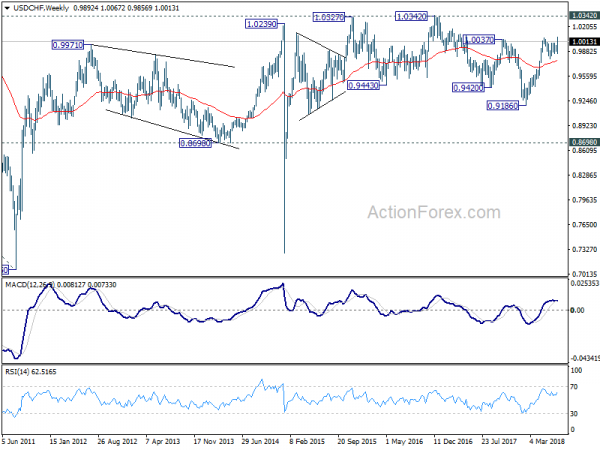

In the bigger picture, rise from 0.9186 is seen as a leg inside the long term range pattern. After drawing support from 55 day EMA, it’s now resuming for 1.0342 key resistance. For now, we’d still cautious on strong resistance from there to limit upside. Meanwhile, break of 0.9787 support is needed to signal completion of the rise. Otherwise, outlook will remain bullish even in case of deep pull back.

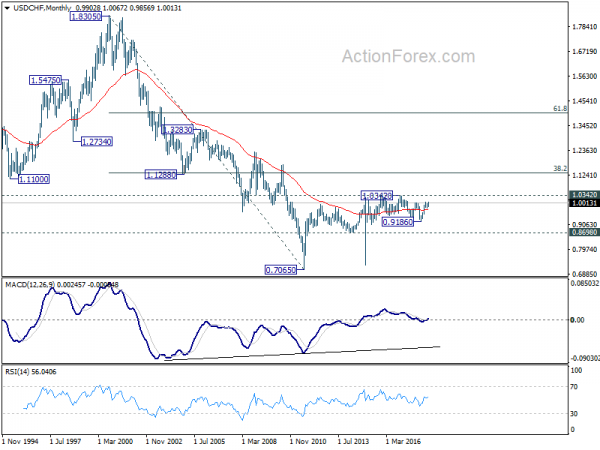

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.