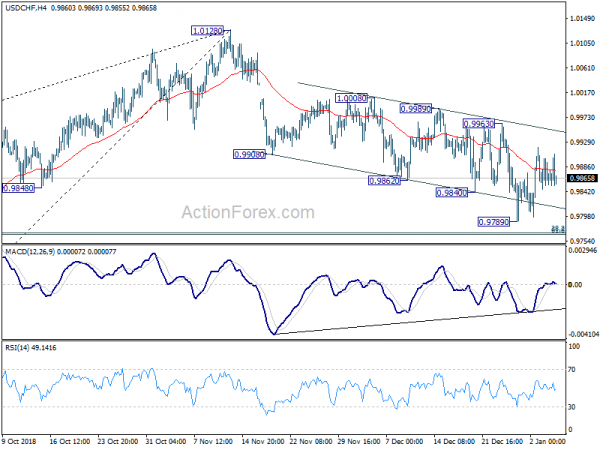

USD/CHF stayed in right range above 0.9789 last week and outlook is unchanged. Initial bias stays neutral this week first. Fall from 1.0128 is seen as a correction. Thus, in case of another decline, downside should be contained by 0.9765/8 cluster support (61.8% retracement of 0.9541 to 1.0128 at 0.9765, 38.2% retracement of 0.9186 to 1.0128 at 0.9768) to bring rebound. On the upside, break of 0.9963 resistance will suggest that such correction has completed and turn bias to the upside for retesting 1.0128 resistance. However, sustained break of 0.9765/8 will bring deeper fall back to 0.9541 support next.

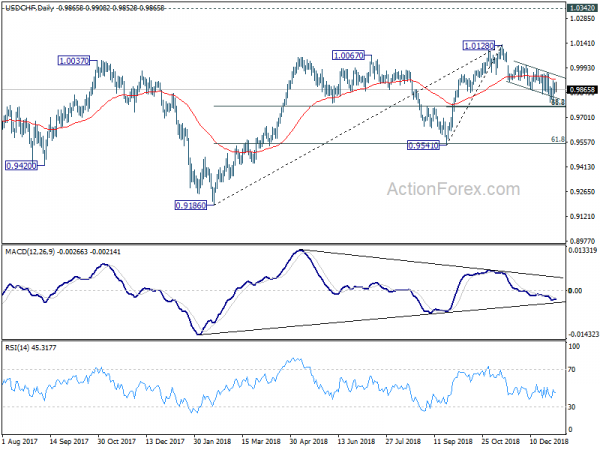

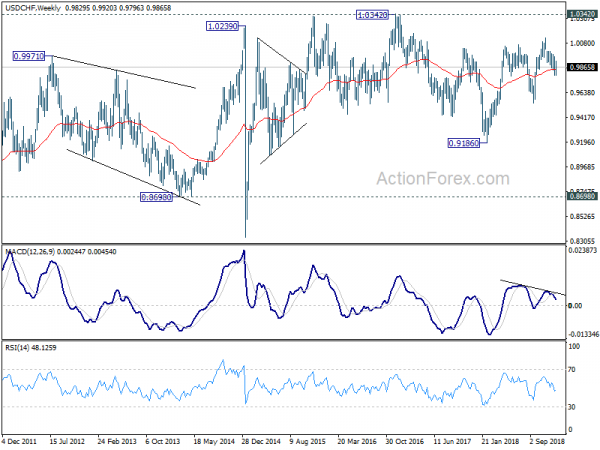

In the bigger picture, while the fall from 1.0128 was slightly deeper than expected, the structure suggests it’s a corrective move. As long as 0.9765/8 cluster support (61.8% retracement of 0.9541 to 1.0128 at 0.9765, 38.2% retracement of 0.9186 to 1.0128 at 0.9768) holds, we’d expect up trend from 0.9541 and 0.9186 to resume later through 1.0128. However firm break of 0.9765/8 will argue that the trend has reversed. Further break of 0.9541 support will confirm this bearish scenario and bring deeper fall back to 0.9186 low.

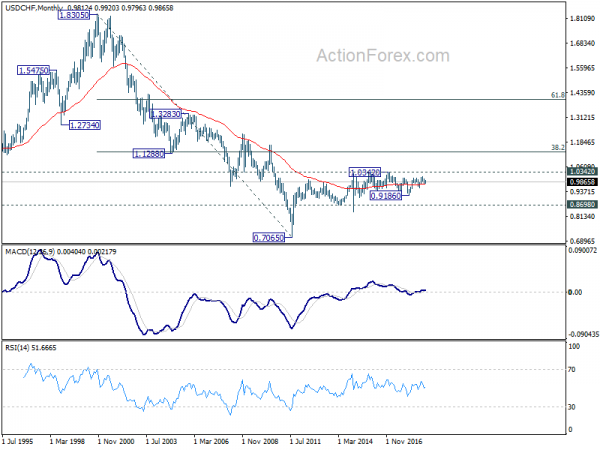

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.