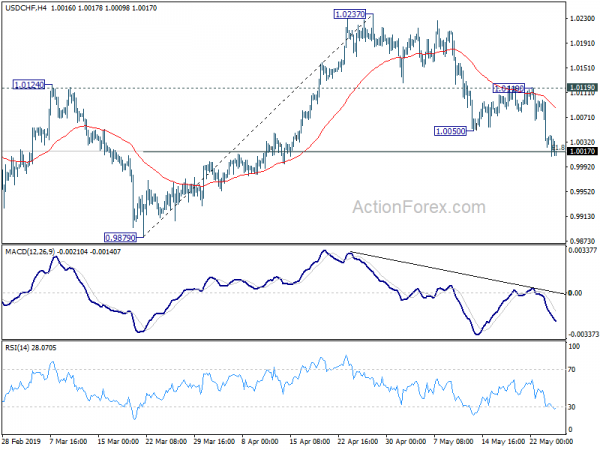

USD/CHF’s fall from 1.0237 extended to as low as 1.0008 last week and broke 55 day EMA decisively. Initial bias stays on the downside this week for further fall. Sustained trading below 61.8% retracement of 0.9879 to 1.0237 at 1.0016 will pave the way to retest 0.9879 key support. On the upside, break of 1.0119 resistance will suggest that the decline from 1.0237 has completed and turn bias to the upside.

In the bigger picture, USD/CHF is losing upside momentum ahead of 1.0342 key resistance (2016 high). There is no clear sign of reversal yet. But even in case of another rise, we’d be cautious on strong resistance from 1.0342 to limit upside. On the downside, break of 0.9879 support will suggest that larger rise from 0.9186 (2018 low) has completed. Deeper fall will be seen to 0.9716 support for confirmation.

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.