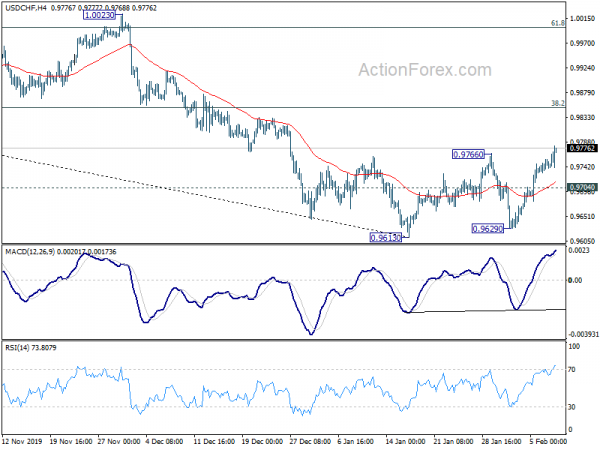

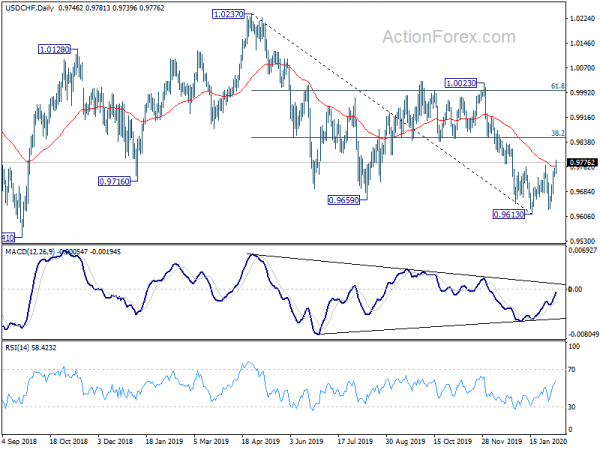

USD/CHF’s break of 0.9766 resistance last week suggests that 0.9613 is at least a short term bottom. It’s early to tell, but considering bullish convergence condition in daily MACD, the decline from 1.0237 might have completed with three waves down to 0.9613 too. Initial bias is now on the upside this week for 38.2% retracement of 1.0237 to 0.9613 at 0.9851 first. On the downside, below 0.9703 minor support will bring retest of 0.9613 low instead.

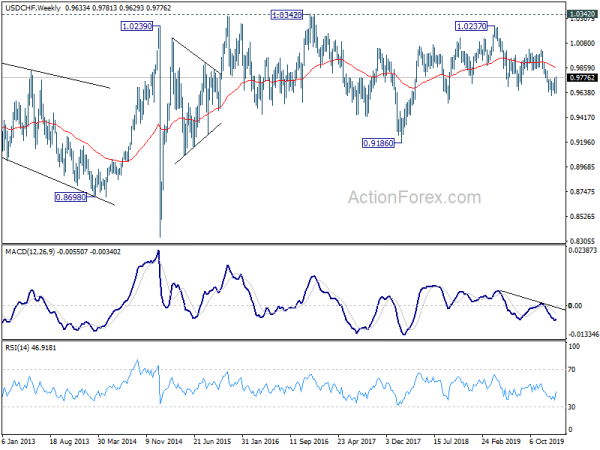

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying sideway trading started from 1.0342 (2016 high). Fall from 1.0237 is a leg inside the pattern and could target 0.9186 (2018 low). In case of another rise, break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall.

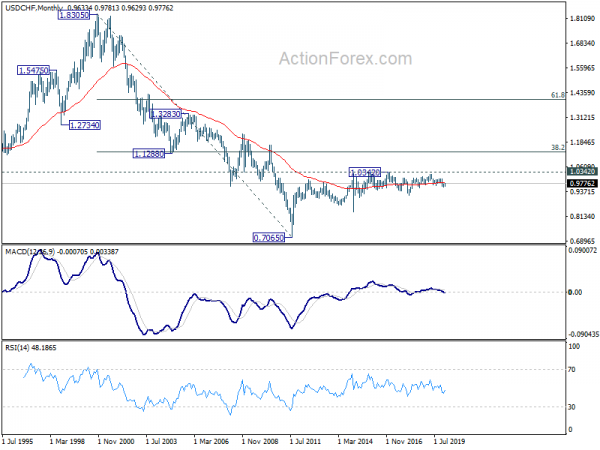

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.