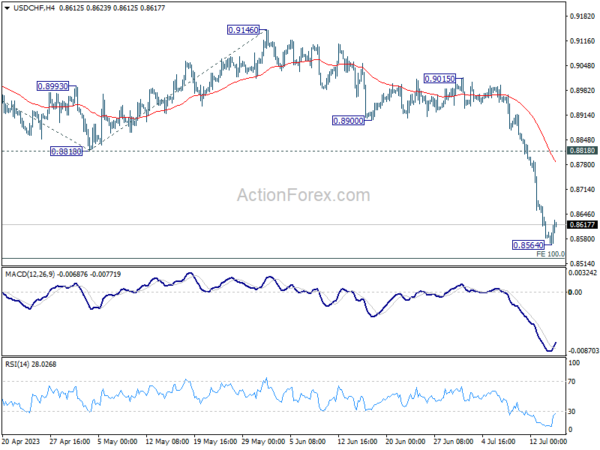

USD/CHF’s decline from 1.0146 resumed last week and broke 0.8756 long term support decisively. But as a temporary low was formed at 0.8564 with subsequent recovery, initial bias is neutral this week for some consolidations first. Upside of recovery should be limited below 0.8818 support turned resistance to bring another fall. Break of 0.8564 will target 100% projection of 0.9439 to 0.8818 from 0.9146 at 0.8525 next.

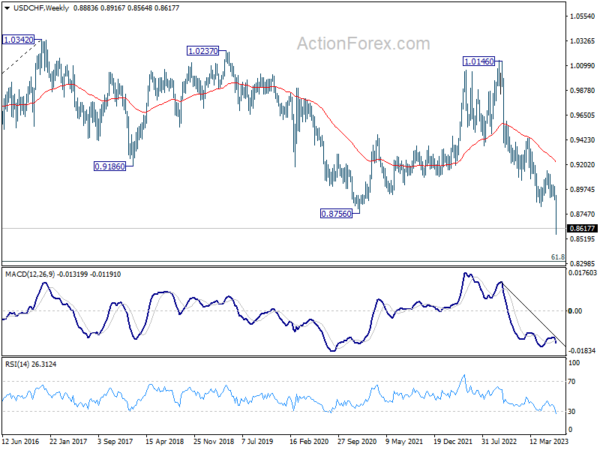

In the bigger picture, the break of 0.8756 (2021 low) indicates break out from the long term range pattern. For now, medium term outlook will stay bearish as long as 0.9146 resistance holds. Further fall would be seen to 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317 next.

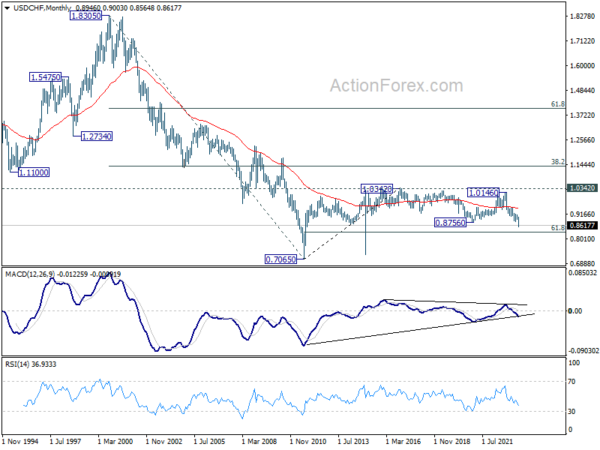

In the long term picture, there is no clear sign that down trend from 1.8305 (2000 high) has completed. With 38.2% retracement of 1.8305 to 0.7065 at 1.1359 intact, outlook is neutral at best. Sustained break of 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317 will bring retest of 0.7065 low.