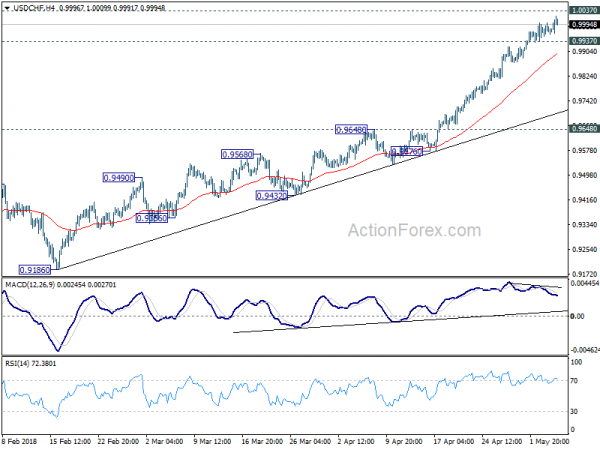

USD/CHF’s rally extended to as high as 1.0022 last week. The pair lost some upside momentum as seen in 4 hour MACD, but there is no sign of topping yet. Initial bias stays on the upside or 1.0037 resistance. Firm break there will pave the way to 1.0342 key resistance next. On the downside, though, below 0.9937 minor support will indicate short term topping. And, in that case, deeper retreat could be seen to 4 hour 55 EMA (now at 0.9897) and below before staging another rise.

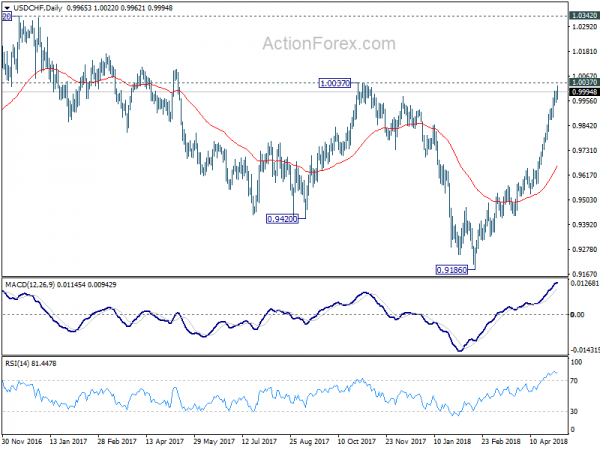

In the bigger picture, medium term decline from 1.0342 has completed with three waves down to 0.9186. Rise from there is currently viewed as a leg inside the long term range pattern. Hence, while further rally would be seen, we’d be cautious on strong resistance from 1.0342 to limit upside. For now, further rise is expected as long as 0.9648 resistance turned support holds, even in case of pull back.

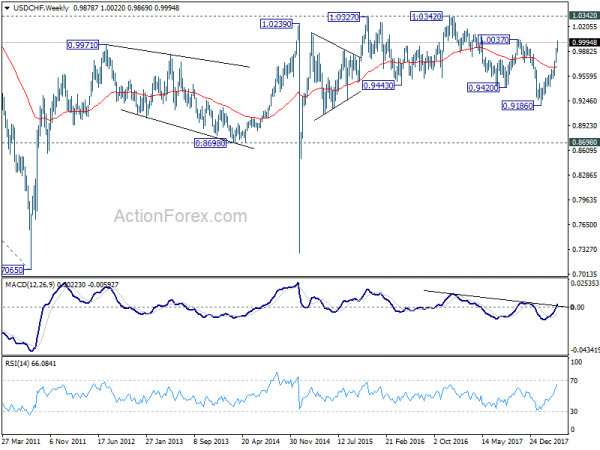

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.