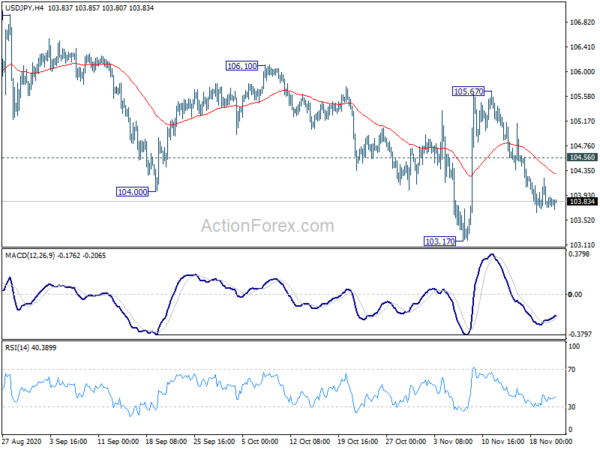

USD/JPY’s down trend momentum diminished ahead of 103.17 last week but further fall will remain in favor as long as 104.56 minor resistance holds. The pair is staying well inside falling channel, and below 55 day EMA, keeping near term outlook bearish. Break of 103.17 low will resume whole down trend form 111.71. On the upside, however, break of 104.56 will turn bias back to the upside for 105.67 resistance instead.

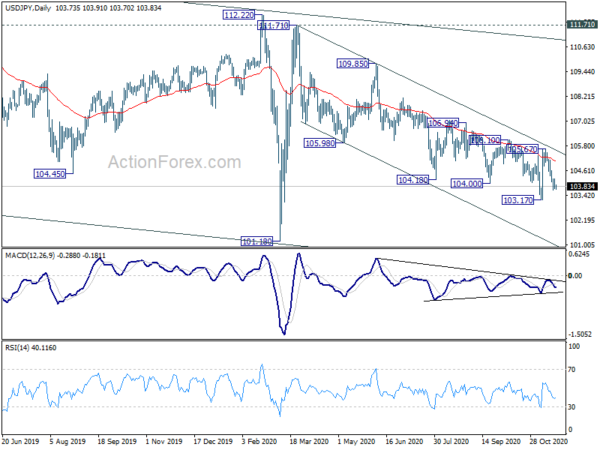

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bearish.

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective move which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.