Weekly

• Last Candlesticks pattern: Long white candlestick

• Time of formation: 10 Jul 2017

• Trend bias: Up

Daily

• Last Candlesticks pattern: Long white candlestick

• Time of formation: 18 Jul 2017

• Trend bias: Up

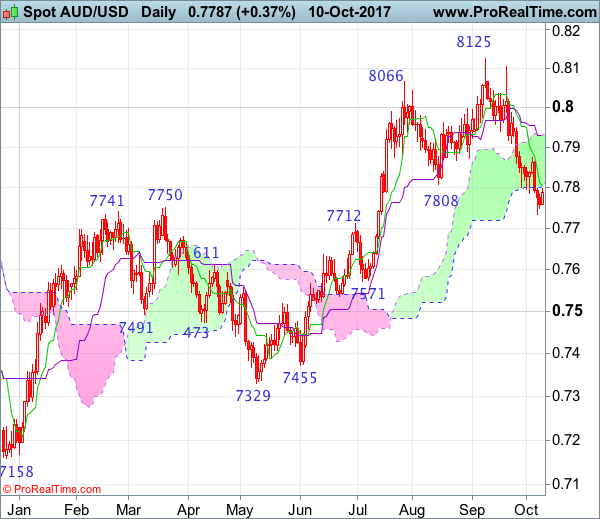

Although aussie rebounded to as high as 0.7897 late last week, as the pair met renewed selling interest there and has retreated again, retaining our bearishness and weakness to 0.7770-75 is likely, however, break there i needed to signal the rebound from 0.7733 and bring retest of this level later, break there would signal the fall from 0.8125 top is still in progress for retracement of early upmove to previous resistance at 0.7712, break there would extend weakness to 0.7660-70 and then 0.7620-30 but support at 0.7535-40 should remain intact due to oversold condition.

On the upside, expect recovery to be limited to 0.7870-75 and price should falter below said resistance at 0.7897, bring another decline later. Above said resistance at 0.7897 would risk test of the Kijun-Sen (now at 0.7918) but a daily close above there is needed to signal the fall from 0.8125 has ended instead, bring a stronger rebound to 0.7970-75, however, still reckon upside would be limited to 0.8000 and price should falter below resistance at 0.8103, bring another decline later.

Recommendation: Hold short entered at 0.7880 for 0.7680 with stop above 0.7900

On the weekly chart, although last week’s rebound formed a white candlestick, if our view that top has been formed at 0.8125 is correct, upside should be limited to last week’s high at 0.7897, bring another retreat later, below 0.7770 would bring test of 0.7727-33 (50% Fibonacci retracement of 0.7329-0.8125 and this month’s low), break there would add credence to this view and extend weakness to 0.7675-80 and possibly 0.7630-35 (61.8% Fibonacci retracement) but reckon support at 0.7535 would hold from here.

On the upside, price should falter below said resistance at 0.7897 and bring another retreat. Above said resistance would risk a stronger rebound to the Tenkan-Sen (now at 0.7929) but only a weekly close above there would defer and bring further gain to 0.8020-30, however, price should falter below resistance at 0.8103 and bring another decline later. A break of 0.8103 resistance would signal the retreat from 0.8125 top has ended instead, bring retest of this level. Looking ahead, only above there would extend the erratic rise from 0.6827 low to previous resistance at 0.8163, then 0.8200 but loss of upward momentum should limit upside to previous resistance at 0.8295.