The forex markets opened the week relatively quietly. Yen is the notably weaker one, extending last week’s selloff. Sterling is trading mildly firmer but there is no clear strength. Similarly, Euro also recovers mildly too but it’s kept below 1.1814 resistance against dollar so far, maintains an undertone. The calendar is relatively light today and trading could remain subdued. But activity will quickly increase as a busy week starts "informally" on Tuesday. Fed, ECB, BoE and SNB will meet and there are heavy data including US and UK CPI to be featured.

Bitcoin futures trading starts in CBOE

Bitcoin futures trading started with (Chicago Board Options Exchange) CBOE futures Exchange together at the start of this week’s global trading hours. CBOE said in a tweet that while operations are generally normal, heavy traffic caused the system to perform "performing slower than usual and may at times be temporarily unavailable." But that was mainly due to interests from the world, rather than actual trading. The futures are based on auction price of bitcoin in USD on the Gemini Exchange.

UK BCC warned of Brexit uncertainty despite last week’s deal

UK British Chambers of Commerce warned that despite last week’s progress on Brexit negotiation, the vast uncertainties would still undermine investments, until the picture is cleared. BCC director general said that "despite last week’s deal, Brexit uncertainty still lingers over business communities, and is undermining many firms’ investment decisions and confidence." Also, "despite pockets of resilience and success, and strong results for some UK firms, the bigger picture is one of slow economic growth amid uncertain trading conditions." The lobby group forecasts BoE to keep interest rates on hold until end of 2019. And it downgraded 2018 growth projection from 1.2% to 1.1%.

Japan business conditions improved

In Japan, the Ministry of Finance’s business survey index (BSI) showed generally improved business conditions. For large corporations, with capital of JPY 1b or above), all industry business conditions improved to 6.2, up from 5.1. Large manufacturing conditions rose to 9.7, up from 9.4. Large non-manufacturing business conditions rose to 4.5, up from 2.9.

China CPI slowed, ease pressure for tightening

In China, CPI slowed to 1.7% yoy in November, down from 1.9% yoy and missed expectation of 1.8% yoy. PPI also dropped to 5.8% yoy, down from 6.9% yoy and met expectations. Slowing inflation is seen as welcomed by both the authority and the markets. The data suggests that China is in no rush to raise interest rate or tighten up monetary policies.

Looking ahead – Fed, ECB, BoE, SNB to meet

It’s an extremely busy week with four central banks featured. SNB, ECB and BoE are all expected to keep policies unchanged. And, we’re not expecting any surprise from them. Fed is widely expected to raise interest rate for the third time this year. Federal funds rate would be hiked by 25bps to 1.25-1.50%. The voting, inflation forecast and policymakers’ own dot plot forecast will be key for assessing whether Fed would hike three more times next year.

In addition to that, UK CPI and US CPI will catch most attentions. Other important data include German ZEW, Eurozone PMIs, US retail sales, Japan Tankan survey and Australia employment

Here are some highlights for the week ahead:

- Tuesday: Australia house price index, NAB business confidence; Japan tertiary industry index, PPI; UK CPI, PPI; German ZEW; US PPI

- Wednesday: German CPI final; UK employment; US CPI, FOMC rate decision

- Thursday: Australia employment; China industrial production, fixed asset investment, retail sales; UK RICS house price balance; Swiss PPI, SNB rate decision; Eurozone PMIs, ECB rate decision; UK retail sales, BoE rate decisions; Canada new housing price index; US retail sales, jobless claims, import prices, PMIs

- Friday: New Zealand manufacturing index; Japan tankan survey; Eurozone trade balance; Canada manufacturing sales; US Empire State manufacturing, industrial production

USD/JPY Daily Outlook

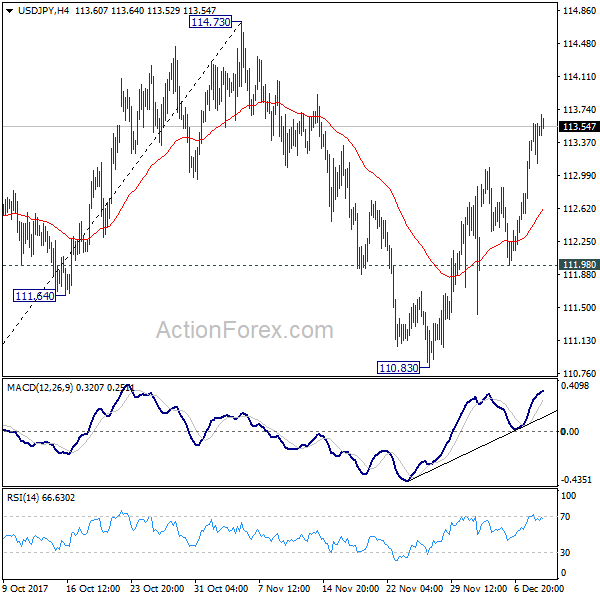

Daily Pivots: (S1) 113.16; (P) 113.37; (R1) 113.67; More…

USD/JPY edges higher to 113.68 so far and intraday bias remains on the upside. Current rise from 110.83 would extend to 114.73 key near term resistance. Decisive break there will resume whole rise form 107.31. More importantly, that will confirm completion of medium term correction from 118.65 at 107.31. In that case, retest of 118.65 should be seen next. However, break of 111.98 support will extend the correction from 114.73 with another fall, possibly to 61.8% retracement of 107.31 to 114.73 at 110.14 before completion.

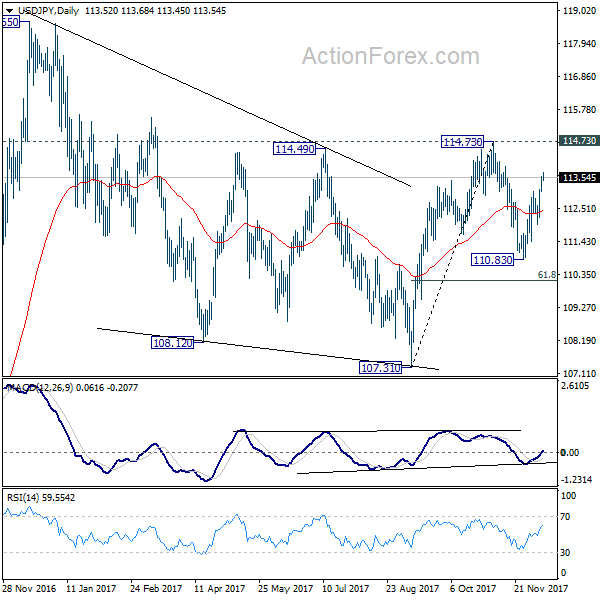

In the bigger picture, we’re holding on to the view that correction from 118.65 is completed a 107.31. And medium term rise from 98.97 (2016 low) is resuming. Sustained break of 114.73 should affirm our view and send USD/JPY through 118.65. However, break of 107.31 will dampen this will and extend the medium term fall back to 98.97 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large All Industry Q/Q Q4 | 6.2 | 5.8 | 5.1 | |

| 23:50 | JPY | BSI Large Manufacturing Q/Q Q4 | 9.7 | 10 | 9.4 | |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Nov | 4.00% | 4.10% | 4.10% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Nov P | 49.80% |