Sharp volatility in Sterling continues today as hawkish comments from BoE chief economist Andy Haldane propels it higher. Haldane said today that partial removal of monetary stimulus would be "prudent relatively soon". And he noted that "risks associated with tightening too early, on the one hand, and too late, on the other, has swung materially towards the latter in the past six to nine months." He pointed out that "the risks of tightening too early have shrunk as growth and, to lesser extent, inflation have shown greater resilience than expected. And if policy tightened too late, this could result in a much steeper path of rate rises later on."

Haldane’s comments was taken seriously by the markets as firstly, he’s the chief economist. Secondly, he’s perceived by many as the most dovish MPC member. Thirdly, while Kristin Forbes will be released by Silvana Tenreyro, there are potentially still three MPC member, including Haldane, Ian McCafferty and Michael Saunders, that could vote for rate hike ahead. Haldane’s comments were in sharp contrast to BoE Governor Mark Carney’s, showing a clear split between the board.

Separately, a report by BoE’s regional agents noted moderate growth in the country overall. Export volume was helped by depreciation of the Pound and showed continuing growth. More importantly, rising intentions on investments were seen. The report noted that upward pressure on companies’ costs due to currency effect "may have passed their peak". Meanwhile, it warned that highest costs are feeding into consumer inflation that could weight on consumptions and some investments.

Technically, nonetheless, GBP/USD is staying below 1.3813 resistance, GBP/JPY below 142.75 resistance, EUR/GBP above 0.8639 support. The pound is staying near term bearish in these pairs.

ECB noted US, China and Brexit as new sources of risks

ECB noted in its monthly economic bulletin that "careful communications by the Federal Reserve System, coupled with a very gradual course of monetary policy tightening, and the decline in vulnerabilities in major emerging markets, appears to have eased the risk of a disorderly tightening of global financial conditions." But the central bank also warned of "new sources of risk". In particular, ECB pointed to the "potentially protectionist direction of the new US administration" that could have a "significant negative effect on the global economy". In addition, "China’s vulnerabilities over the medium term are also still elevated". And potential contentious negotiations over Britain’s departure from the European Union remain a source of concern".

BoJ Kuroda: economy on firmer footing

BoJ Governor Haruhiko Kuroda said today that the economy is on "firmer footing" but Japan is still "distant from our 2 percent inflation target". He reiterated that "it is appropriate to keep monetary conditions easy with our current market operations framework." Also Kuroda noted that it’s he is not thinking about stimulus exit yet. And the pace of JGB purchase could rise again easily. Regarding the economy, he offered an optimistic of assessment of capital expenditure and corporate profits. and Output gap is moving back into positive territory.

The minutes of BoJ’s April meeting showed that policy makers were comfortable with the fluctuation in JGB purchases. The minutes noted that "members reaffirmed their view that debt purchases will fluctuate within a range depending on market conditions and agreed this poses no problems to the BOJ’s guidance for market operations." This came into question as BoJ recently slowed down the bong purchases. And with the current pace, the total annual increase could be projected as JPY 60T, instead of JPY 80T as the central noted in its communications. Nonetheless, it’s been clear that BoJ changed its approach last year to the so called Yield Curve Control framework. That is, the central bank is targeting to keep long term yield at zero, instead of a figure of asset purchase.

On the data front

UK public sector net borrowing dropped to GBP 6.0b in May. Australia Westpac leading index rose 0.0% mom in May. Japan all industry index rose 2.1% mom in April. RBNZ rate decision will be a focus in the upcoming Asian session. The central bank is widely expected to keep OCR unchanged at 1.75%.

GBP/USD Mid-Day Outlook

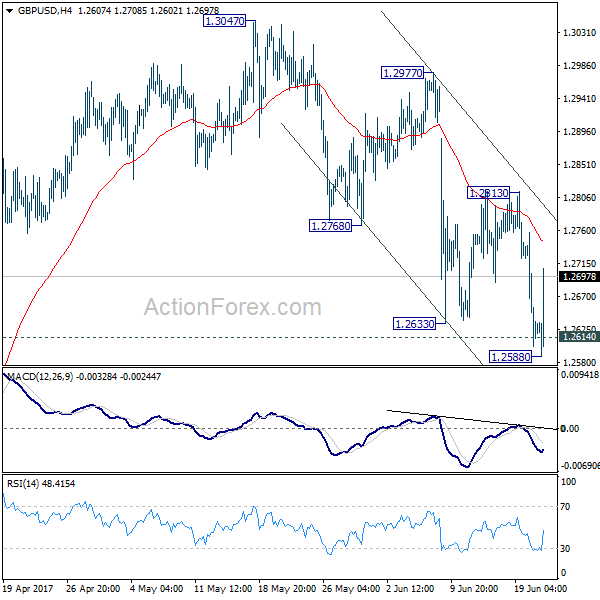

Daily Pivots: (S1) 1.2565; (P) 1.2661; (R1) 1.2721; More…

GBP/USD rebounds strongly after dipping to 1.2588 earlier today. As the pair is trying to draw support from 1.2614 key support level, intraday bias is turned neutral first. Deeper fall is still expected as long as 1.2813 resistance holds. As noted before, we’re still favoring the bearish case that consolidation pattern from 1.1946 has completed at 1.3047 already. Sustained break of 1.2614 resistance turned support should confirm our bearish view and target a test on 1.1946 low next. However, break of 1.2813 resistance will dampen our view and turn bias back to the upside for 1.3047 and above.

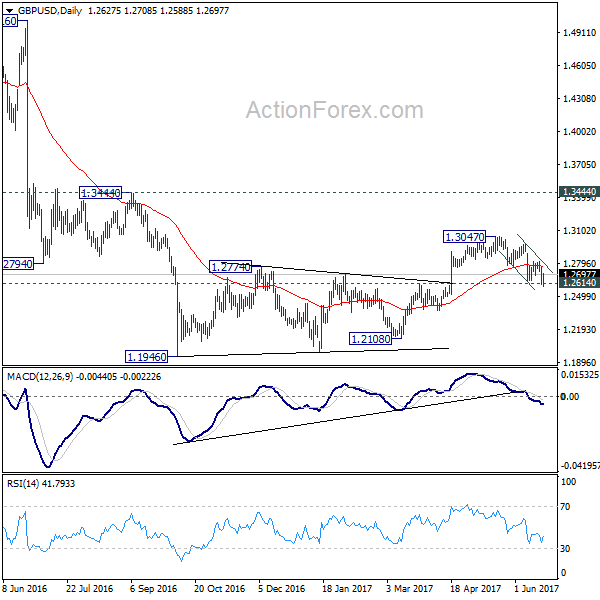

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. Price actions from 1.1946 medium term low are seen as a consolidation pattern, which could have completed after hitting 55 week EMA. Break of 1.1946 low will target 61.8% projection of 1.5016 to 1.1946 from 1.3047 at 1.1150 next. In case the consolidation from 1.1946 extends, outlook will stay remain bearish as long as 1.3444 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Minutes April Meeting | ||||

| 0:30 | AUD | Westpac Leading Index M/M May | 0.00% | -0.10% | ||

| 4:30 | JPY | All Industry Activity Index M/M Apr | 2.10% | 1.60% | -0.60% | -0.70% |

| 8:30 | GBP | Public Sector Net Borrowing (GBP) May | 6.0B | 7.3B | 9.6B | 8.7B |

| 14:00 | USD | Existing Home Sales May | 5.54M | 5.57M | ||

| 14:30 | USD | Crude Oil Inventories | -1.7M | |||

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% |