Dollar softer after week full of political uncertainty

The USD ended the week with a muted market reaction as the Trump administration pulled the healthcare bill as there was a lack of support from Republicans to pass the bill into law. The Trump administration has lost momentum as their choice of policies to champion out of the gate were not the ones the market expected after a Trump win in the U.S. election. The comments from House Speaker Ryan and President Trump is now to focus on pro-growth policies which were the ones that sparked the Trump trade, also known as the Reflation trade.

The week of March 27 to 31 will feature a light economic data calendar with the highlight being the German Business Confidence on Monday, March 27 at 4:00 am EDT, the U.S. Consumer Confidence on Tuesday, March 28 at 10:00 am.

The silver lining for the dollar on the failure to push the healthcare bill is that it clears the way for awaited reforms such as taxes and infrastructure spending. Treasury Secretary Steve Mnuchin said earlier today that a tax overhaul was coming soon even before of the healthcare bill was pulled. In his words tax reform is a lot simpler than health care. FOMC speakers will be also front and center with Evans, Kaplan, and Kashkari set to speak at several events during the week.

The EUR/USD gained 0.542 percent in the last five trading days. The single currency is trading at 1.0805 as President Trump’s healthcare bill faces strong opposition. The President has declared that if the bill is not approved on Friday he will leave Obamacare in place.

There were few economic indicators released this week in Europe and the United States. Unemployment claims in the U.S. came in higher than expected at 261,000 with core durable goods also missing forecasts with a 0.4 percent gain.

The Trump administration is proving to be one of the fastest to lose the post election momentum. When he was the president-elect Trump was able to get markets excited with the promise of pro-growth policies focused on tax stimulus and infrastructure spending. The Trump trade started to crumble when due to political reasons the first policies signed by President Trump were aimed at immigration, anti-trade and now healthcare reform facing tough opposition form the Democratic party and in the case of healthcare even from Republicans.

On Monday, March 27 the German Ifo Business Climate will be released at 4:00 am EDT. Confidence from German manufacturers, builders, wholesalers and retailers participate in the survey that has been improving slowly since September 2016. Consumer confidence in the U.S. will be released on Tuesday, March 28. The disconnect from strong consumer confidence and softer retail sales is expected to continue with the release of the Conference Board data. The Final GDP will be released on Thursday, March 30 at 8:30 am EDT. The third release on the fourth quarter gross domestic product for the United States.

XAU/USD gained 1.806 percent in the past five days. The price of gold is trading at $1,253 as political uncertainty surrounding the healthcare bill in the U.S. made the yellow metal increase its appeal as a safe haven. Gold rose against the USD as the greenback lost ground ahead of the healthcare bill in congress. Eventually the bill was pulled for lack of support and it raises questions marks about the future of Trump policies in particular fiscal stimulus and infrastructure.

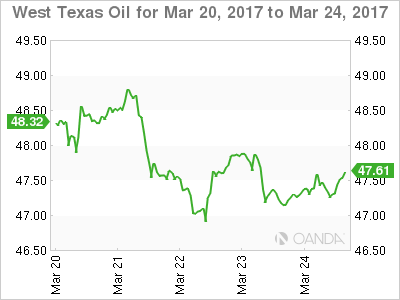

Oil lost 2.498 percent in the least week. The price of West Texas is trading at 47.47 as the effects of the Organization of the Petroleum Exporting Countries (OPEC) production cut agreement are being offset by higher inventories in the U.S. as more shale producers are coming online. U.S. drillers added the most oil rigs since January.

There is a meeting in Kuwait this Sunday where OPEC and non-OPEC members will discuss the future of the production cut agreement and a possible extension. The weakness of the USD has kept the price of oil from falling further, but as doubts emerge around the next agreement and the impact producers that are not part of it could have as they ramp up production as prices are stable.

Market events to watch this week:

Monday, March 27

- 4:00am EUR German Ifo Business Climate

Tuesday, March 28

- 10:00am USD CB Consumer Confidence

- 10:10am CAD BOC Gov Poloz Speaks

Wednesday, March 29

- 10:30am USD Crude Oil Inventories

Thursday, March 30

- 8:30am USD Final GDP q/q

- 8:30am USD Unemployment Claims

Friday, March 31

- 4:30am GBP Current Account

- 8:30am CAD GDP m/m

*All times EST