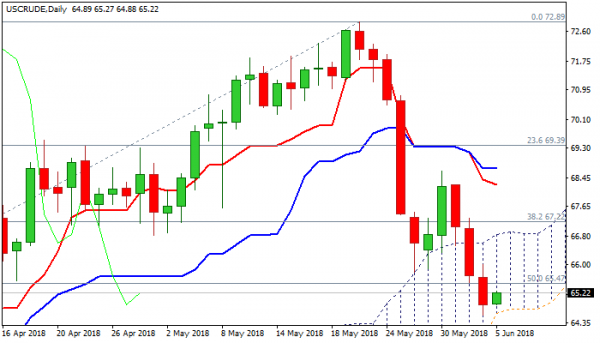

WTI oil price is slightly higher in early Tuesday’s trading, consolidating strong fall of past three days. Oil was down nearly 5% on last Thu/Mon fall from $68.26 to $64.57, being under strong pressure on rising US production and concerns that major world oil producers may raise output.

Three-day fall found footstep just above the base of rising daily cloud ($64.62) and may consolidate before fresh attempts lower.

Monday’s close below 100SMA ($65.30) was bearish signal, with immediate focus expected to remain at the downside while 100SMA (now reverted to resistance) caps.

Bearish daily techs support the notion, with sustained break below daily cloud to generate strong bearish signal and risk extension towards $63.73 (Fibo 61.8% of $58.06/$72.89 ascend).

Consolidation is expected to ideally hold below 100SMA but stronger upticks cannot be ruled out.

Broken daily cloud ($66.86) is expected to cap extended upticks and keep bearish structure intact.

US API crude stocks data is due later today and eyed for fresh signals.

Res: 65.30, 66.02, 66.86, 67.44

Sup: 64.62, 63.73, 63.19, 61.92