The European Central Bank is due to conclude its two-day monetary policy meeting on Thursday, with its decision expected at 11:45 GMT. With no change in policy or to the Bank’s forward guidance anticipated at the October meeting, all eyes will be on Mario Draghi’s press conference at 12:30 GMT to hear the ECB chief’s latest views on the slowing Eurozone economy and a drawn-out budget stand-off between Italy and the European Union.

At the last meeting on September 13, Draghi reiterated that the risks to the Eurozone’s growth outlook remained “roughly balanced” even as an increasing number of indicators pointed to weakening growth in the region. Days later, at a European parliamentary hearing, Draghi sounded even more hawkish, saying there was a “vigorous pick-up in underlying inflation”. The comments drove the euro to a three-month of $1.1815 as investors interpreted this as an unexpected shift in tone from the central bank.

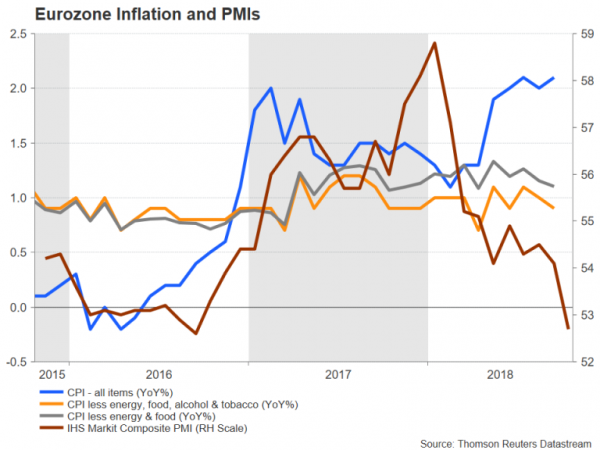

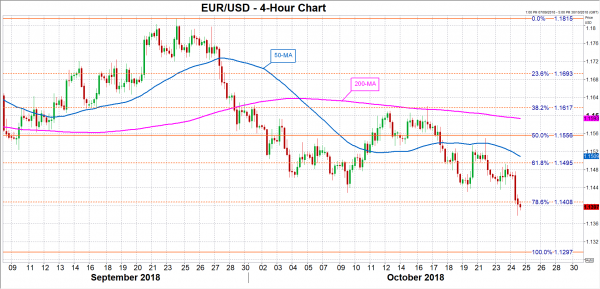

However, the euro has since reversed lower, sliding to two-month lows below the $1.14 level, as economic data has continued to mostly disappoint, with the Italian budget crisis adding to the uncertainty over the outlook. The Eurozone flash PMI release for October showed the composite PMI, which closely tracks GDP growth, fell to the lowest in two years, pointing to GDP growth of just 0.3% during the fourth quarter.

There hasn’t been any pick up in underlying inflation either, despite Draghi’s optimism. While headline inflation has risen above 2% (with the help of higher energy prices), core inflation measures remain firmly stuck around 1%.

On the positive side, unemployment in the euro area has been falling faster than expected, giving rise to some tepid wage pressures, and perhaps justifying the ECB’s more confident outlook on inflation. Furthermore, ECB data out on Wednesday showed business lending in the Eurozone hit a post-crisis high in September, rising by 4.3% year-on-year and signalling higher corporate spending in the future.

While Draghi is unlikely to deviate much from recent remarks when he briefs reporters after Thursday’s meeting, traders will be paying close attention to any signs of growing concerns among ECB policymakers about the strength of the Eurozone economy. Draghi will probably also be put under the spotlight over his home country of Italy, as the new coalition government is adamant about sticking to its proposed budget deficit target for 2019, in defiance of the European Commission, which has rejected the proposal.

Having plummeted to as low as $1.1378 on Wednesday, the single currency could skid towards the August trough of $1.1297 should Draghi fuel worries about the growth outlook, which in turn would raise doubts about the timing of the first rate hike, currently projected to arrive in the fourth quarter of 2019. A breach of that low would take the focus to the $1.11 handle as the next key support.

However, should Draghi maintain a cautiously bullish outlook and stick to the Bank’s policy normalization timeline, the euro could correct higher. A short-term reprieve from the ECB could help the euro bounce above the 78.6% Fibonacci retracement level of the upleg from $1.1297 to $1.1815, at $1.1408, and climb towards the 61.8% Fibonacci at $1.1495. A move even higher could see the euro attempt to overcome the 50% Fibonacci at $1.1556 as the next resistance barrier.