The US dollar is higher against most major pairs on Wednesday. The Japanese yen is the outlier as lack of fundamental data and an OECD global forecast cut lowered investor’s appetite for risk. Central banks this week have stressed their caution as economic performance leaves a lot to be desired. The European Central Bank (ECB) is the next in line to publish its monetary policy statement with a side of dovish rhetoric.

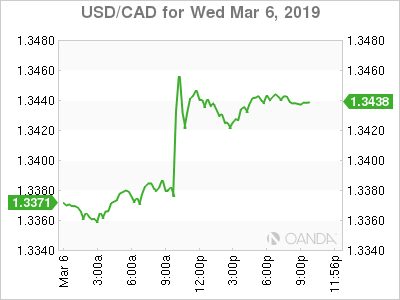

The Canadian dollar fell 0.62 percent on Wednesday after the Bank of Canada (BoC) joined the dovish choir of central banks. The BoC held interest rates unchanged at 1.75 percent and future hikes are uncertain this year. The softer than forecasted fourth quarter of 2018 has forced the central bank to revise it hawkish view in the short term although headwinds could push an interest rate lift off the table for this year.

Oil prices were not supportive of the loonie as higher than expected inventories in the US and Libya’s largest oil field back online dragged energy prices lower.

Global growth warning signs have forced central banks to change their tone, and the BoC’s dovish turn is a direct result of a domestic economic slowdown.

The US dollar rose as investors sought the safety of US debt as treasuries rose as anxiety about the US-China trade deal and Brexit are once again surging.

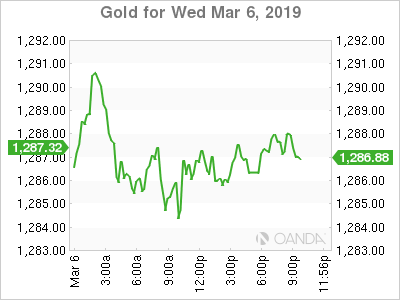

GOLD

Gold rose 0.28 on Wednesday as the US private payrolls report underperformed ahead of the U.S. non-farm payrolls (NFP) on Friday. The U.S. Federal Reserve has put on pause its monetary policy tightening until growth improves. If American employment disappoints this week the case for a hike of the US fed funds rate will take a hit. The Fed’s beige book released today highlights the aftermath of the government shutdown on economic activity painting a mixed picture as worker shortages remain, while growth is cooling down.

The yellow metal has been under pressure as the US-China trade dispute appears near an agreement putting an end to back and forth tariffs and Brexit entering its final weeks. Optimism on the geopolitical front can be short lived which is why gold is quick to recover in times of uncertainty.

More central banks are taking a wait-and-see approach, the latest being the Bank of Canada (BoC), as global growth has been negatively impacted with the rise of trade barriers between nations.

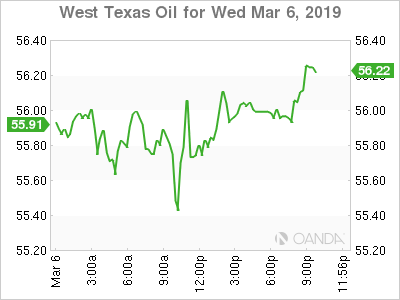

OIL

Oil is mixed after a larger than expected buildup of US inventories dragged WTI lower. US production has been ramping up and the API estimate and the official Energy Information Administration (EIA) data aligned to pressure prices downward. The decline was not deeper as the same report showed a drop in refined fuel.

Yesterday Chevron and Exxon published their Permian basin projections showing a rise in shale oil production. The balance between rising US production and the OPEC+ efforts to stabilize prices with a production cut was broken by higher than expected US inventories and the OECD warning of lower global growth impacting energy demand going forward.

No news was bad news for the energy market as lack of details on the US-China trade agreement meant the wider trade deficit data out of the US and the OECD forecast downgrade took prices lower.

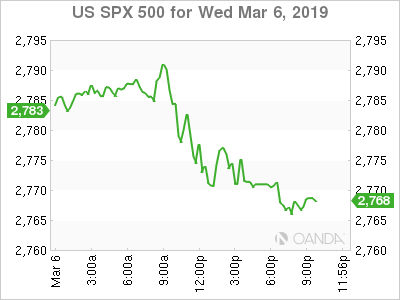

STOCKS

Global indices finished lower as global growth concerns rose after the OECD downgraded its forecasts and there was little news on the US-China trade deal and the Brexit divorce giving investors guidance. With the Bank of Canada (BoC) joining the ranks of the doves, growth anxiety became a widespread theme as treasuries rose.