Canadian Dollar rebounded sharply after US President Donald Trump announced a 30-day pause on planned tariffs against Canadian imports, just hours after implementing a similar delay for Mexico.

The decision came after negotiations between Trump and Canadian Prime Minister Justin Trudeau, who confirmed that Canada would take aggressive new measures to combat fentanyl trafficking, including deploying nearly 10,000 personnel to reinforce border security. Canada also committed to appointing a “Fentanyl Czar”, classifying cartels as terrorist organizations, and launching a Canada-US “Joint Strike Force” targeting organized crime and money laundering.

Markets welcomed the de-escalation, as the tariff pause removes immediate downside risks for the Canadian economy. Trump emphasized that the suspension is conditional on further progress in security measures and that an “Economic deal with Canada” may still need to be structured.

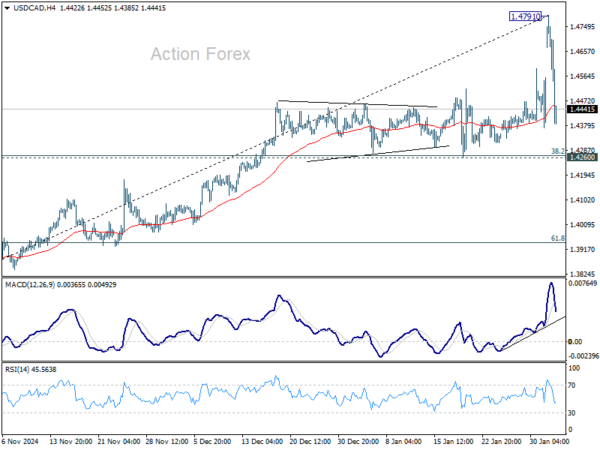

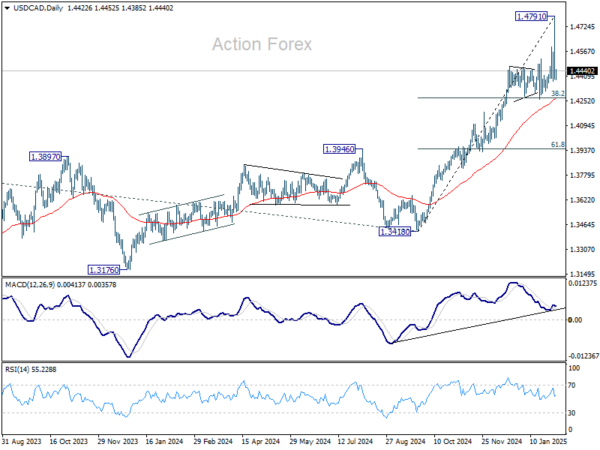

Technically, a short term top is likely formed at 1.4791 in USD/CAD after this week’s strong volatility. More sideway trading should now be seen in the near term. However, outlook will continue to stay bullish as long as 1.4260 cluster support holds (38.2% retracement of 1.3418 to 1.4791 at 1.4267), which is also close to 55 D EMA (now at 1.4267). USD/CAD’s up trend is still in favor to resume at a later stage when the consolidation completes.