A seven-day rally in global equities paused during Thursday’s Asian session, following a mixed overnight performance on Wall Street. The Dow Jones Industrial Average and Russell 2000 slid 0.7% and 1.4%, respectively, while the S&P 500 and Nasdaq 100 pushed to fresh record highs, up 0.1% and 0.3%. Gains were driven by mega-cap tech names including Nvidia (+1.7%), Amazon (+1.7%), Microsoft (+1%), and Alphabet (+0.9%).

Asia’s longest winning streak since January ends

Asia-Pacific markets snapped their longest winning streak of the year. Hong Kong’s Hang Seng Index dropped 0.9% intraday after hitting a 3.5-year high, while Japan’s Nikkei 225 fell 0.9%, just shy of its all-time peak at 42,427. Singapore’s Straits Times Index also saw profit-taking, down 0.3% after a record-breaking 14-session rally.

Profit-taking and the US dollar rebound pressure Asian equities

Today’s Asian regional pullback likely reflects overbought conditions and a technical rebound in the US dollar after a four-day losing streak. The US dollar Index’s intraday firm tone is weighing on risk assets in Asia as traders reassess their short-term bullish momentum.

The worst performers against the US dollar at this time of writing are CAD (-0.17%), AUD (-0.16%), and GBP (-0.13%)

The intraday bounce seen in the US dollar is also reinforced by a slowdown in growth in Japan’s leading inflation gauge, where Tokyo’s core-core CPI (excluding food and energy) advanced at a slower pace of 2.9% y/y in July, a drop from 3.1% recorded in June.

Gold slips further as US dollar firms, support levels in focus

Gold (XAU/USD) declined for the third straight session, falling 0.4% intraday. The yellow metal is now approaching key support at its 20- and 50-day moving averages near US$3,333, amid headwinds from a strengthening US dollar.

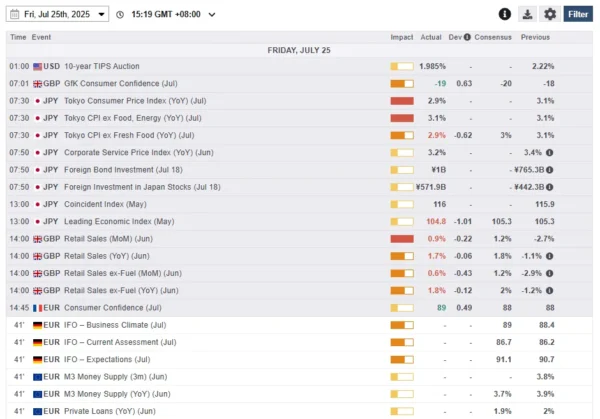

Economic data releases

Fig 1: Key data for today’s Asia mid-session (Source: MarketPulse)

Chart of the day – Hang Seng Index at risk of minor corrective decline

Fig 2: Hong Kong 33 CFD Index minor & medium-term trends as of 25 July 2025 (Source: TradingView)

The price actions of the Hong Kong 33 CFD Index (a proxy of the Hang Seng Index futures) have rallied as expected. Recap our previous Chart of the day – Start of a potential impulsive bullish sequence for Hang Seng Index.

The two weeks of advancement have hit the upper boundary of a major ascending channel from the January 2024 low, now acting as an intermediate resistance at 25,750. The hourly RSI momentum indicator has just staged a bearish breakdown below a parallel ascending support from 19 June.

These observations suggest that bullish momentum has waned, and the Hong Kong 33 CFD Index is likely to stage a potential imminent minor corrective decline to retrace some of the gains seen from the prior rally from the 4 July 2025 low to the 24 July 2025 high (see Fig 2).

Watch the 25,750 key short-term pivotal resistance, and a break below 25,260 may reinforce the minor corrective decline sequence on the Hong Kong 33 CFD Index to expose the next intermediate support at 24,940/850.

On the flipside, a clearance above 25,750 revives the bullish tone for the continuation of the bullish impulsive up move sequence to seek out the next intermediate resistance at 26,030/26,220 (Fibonacci extension and medium-term swing high areas of 20/26 October 2021).