- Gold (XAU/USD) has breached $5000/oz, challenging the consensus that its recent rally was a “dead cat bounce.”

- While the long-term trend is bullish, the short-term view is neutral-to-bearish, with a key upside breakout level at 5046.

- A barrage of US data and geopolitical risk ahead this week could be a key driver for Gold prices.

The price of gold has breached the $5000/oz handle once more. A surprise given the overwhelming consensus by analysts that the recent rally had shown signs of being a ‘dead cat bounce’ given the grind we saw from gold prices.

However, Gold has once again grinded its way back above the key $5000/oz handle, with more questions now being asked. Chief among them is whether the precious metal will be able to kick in from here or will we be in for more indecision for the rest of the week?

What was behind the recent pullback in Gold prices?

There has been a lot of mixed messages as to what the reasons were behind Gold’s recent slide.

In my view the initial pullback in gold prices was driven by a strengthening US dollar and a shift toward risk-off sentiment across global markets.

US Dollar Index (DXY) Daily Chart, February 18, 2026

Source: TradingView

These price swings were further intensified by thin liquidity, as major Asian markets were closed for the Lunar New Year, making gold more vulnerable to macroeconomic shifts and currency fluctuations.

Despite this sensitivity to the dollar and broader market nerves, the recent decline appears to be a temporary correction rather than a long-term trend. As Asian markets reopen and liquidity returns to normal levels, gold appears to have found firmer support.

Given the ongoing macroeconomic uncertainty and solid underlying fundamentals, any further price dips will likely attract fresh buying interest from investors looking for a safe haven.

Looking Ahead: US data, US dollar dynamics and geopolitical risks

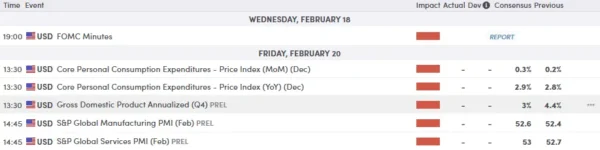

Looking ahead, US markets will focus on housing data, remarks from Fed officials, GDP figures for Q4 2025, and the release of the Fed’s preferred inflation measure, the core Personal Consumption Expenditures (PCE) Price Index.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

All of these will have some role to play in Gold’s next move as markets remain somewhat cautious given the uncertainties at play.

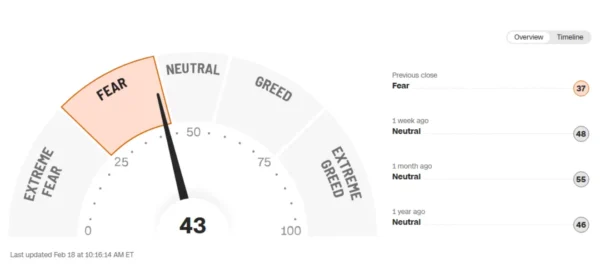

Looking at the fear and greed index and markets are still in fear territory with a score of 43. This is also keeping Gold prices supported, as fear tends to keep market participants interested in safe haven bets.

Source: FinancialJuice

Technical Outlook – Gold (XAU/USD)

From a technical standpoint,Gold has resumed its long term bullish trajectory but significant challenges remain.

The overall long-term structure remains bullish (upward), but the shorter-term chart (H4) shows a neutral-to-bearish tilt as the market consolidates its recent 15% drop from the $5,500 highs.

Looking at the four-hour chart below and the range between 5096 and 4760 will be key in the near-term.

Looking at the potential for an upside breakout and the swing high at 5046 (printed on February 13) is the first point of contention. A four-hour candle close above this level may open the dorr for a range break beyond the 5096mark and open up a potential 330 odd dollar move to the upside.

Further supporting the bullish breakout narrative is the period-14 RSI on the H4 chart which is now above the 50 level, hinting at bullish momentum.

Conversely, a move lower here first needs to navigate support at 4908 before the swing low around the 4860 handle comes into focus.

Only then will the range low around 4760 become an area of focus.

Gold (XAU/USD) Four-Hour Chart, February 18, 2026

Source: TradingView (click to enlarge)