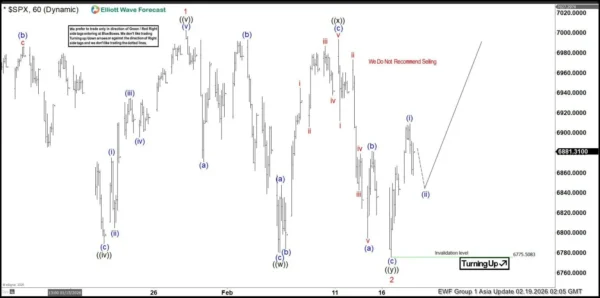

S&P 500 completes wave 2 pullback near 6775.50 and resumes bullish momentum above the blue box.

The S&P 500 (SPX) appears to have completed its pullback in red wave 2 at the equal legs area near 4776, unfolding in a corrective 7-swing structure. From that support zone, price has turned higher, suggesting wave 3 is now underway. While there remains a possibility that the correction could extend into an 11-swing structure toward the 1.618 Fibonacci extension around 6440, but we are taking a more aggressive stance that the pullback has already ended. The strong reaction from the blue box area reinforces the bullish outlook and supports the idea that buyers have regained control.

Wave 3 typically represents the strongest and most impulsive leg within the Elliott Wave sequence. Early price action is showing constructive characteristics, indicating upside momentum is building. As long as SPX holds above 6775.5083 low, the preferred scenario calls for continued upside extension. We do not recommend selling against the current structure. Instead, pullbacks are expected to remain corrective and provide buying opportunities in alignment with the developing bullish sequence.

Overall, the index is positioned for further upside while holding above key support levels.

SPX 1-Hour Elliott Wave Chart From 2.19.2026

SPX Elliott Wave Video:

You are currently viewing a placeholder content from Default. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.