We expect ECB to implement more easing measures to stimulate the economy, and the timing would likely be in September. The July meeting, scheduled later this week, would be used to prepare the market further the easing package. Over the past month, ECB has sent strong signals that a rate cut would likely come. Besides the June meeting minutes, President Mario Drahi signaled at Sintra’s forum on June 18 that, “in the absence of improvement, such that the sustained return of inflation to our aim is threatened, additional stimulus will be required”.

Earlier this month, ECB members also hinted more stimulus would come soon. Chief economist Philip Lane suggested that “substantial accommodation is still required to bring inflation back to aim. If more easing is needed, we have the tools… Pro-active measures (including negative rates) are the surest way to ensure inflation climbs to our aim”. At an interview with BFM Business TV, Board member Benoît Cœuré also noted that “accommodative monetary policy is needed more than ever”. However, the members probably have not reached an agreement on what measures should be implement as kick- off.

Lackluster Recovery Prompts More Stimulus

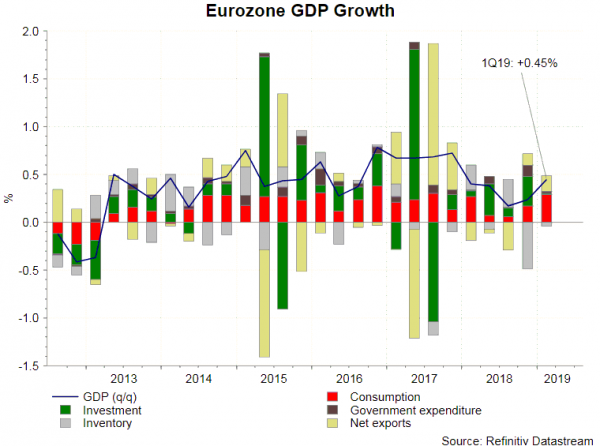

Eurozone’s economic developments have remained weak since the last meeting. Similar to other major economies, post- crisis lowe unemployment rate in the Eurozone has failed to boost inflation. headline CPI steadied at 1.3%, while core inflation improved to +1.1%, in June. Both readings stay markedly below ECB’s +2% target. GDP growth climbed to +0.45% q/q in 1Q19. Growth in both business investment and government spending shrank from the prior quarter. Final PMI index climbed +0.4 point to 52.2. As suggested in the accompanying report, “the survey is indicative of GDP merely rising by just over 0.2% in the second quarter, and a deterioration of business expectations for the year ahead to one of the lowest seen for over four years suggests the business mood remains somber”. It added that “downside risks to the outlook prevail amid trade war worries, rising geopolitical uncertainty and slowing global economic growth”. Separately, Germany’s ifo business climate index fell to 97.4 in June, down from 97.9 in May. This is its lowest level since November 2014. The accompanying statement noted that “companies have grown increasingly pessimistic about the coming months”.

At this week’s meeting, we expect the forward guidance would be adjusted in order to prepare the market for further easing. In June, ECB extended the forward guidance, expecting the policy rates to remain at their present levels “at least through the first half of 2020”. We expect it to add that the policy rates would stay “at present or lower levels” at the upcoming meeting. At the meeting statement, as well as the press conference, ECB would likely indicate that the members discussed about the possibility of restarting QE and the tiered interest rate system

If ECB is to announce further easing, it would come in the form of an easing package, rather than just a rate cut. The package would include enhancement of the forward guidance, reduction of the deposit and resumption of QE. At the Sintra forum, Draghi noted that policymakers “remain able to enhance our forward guidance by adjusting its bias and its conditionality to account for variations in the adjustment path of inflation”. On the rate cut, it likely that the members would decide to lower the deposit rate by -20 bps from the current -0.4%. Any rate cut could come with tieriin as so as to defend bank profitability. Taking interest rates deeper to the negative territory alone would by no means be “stimulative”. As such, ECB would likely accompany it with resumption of QE, the asset buying program that ended in December 2018. We expect the central bank resume asset buying for 12 month initially and include corporate bonds and sovereign debt in the program.

There are several reasons we believe September would be more appropriate that July. Updated ECB staff projections will be released in September should give the members more information to determine what measures to take. Since ECB would likely announce a set of measures, it would be prudent for the members to be better informed before making decision. Meanwhile, announcing measures in September would allow ECB to gauge Fed’s action (likely a rate cut) on July 31.