Dollar trades generally weaker today except versus Yen and Canadian Dollar, where it’s consolidating in oversold conditions. The greenback, nonetheless, continues to feel the weight added by dovish testimony of Fed Chair Janet Yellen. Yellen will have the second round of her testimony today but that will likely bring little news. Meanwhile, overwhelming strength is seen in Aussie and Kiwi today, as lifted by rebound in commodity prices and solid Chinese trade data. Euro, on the hand, is also struggling as traders start to turn cautious on ECB policy bets. Sterling is believed to be saved by comments from BoE hawk Ian McCafferty and rebounds against most others.

US: Solid jobs, slower inflation

US initial jobless claims dropped 3k to 247k in the week ended July 8, slightly above expectation of 245k. That’s the 123 straight weeks of sub 300k reading. Four week moving average rose 2.25k to 245.75k. Continuing claims stood at 1.95m in the week ended July 1, staying below 2m for 14 straight week. Also from US, headline PPI slowed to 2.0% yoy in June but beat expectation of 1.9% yoy. Core PPI also slowed, to 1.9% yoy, below expectation of 1.9% yoy. Released from Canada, new housing price index rose 0.7% mom in May.

ECB Draghi might signal policy shift at Jackson Hole

There are talks surfacing today that ECB President Mario Draghi could make use of the Fed’s Jackson Hole conference in August to address the future of ECB’s monetary stimulus. That will be the first appearance in the annual conference in three years. It’s generally believed that ECB will formally announce what to do after the current EUR 60b per month asset purchase ends by the year end. And Jackson Hole could be a perfect occasion for Draghi to signal the policy shift.

ECB Governing Council member Ilmars Rimsevics said on Latvian radio today that the quantitative easing problem could continue fro at least " a couple of years" He pointed out that back in June, inflation forecasts were cut to 1.5% this year and 1.3% next. He noted that "shows that the medium-term inflation target of 2 percent is not met, which means that this programme could continue for at least a couple of years."

Released from Germany, CPI was finalized at 0.2% mom, 1.6% yoy in June. From Swiss, PPI dropped -0.1% mom, -0.1% yoy in June.

BoE hawk McCafferty pushed for balance sheet unwinding

BoE hawk Ian McCafferty said in an interview that the central bank should start considering to unwind its GBP 435b assets from the quantitative easing program. While there has been talks about rate hikes, this is so far the first voice regarding unwinding. Meanwhile, McCafferty maintained his views that interest rates should be raised and would continue to vote for a hike in August meeting. He cited the solid job data released earlier this week as the support for his view. Regarding inflation, he expects it to peak at around 3% while consumer growth will slow.

BoJ to revise down inflation forecasts, up growth projections

In Japan, there are continuous speculations on BoJ’s forecasts revision in July. Unnamed sources were quoted by newspaper saying the BoJ will lower fiscal 2017 inflation projection from 1.4% to somewhere between 1% and 1.4%. That would be a sensible decision as core inflation stood at 0.4% in May, well off the 2% target. On the other hand, to be in line with recent upgrade in economic assessment, BoJ could also raise growth projections.

China trade data suggests solid external demand and resilient domestic economy

China posted a trade surplus of USD 42.8b in June, widened from prior month’s USD 40.8b but missed expectation of USD 43.2b. Exports jumped 11.3% yoy while imports grew 17.2% yoy. The data showed that the economy in China is holding well, with solid global demand for its exports. The domestic economy also showed much resilience. In Yuan terms, trade surplus widened to CNY 294b, up from CNY 282b and beat expectation of CNY 273b.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2827; (P) 1.2867; (R1) 1.2922; More…

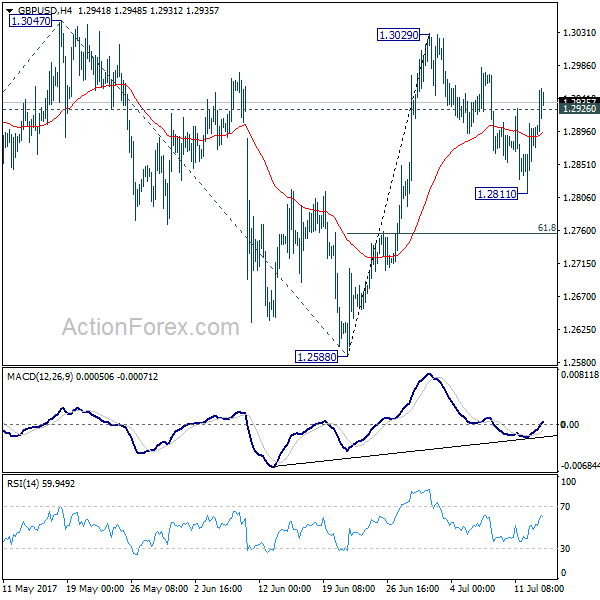

GBP/USD’s rebound and break of 1.2926 minor resistance suggests that pull back from 1.3029 has completed at 1.2811 already. Intraday bias is turned back to the upside for 1.3029/47 resistance zone. Decisive break there will extend the larger rally to 61.8% projection of 1.2108 to 1.3047 from 1.2588 at 1.3168 next. On the downside, sustained break of 1.2811 and 55 day EMA will dampen our bullish view and turn bias back to the downside for 1.2588 support instead.

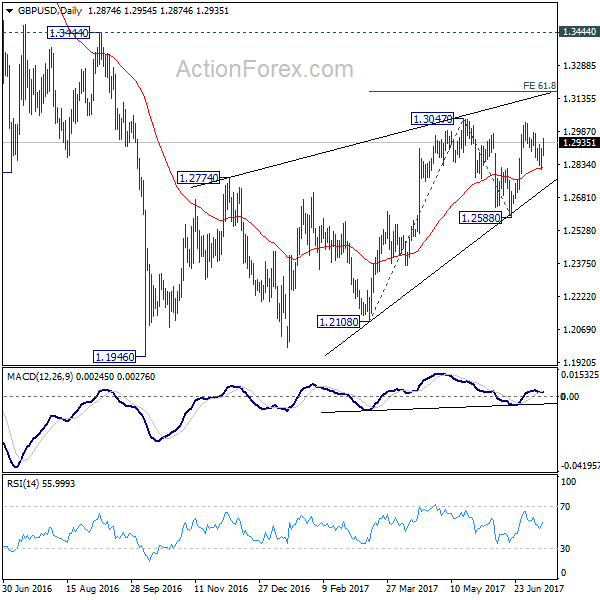

In the bigger picture, overall, price actions from 1.1946 medium term low are seen as a corrective pattern that is still in progress. While further upside is now in favor, overall outlook remains bearish as long as 1.3444 key resistance holds. Larger down trend from 1.7190 is expected to resume later after the correction completes. And break of 1.2588 will indicate that such down trend is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance Jun | 7% | 15% | 17% | |

| 01:00 | AUD | Consumer Inflation Expectation Jul | 4.40% | 3.60% | ||

| 03:22 | CNY | Trade Balance (USD) Jun | 42.8B | 43.2B | 40.8B | |

| 03:22 | CNY | Trade Balance (CNY) Jun | 294B | 273B | 282B | |

| 06:00 | EUR | German CPI M/M Jun F | 0.20% | 0.20% | 0.20% | |

| 06:00 | EUR | German CPI Y/Y Jun F | 1.60% | 1.60% | 1.60% | |

| 07:15 | CHF | Producer & Import Prices M/M Jun | -0.10% | 0.00% | -0.30% | |

| 07:15 | CHF | Producer & Import Prices Y/Y Jun | -0.10% | 0.00% | 0.10% | |

| 12:30 | CAD | New Housing Price Index M/M May | 0.70% | 0.20% | 0.80% | |

| 12:30 | USD | PPI M/M Jun | 0.10% | 0.00% | 0.00% | |

| 12:30 | USD | PPI Y/Y Jun | 2.00% | 1.90% | 2.40% | |

| 12:30 | USD | PPI Core M/M Jun | 0.10% | 0.20% | 0.30% | |

| 12:30 | USD | PPI Core Y/Y Jun | 1.90% | 2.00% | 2.10% | |

| 12:30 | USD | Initial Jobless Claims (JUL 08) | 247K | 245k | 248k | 250K |

| 14:00 | USD | Fed Chair Yellen Testifies Before Senate Banking Panel | ||||

| 14:30 | USD | Natural Gas Storage | 72 | |||

| 18:00 | USD | Monthly Budget Statement Jun | -16.2B | -88.4B |