Yen is trading mixed after BoJ announced additional easing measures, following shortened monetary policy meeting. Australian and New Zealand Dollars are the strongest ones. Both countries have been performing extraordinarily well in containing the coronavirus spread and are planning for lockdown exits. On the other hand, Dollar and Swiss Franc are currently the weakest ones for today. In particular, the timing of starting phased lockdown exit in May in the US is questionable.

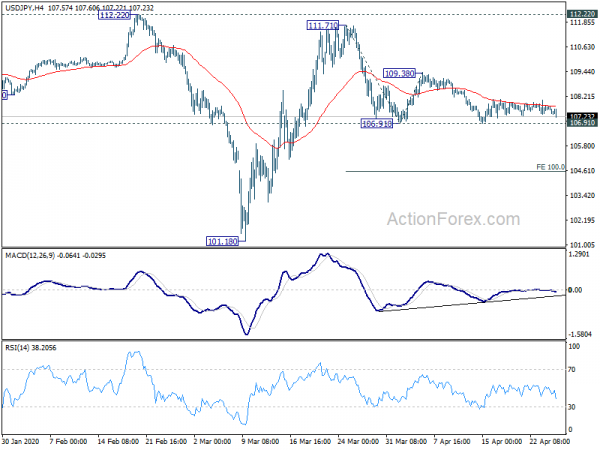

Technically, more downside remains in favor in USD/JPY with the pair being held by 4 hour 55 EMA. Yet, break of 106.91 support is needed to confirm resumption of fall from 111.71. AUD/USD is now eyeing 0.6444 temporary top. Break will resume whole rebound from 0.5506. 0.6670 key support turned resistance will then be in focus, which could define the medium term trend.

In Asia, currently, Nikkei is up 2.41%. Hong Kong HSI is up 1.64%. China Shanghai SSE is up 0.70%. Singapore Strait Times is up 1.41%. Japan 10-year JGB yield is down -0.0081 at -0.030.

BoJ to purchase JGBs without setting an upper-limit

BoJ announced further enhancement on monetary easing after shortening the two-day meeting to just three hours. Short term interest rate is held at -0.1%. Meanwhile, BoJ will purchase JGBs to and T-bills “without setting an upper-limit” to keep 10-year JGB yields at around zero percent.

Other two measures include firstly, commercial papers and corporate bonds purchases upper limit is raised to JPY 20 trillion., with maximum maturity extended to 5 years. Secondly, the Special Funds-Supplying Operates to Facilitate Financing in response to the Novel Coronavirus will expand the range of eligible collateral, counter parities, with 0.1% positive interest rate applied.

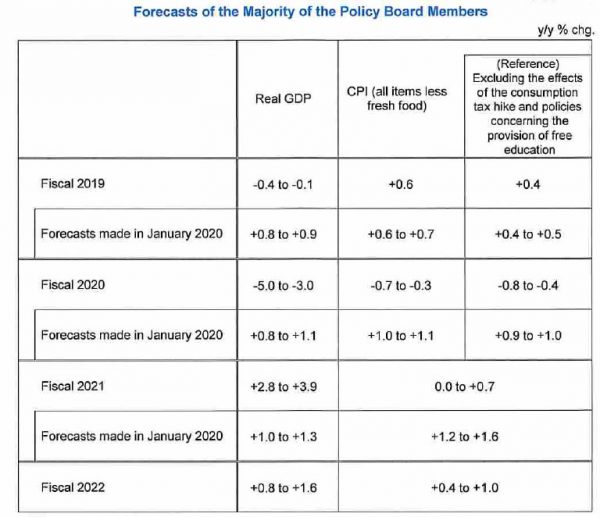

BoJ: GDP to contract -5% to -3% in fiscal 2020, return to deflation

In the Outlook for Economic Activity and Prices, BoJ said the economy is “likely to remain in severe situation for the time being” due to the impact of the coronavirus pandemic. GDP could shrink as much as -5.0% to -3.0% in fiscal 2020. Japan could also return to deflation with core CPI down -0.7 to -0.4%. BoJ added that “future developments are extremely unclear” and risks to both economic activity and prices are “skewed to the downside”.

GDP growth forecast:

- Fiscal 2019 at -0.4% to -0.1% (down from 0.8% to 0.9%).

- Fiscal 2020 at -5.0 to -3.0% (down from (0.8 % to 1.1%).

- Fiscal 2021 at 2.8% to 3.9% (up from 1.0% to 1.3%).

- Fiscal 2020 at 0.8% to 1.6%.

Core CPI forecast (excluding sales tax hike effects):

- Fiscal 2019 at 0.4% (vs 0.4% to 0.5%).

- Fiscal 2020 at -0.7% to -0.4% (down from 0.9% to 1.0%).

- Fiscal 2021 at 0.0% to 0.7% (down from 1.2% to 1.6%).

- Fiscal 2022 at 0.4% to 1.0%.

US Mnuchin expects Q3 rebound, NY Cuomo outlined phase-in reopening

US Treasury Secretary Steven Mnuchin tried to sound optimistic in a Fox New Sunday interview, and predicted a rebound in the economy is Q3. He said, “I think as we begin to reopen the economy in May and June, you’re going to see the economy really bounce back in July, August, September.”

“And we are putting in an unprecedented amount of fiscal relief into the economy,” he added. “You’re seeing trillions of dollars that’s making its way into the economy and I think this is going to have a significant impact.” “As businesses begin to open, you’re going to see demand side of the economy rebound.”

Separately, New York Governor Andrew Cuomo outlined the phased-in reopening plan of the state in details on Sunday. Construction and manufacturing upstate, which are seen as being low risk, will begin reopening in the first phase starting may 15. After at least two weeks, phase two could begin involving evaluation businesses on a case-by-case basis, on how essential they are. The reopening of the more “problematic” downstate New York City, Nassau, Suffolk, Westchester, “they all have to be coordinated”, Cuomo said.

US Hassett: Unemployment could jump to 16% in next jobs report

White House economic adviser Kevin Hassett told ABC’s “This Week” that the coronavirus pandemic is “really grave situation”, and the “biggest negative shock” that the US has “even seen”. He added, “unemployment rate is going to jump to a level probably around 16 percent or even higher in the next jobs report.”

Q2 GDP contraction would be a “big number” and “the next couple of months are going to look terrible”. “We’re going to need really big thoughtful policies to put together to make it so that people are optimistic again,” Hassett added.

“I’m sure that over the next three or four weeks, everybody’s going to pull together and come up with a plan to give us the best chance possible for a V-shaped recovery,” Hassett said. And, “I … don’t think you get it if we don’t have another round of really solid legislation.”

Fed and ECB to stand pat. US and Eurozone GDP watched

Two more central banks will meet in a rather busy week. Fed and ECB are both expected to keep monetary policy unchanged. Enough should have been done on the monetary policy side in countering the impact of the coronavirus pandemic. If there would be any more work needed, they should be on the fiscal side.

On the data front, Q1 GDP from US and Eurozone will be the highlight of the week, for gauging the overall initial impact of the pandemic. Canada will also release GDP but February’s data carries much less significance. Forward looking indicators, like US consumer confidence and ISM manufacturing, China’s PMIs will likely be more market moving than others.

Here are some highlights for the week:

- Tuesday: Japan unemployment rate; UK CBI realized sales; US goods trade balance, wholesale inventories, S&P Case-Shiller house price, Conference Board consumer confidence.

- Wednesday: New Zealand trade balance; Australia CPI; Germany CPI, import price; Eurozone M3 money supply; US GDP, pending home sales, FOMC rate decision.

- Thursday: Japan industrial production, retail sales, consumer confidence, housing starts; China official PMIs; New Zealand ANZ business confidence; Australia import prices, private sector credit; Swiss retail sales, KOF; French GDP, consumer spending; Germany retail sales, unemployment; Eurozone GDP, CPI flash, unemployment rate, ECB rate decision, Canada GDP, IPPI and RMPI; US personal income and spending, employment cost index, jobless claims, Chicago PMI.

- Friday: Australia AiG manufacturing, PPI; Japan Tokyo CPI, PMI manufacturing final; UK PMI manufacturing final, M4 money supply; US ISM manufacturing index, construction spending.

USD/JPY Daily Outlook

Daily Pivots: (S1) 107.32; (P) 107.54; (R1) 107.71; More...

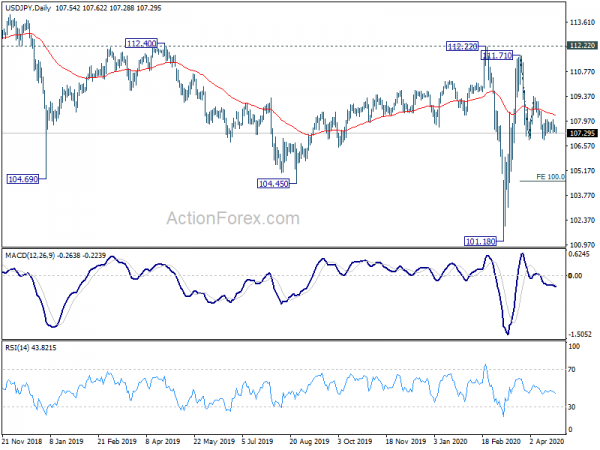

Intraday bias in USD/JPY remains neutral for the moment and further decline remains in favor. On the downside, break of 106.91 will extend the decline from 111.71 to 100% projection of 111.71 to 106.91 from 109.38 at 104.58. On the upside, break of 109.38 will suggest that fall from 111.71 has completed. Intraday bias will be turned back to the upside for 111.71/112.22 resistance zone.

In the bigger picture, at this point, whole decline from 118.65 (Dec 2016) continues to display a corrective look, with well channeling. There is no clear sign of completion yet. Break of 101.18 will target 98.97 (2016 low). Meanwhile, sustained break of 112.22 should confirm completion of the decline and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 3:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 14:30 | USD | Dallas Fed Manufacturing Business Index Apr | -70 |