Sterling surges broadly today on news that UK Prime Minister Theresa May could trigger Article 50 for Brexit this week. The House of Commons is set to debate the Brexit bill today and there is hope for passing the bill unamended. The House of Lords has already approved two amendments to the bill last week, in particular to grant the Parliament a "meaningful vote" on the final agreement. Passing the of bills in Commons today would set the stage for May to start’ her plan for a so-called "hard Brexit". And the announcement could happen as soon as tomorrow. GBP/USD is trading above 1.22 at the time of writing, comparing to last week’s low at 1.2133. EUR/GBP is back at 0.872, comparing to last week’s high at 0.8786. While Sterling recovers today, it’s still holding below near term resistance against Dollar and Euro. Thus, it’s maintaining bearish outlook.

Scotland seeks another independence referendum

Also from UK, Scotland’s First Minister Nicola Sturgeon announced today that she will seek another independence referendum as early as next year as a response to Brexit. She noted that with Brexit, there is a "material change in circumstances" since Scottish voted to stay in UK by 55 to 45 in 2014. She emphasized that "the future of the U.K. looks very different today than it did two years ago." She criticized that while she sought negotiations with UK PM May on Brexit details, the UK government "has not moved even an inch in pursuit of compromise or agreement." Sturgeon targets to have the referendum in late 2018 or early 2019. And by the time, the exact terms of Brexit should be known.

Euro lower as as Dutch vote this week

Euro trades broadly lower today and pares back some of the ECB triggered gains. Focus is turning to the election in the Netherlands this week. Dutch will head to vote and elect their next prime minister. The Netherlands is seen by many as a "fractured" policy environment and as many as 28 parties are running to be a part of the next government. And as many as five parties could be needed to form the coalition even though the Liberals are tipped to secure a majority of votes. While the result of the Dutch election is unlikely to surprise the markets much, some analysts see that as a precursor to French elections in April and May.

Dollar soft ahead of FOMC

Dollar stays weak in general even though in recovers some losses against Euro and Yen. Fed is widely expected to hike interest rate by 25bps this week. However, such expectation should be fully priced in, traders are looking through the FOMC meeting and turning cautious. In particular, Fed’s updated Summary of Projections (SEP) and the monetary policy outlook for the rest of the year would be crucial to Dollar’s trend in near term.

BoJ, BoE, SNB to meet

In addition to FOMC meeting, BoJ, BoE and SNB will announce monetary policy decisions this week. All are scheduled for Thursday and thus, we’ll have a 24 hours of central bank frenzy from Wednesday to Thursday. All, BoJ, BoE and SNB are expected to stand pat. BoJ is expected to maintain the so called yield curve control framework. BoE’s bias would likely stay neutral but may adjust its view on upside risks in inflation. The SNB is expected to leave its sight deposit rate unchanged at -0.75%. These three central bank announcements could end up being non-events.

GBP/USD Mid-Day Outlook

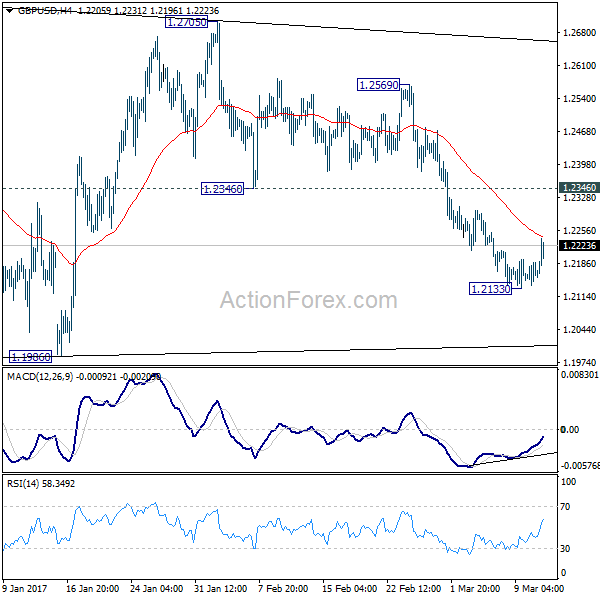

Daily Pivots: (S1) 1.2133; (P) 1.2160; (R1) 1.2187; More…

GBP/USD reaches as high as 1.2398 today so far as recovery from 1.2133 extends. Intraday bias remains neutral for the moment as such rise is seen as a correction. We’d expect upside of recovery to be limited by 1.2346 support turned resistance and bring fall resumption. As noted before, consolidation pattern from 1.1946 is completed at 1.2705 is resuming larger down trend. On the downside, below 1.2133 will turn bias to the downside for retesting 1.1946/86 support zone. Break of 1.1946 will confirm our bearish view. However, sustained break of 1.2346 will dampen out view and turn focus back to 1.2569 resistance first.

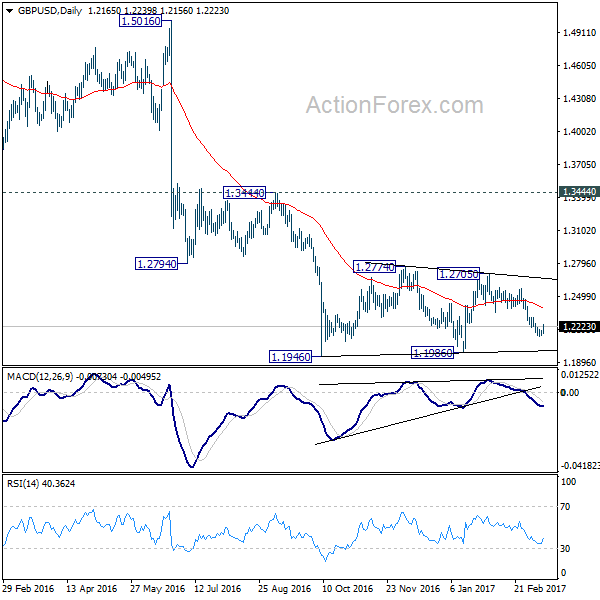

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Feb | -3.20% | 1.00% | 0.50% | |

| 23:50 | JPY | Machine Orders M/M Jan | 1.00% | 0.00% | 6.70% | |

| 4:30 | JPY | Tertiary Industry Index M/M Jan | 0.00% | 0.20% | -0.40% | -0.30% |

| 14:00 | USD | Labor Market Conditions Index Change Feb | 1.3 |