Dollar falls broadly after US non-farm payroll report didn’t provide any shock to the markets. Nevertheless, the headline job growth was still solid, with unemployment rate steady, and wages growth staying at a relatively high level. US 10-year yield dipped initially following the release by quickly recovered. Stocks futures attempted to pare earlier against but failed so far. It remains to be seen if selling in the greenback would pick up any momentum, and whether risk-off sentiment will come back.

Elsewhere in the markets, Canadian Dollar is also relatively unmoved, except versus the greenback, despite strong Canadian employment data. Yen is currently the strongest one thanks to earlier rebound today. Sterling is the second strongest, but it doesn’t really excel much again Euro and Swiss Franc. Aussie appears to lack any momentum to get out of one of the week’s worst position.

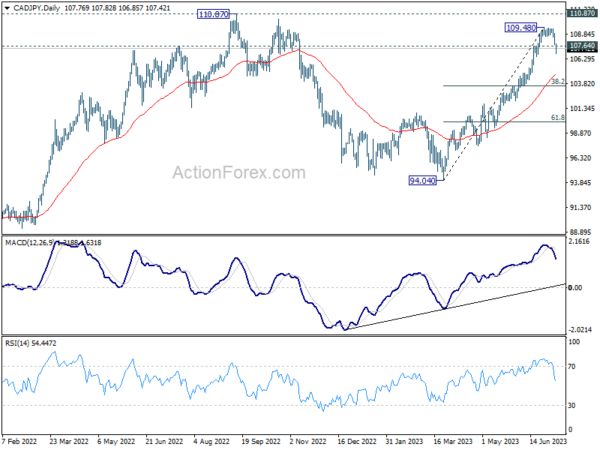

Technically, CAD/JPY’s earlier dive today and break of 107.64 support should confirm short term topping at 109.48, ahead of 110.87 higher. Deeper decline is now in favor in the near term to 55 D EMA (now at 104.74). Reactions from there would reveal whether fall current fall is a correction to rise from 94.04 only, or the third leg of the pattern from 110.87.

In Europe, at the time of writing, FTSE is down -0.24%. DAX is up 0.48%. CAC is up 0.57%. Germany 10-year yield is up 0.024 at 2.651. Earlier in Asia, Nikkei dropped -1.17%. Hong Kong HSI dropped -0.90%. China Shanghai SSE dropped -0.28%. Singapore Strait Times dropped -0.35%. Japan 10-year JGB yield rose 0.0248 to 0.436.

US NFP grew 209k in Jun, lowest since 2020

US non-farm payroll employment grew 209k in June, slightly below expectation of 220k. That’s the lowest level since December 2020. That compares to average of 278k per month over the first 6 months of the year.

Unemployment rate dropped from 3.7% to 3.6%, below expectation of being unchanged at 3.7%. Number of unemployed person was little changed at 6m. Labor force participation rate was unchanged at 2.6% for the fourth consecutive month.

Average hourly earnings rose 0.4% mom, above expectation of 0.3% mom. Average workweek edged up by 0.1 hour to 34.4 hours.

Canada employment up 59.9k in Jun, unemployment rate rose to 5.4%

Canada employment rose 59.9k in June, well above expectation of 19.8k. Employment gains in June were all in full-time work (110k), part-time jobs fell (-50k).

Employment rose in wholesale and retail trade (33k), manufacturing (27k), health care and social assistance (21k) and transportation and warehousing (10k). Meanwhile, declines were recorded in construction (-14k), educational services (-14k) and agriculture (-6k).

Unemployment rate rose from 5.2% to 5.4%, above expectation of 5.3%. There were 1.1m people unemployed in June, an increase of 54k in the month.

Average hourly wages rose 4.2% yoy, down from may’s 5.1% yoy.

ECB Lagarde warns of simultaneous rise in company profits and wages

ECB President Christine Lagarde voiced concerns over lingering inflation risks in a recent interview with Geneviève Van Lède, conducted on July 5.

Lagarde noted that while inflation “has started to decline,” it remains “still higher than our medium-term target of 2%,” according to the ECB’s staff projections. The expectation is for it to remain above target in 2024 and 2025, indicating a continued need to work towards reigning in inflation to meet the target.

On the economic growth front, Lagarde highlighted that growth “has been flat in the last two quarters.” However, she added, “We estimate euro area growth to be around 0.9% in 2023.” She further asserted that “we should see a return to potential growth over the period 2024-25.”

Lagarde also pointed out an interesting development in the context of high inflation. She noted that current period of high inflation did not correspond with a decrease in firms’ profit margins; in fact, margins saw an increase in certain instances, especially where demand for goods and services surpassed supply. Simultaneously, wages have experienced an unexpected rise.

In this complex backdrop, Lagarde stressed, “it is important to know whether firms are going to reduce their margins a little to meet their employees’ expectations of higher wages and to restore some of their purchasing power,” a trend typically seen during past inflation episodes.

Alternatively, there could be a twofold increase in margins and wages. She warned that a simultaneous increase in both would exacerbate inflation risks, cautioning that “we would not stand idly by in the face of such risks.”

BoJ’s Uchida cautions against premature policy shift

BoJ Deputy Governor Shinichi Uchida voiced caution over a hasty shift in monetary policy amid current economic climate. In an interview with Nikkei, Uchida emphasized that Japan was far from needing to hastily raise interest rates.

“The risk of missing the opportunity to achieve our 2% target with a premature policy shift is bigger than that of being too late in tightening policy and allowing inflation to continue running above 2%,” Uchida explained.

Uchida noted the budding changes in Japanese companies’ behavior, which have been rooted in the country’s deflationary period. He stressed the importance of nurturing these developments with care. However, he cautioned that uncertainty remains high over inflation outlook, including impact of pricing behaviors and wage hikes by companies.

“We have not reached a point where we can foresee the 2 percent price stability target can be attained stably and sustainably,” Uchida said. He also recognized the burden placed on households due to more than 2% rise in core CPI, reinforcing the importance of supporting the economy with current monetary easing to stabilize inflation at 2%, in tandem with wage growth.

Uchida also touched on foreign exchange rates, noting the unwanted uncertainty caused by Yen’s rapid and one-sided depreciation. He highlighted the importance of stable foreign exchange rates, which should reflect economic and financial fundamentals. “The BOJ will coordinate with the government, and closely monitor developments in the foreign exchange market and their impact on the economy and prices,” he added.

Japan’s nominal wages surge, yet real wages and household spending stumble

Japanese workers saw their nominal wages surge 2.5% yoy in May, significantly surpassing expected increase of 1.2% yoy. Regular pay, which includes basic salaries, rose by an impressive 1.8% yoy, marking the highest gain since February 1995. Meanwhile, overtime and other non-regular pay saw a modest increase of 0.4% yoy, while special pay including bonuses skyrocketed by 22.2% yoy.

However, inflation-adjusted real wage index tells a different story. It dropped by -1.2% yoy in May, marking a 14-month declining streak. The reduction, nonetheless, was less severe than -3.2% yoy drop experienced a month earlier. This appears to mirror the effects of pay raise agreements established during this year’s “shunto” spring labor-management negotiations.

Despite these wage increases, separate data revealed that Japanese household spending fell -4.0% yoy in May , outpacing median market forecast for a -2.4% yoy drop. This decline extended for the third month and affected a range of expenses from food to clothing to transportation. On a seasonally adjusted monthly basis, household spending dipped by -1.1% mom, This represents the fourth consecutive month of decline.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 143.53; (P) 144.10; (R1) 144.63; More…

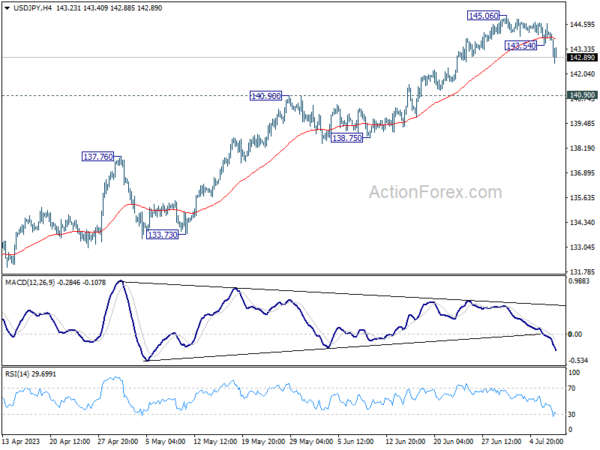

Intraday bias in USD/JPY is back on the downside with break of 143.54 temporary low. Deeper decline would be seen as corrective fall from 145.06 extends. But still, overall outlook remains bullish with 140.90 resistance turned support intact. Break of 145.06 will resume larger rise to 161.8% projection of 127.20 to 137.90 from 129.62 at 146.93.

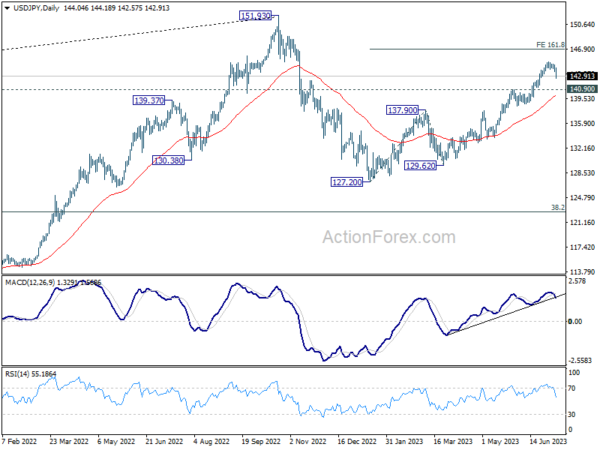

In the bigger picture, rise from 127.20 is currently seen as the second leg of the corrective pattern from 151.93 high. Further rally is expected as long as 138.75 support holds, to retest 151.93. But strong resistance could be seen there to limit upside. Break of 138.75 will indicate the the third leg has started back towards 127.20.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y May | 2.50% | 1.20% | 1.00% | 0.80% |

| 23:30 | JPY | Overall Household Spending Y/Y May | -4.00% | -2.40% | -4.40% | |

| 05:00 | JPY | Leading Economic Index May P | 109.50% | 97.50% | 96.80% | |

| 05:45 | CHF | Unemployment Rate Jun | 2.00% | 2.00% | 2.00% | |

| 06:00 | EUR | Germany Industrial Production M/M May | -0.20% | 0.10% | 0.30% | |

| 06:45 | EUR | France Trade Balance (EUR) May | -8.4B | -9.5B | -9.7B | -10.6B |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Jun | 725B | 734B | ||

| 08:00 | EUR | Italy Retail Sales M/M May | 0.70% | 0.10% | 0.20% | |

| 12:30 | USD | Nonfarm Payrolls Jun | 209K | 220K | 339K | 306K |

| 12:30 | USD | Unemployment Rate Jun | 3.60% | 3.70% | 3.70% | |

| 12:30 | USD | Average Hourly Earnings M/M Jun | 0.40% | 0.30% | 0.30% | 0.40% |

| 12:30 | CAD | Net Change in Employment Jun | 59.9K | 19.8K | -17.3K | |

| 12:30 | CAD | Unemployment Rate Jun | 5.40% | 5.30% | 5.20% | |

| 14:00 | CAD | Ivey PMI Jun | 50.9 | 53.5 |