Yen weakens mildly today even though BoJ offered a brighter view on the economy after keeping monetary policies unchanged. Interest rate was held at -0.1% and the asset purchase program was also kept unchanged under the yield curve control framework. The vote on YCC was by 7-2 vote with policymakers Sato and Kiuchi opposing. The central bank noted in the statement that "Japan’s economy continues to recover moderately as a trend", with consumption "moving on a firm note".Though, CPI is expected to be "slightly negative or about 0 percent for the time being. BoJ also noted that risks to the outlook including development in "emerging and commodity exporting economies", particularly China; developments in US; and Brexit. Separately, the Japanese government projected the real GDP to grow 1.5% in the year starting next April, revised up from prior projection of 1.2%. Nominal GDP growth is projected to be 2.5%, up from prior projection of 2.2%. CPI is forecast to be at 1.1%, down from prior estimate of 1.4%. Meanwhile, the initial budget for next fiscal year is JPY 97.5T, a mild 0.8% from the current year.

Released earlier in the day, the RBA minutes for the December meeting warned of the high levels of household debt due to low interest rates. The central bank left its cash rate unchanged at 1.5% this month. As suggested in the minutes, "over recent years, the board had sought to balance the benefits of lower interest rates in supporting growth and achieving the inflation target with the potential risks to household balance sheets…Members recognized that this balance would need to be kept under review". The central bank remained cautious over the job market, reiterating that there was "considerable uncertainty" about the employment situation and "there was expected to be excess capacity in the labour market for some time, which was consistent with further indications of subdued labour cost pressures".

In US, Fed Chair Janet Yellen’s keynote speech at the University of Baltimore did lift yields a bit. While not offering hints for the monetary policy outlook, Yellen was upbeat over the employment conditions. As she suggested that the US is at "the strongest job market in a decade" and that "there are also indications that wage growth is picking up". However, she also added that that productivity growth was disappointing.

On the data front, Swiss will release trade balance today. German PPI, Eurozone current account and UK CBI realized sales will also be featured. Canada wholesale sales will be released in US session.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 143.98; (P) 145.64; (R1) 146.75; More…

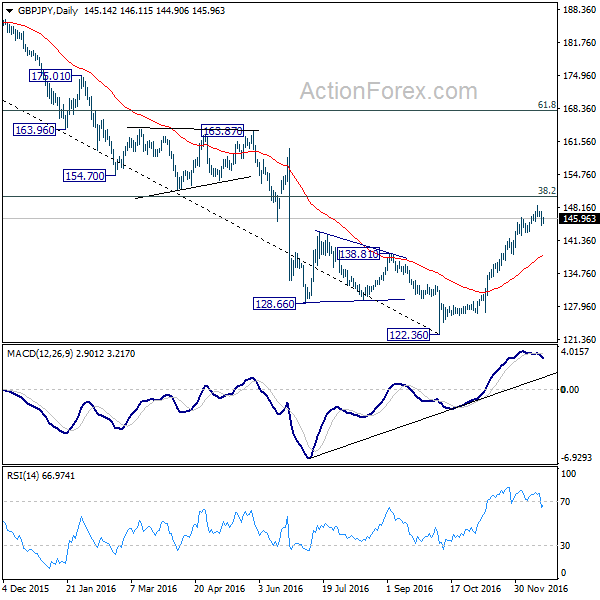

GBP/JPY formed a temporary top at 148.42 and turn into consolidation. The pair recovered mildly after breaching 4 hours 55 EMA but stays in range. Intraday bias remains neutral for sideway trading. Further rally is expected as long as 142.98 support holds and above 148.42 will target long term fibonacci level at 150.43. As rebound from 122.36 is seen as part of a correction pattern, we’d be cautious on topping at 150.43 on first attempt. Meanwhile, considering bearish divergence condition in 4 hours MACD, break of 142.98 should confirm short term topping and turn bias to the downside for 55 days EMA (now at 138.53).

In the bigger picture, the down trend from 195.86 top (2015 high) should have made a medium term bottom at 122.36 after hitting 100% projection of 195.86 to 154.70 from 163.87 at 122.71. Rise from there is now expected to develop into a medium term corrective pattern. Further rise should be seen to 38.2% retracement of 195.86 to 122.36 at 150.4. We’d expect strong resistance from there to limit upside. But sustained break there will extend the rise to 61.8% retracement at 167.78.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| JPY | BOJ Monetary Policy Statement | |||||

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 07:00 | CHF | Trade Balance (CHF) Nov | 3.57B | 2.68B | ||

| 07:00 | EUR | German PPI M/M Nov | 0.10% | 0.70% | ||

| 07:00 | EUR | German PPI Y/Y Nov | -0.20% | -0.40% | ||

| 09:00 | EUR | Eurozone Current Account (EUR) Oct | 24.2B | 25.3B | ||

| 11:00 | GBP | CBI Realized Sales Dec | 20 | 26 | ||

| 13:30 | CAD | Wholesale Sales M/M Oct | 0.30% | -1.20% |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box