Dollar weakens against Euro, Aussie and Canadian in early US session despite solid non-farm payroll report. The selloff is, at this point, seen as a sell-on-news move. Canadian dollar is supported by its own job data. The set of NFP should have done nothing to alter Fed’s decision to hike interest rate next week. Nonetheless, without a surge in wage growth, the report doesn’t add to the case for more than three hikes this year. Focus will turn to next week’s FOMC meeting, with new economic projections.

NFP showed 235k growth in the US job market in February, above expectation of 190k. Prior month’s figure was revised up from 227k to238k. Unemployment rate dropped 0.1% to 4.7% as expected. Average hourly earnings rose 0.2% mom in February, missing expectation of 0.3% mom. Nonetheless, prior month’s wage growth was revised up from 0.1% mom to 0.2% mom. Canadian job market grew 15.3k in February, way better than expectation of -15.5k. Unemployment rate also unexpectedly dropped to 6.6%, versus consensus of 6.8%.

UK inflation expectations climbed to three year high

The BoE’s quarterly Inflation Attitudes survey released today showed inflation expectation surged to highest level in three years. The consumer medium expectation for price growth over the next 12 months was at 2.9%, highest since 2013. That was up from prior 2.8% at prior survey back in November. Five year inflation expectations jumped to 3.2%, up from prior 3.1%. Meanwhile, 42% of respondents expected interest rates to rise over the next 12 months. 28% said interest rate would stay unchanged. Only 6% expected inflation rate to fall.

Released from UK, industrial production dropped -0.4% mom, rose 3.2% yoy in January. Manufacturing production dropped -0.9% mom, rose 2.7% yoy. Construction output dropped -0.4% mom. Visible trade deficit narrowed to GBP -10.8b. Also from Europe, German trade surplus widened slightly to EUR 18.5b in January.

Short term JGB yields rose

In Japan, short term JGB yields rose today as BoJ reduced the size of purchase of corresponding maturities. The one- to three- year JGB purchase was lowered to JPY 300b, JPY 20b lower than prior purchase last week, and was the smaller amount since September 2014. Purchase of discount bills was lowered to JPY 250b, smallest since 2015. Two year JGB yield rose 1.5 basis points to -0.255%. Three-month bill yields rose 1.5 basis points to -0.399%. Japan’s BSI large manufacturing index dropped to 1.1 in Q1.

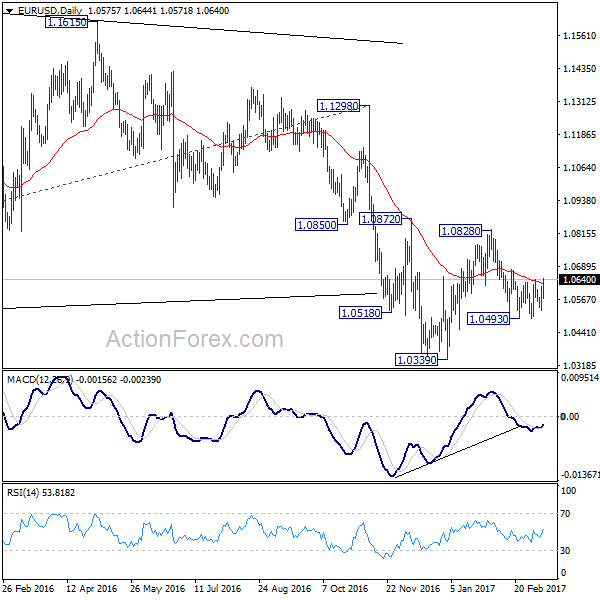

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0528; (P) 1.0572 (R1) 1.0619; More…..

EUR/USD extends the post-ECB rally today and breaches 1.0630 resistance again. The development suggests that pull back from 1.0828 has completed at 1.0493 already. More importantly, corrective rise from 1.0339 is possibly still in progress for another rising leg. Intraday bias is mildly on the upside for 1.0678 resistance first. Break will send EUR/USD through 1.0828 resistance.

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large Manufacturing Q/Q Q1 | 1.1 | 8.4 | 7.5 | |

| 00:30 | AUD | Home Loans Jan | 0.50% | -1.00% | 0.40% | 0.20% |

| 07:00 | EUR | German Trade Balance (EUR) Jan | 18.5B | 18.0B | 18.4B | 18.3B |

| 09:30 | GBP | Industrial Production M/M Jan | -0.40% | -0.50% | 1.10% | 0.90% |

| 09:30 | GBP | Industrial Production Y/Y Jan | 3.20% | 3.20% | 4.30% | |

| 09:30 | GBP | Manufacturing Production M/M Jan | -0.90% | -0.70% | 2.10% | 2.20% |

| 09:30 | GBP | Manufacturing Production Y/Y Jan | 2.70% | 2.90% | 4.00% | |

| 09:30 | GBP | Construction Output M/M Jan | -0.40% | -0.40% | 1.80% | |

| 09:30 | GBP | Visible Trade Balance (GBP) Jan | -10.8B | -11.1B | -10.9B | |

| 13:05 | GBP | NIESR GDP Estimate Feb | 0.60% | 0.60% | 0.70% | 0.80% |

| 13:30 | CAD | Net Change in Employment Feb | 15.3K | -15.5k | 48.3k | |

| 13:30 | CAD | Unemployment Rate Feb | 6.60% | 6.80% | 6.80% | |

| 13:30 | USD | Change in Non-farm Payrolls Feb | 235K | 190k | 227k | 238K |

| 13:30 | USD | Unemployment Rate Feb | 4.70% | 4.70% | 4.80% | |

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.20% | 0.30% | 0.10% | 0.20% |

| 15:00 | GBP | NIESR GDP Estimate Feb | 0.60% | 0.70% |