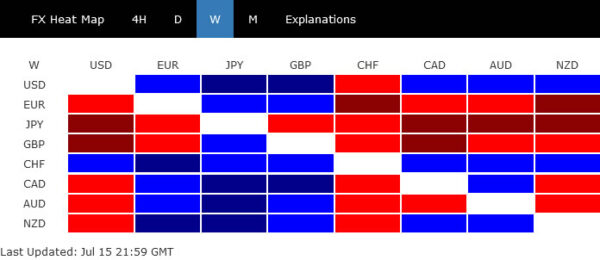

Dollar was the strongest one for most part of the week, and even breached parity against Euro. But the greenback pared gains on late turn in market sentiment, and ended as the second best only. Swiss Franc was surprisingly the best performer, while Kiwi was the third. Yen was the weakest one, as selloff continued on diverging central bank path with other peers. Sterling and Euro were the next weakest. Canadian Dollar just ended mixed even though BoC surprised the markets with a mega 100bps hike.

Investors are now still expecting “just” a 75bps rate hike by Fed this month, and that helped sentiment recovered. Considering the prospect of stronger rebound is stocks, risk of a pull back in the greenback is growing, except versus Yen. Additionally, Euro might finally rebound on short covering after failing to break through parity against Dollar decisively. Gold is also approaching a key support level.

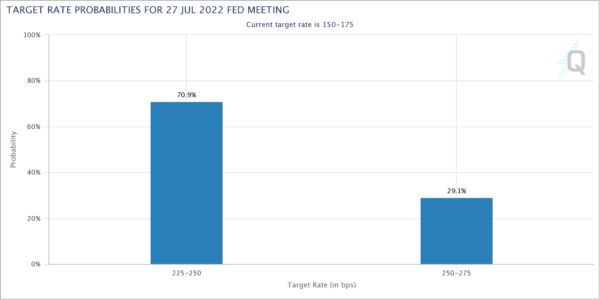

Markets pricing in 71% chance of 75bps Fed hike in Jul

There surprised mega hike of 100bps by BoC last week prompted speculations that Fed will follow at its July 27 decision. Markets were once pricing in 50/50 chance of that happening. But such speculations receded after comments from some Fed officials. The messages are that firstly, with a 75bps hike to 2.25% to 2.50%, federal funds rate will already be in the neutral range. Secondly, a 100bps won’t make a huge difference from a 75bps at this point.

Additionally, the University of Michigan consumer survey showed that inflation expectations were easing. Five-year inflation expectations dropped from 3.1% to 2.8%, hitting the lowest level in a year. One-year inflation expectation also ticked down from 5.3% to 5.2%, lowest since February. There are hopes of realized inflation data to start reverse in the upcoming periods.

Fed will have nearly two months of data between July and September FOMC meeting, with interest rate at neutral, before gauging the next move. A 75bps hike is still sensible. Anyways, Fed fund futures are pricing in 71% chance of a 75bps hike, 29% of 100bps.

DOW staged relief rebound, more upside ahead?

US stocks staged a relief rebound towards the end of the week. It’s still early to conclude, but DOW’s corrective fall from 36952.65 appears to have completed with three waves down to 29653.29. That came after hitting 30k handle, and 38.2% retracement of 18213.65 to 36952.65 at 29794.35.

Firm break of 31511.46 resistance will affirm this bullish case. Sustained trading above 55 day EMA (now at 31866.31) will pave the way to 55 week EMA (now at 33237.69). Such development could start happening in Q3, if incoming data really starts to show topping in US inflation, while keeping the economy robust, and as Fed starts to slow its pace of tightening.

10-year yield continues sideway consolidation

Outlook in 10-year yield is unchanged as it gyrated around 55 day EMA last week. Price actions from 3.483 are seen as a medium term consolidation pattern, with range set between 2.709 and 3.483). It’s probably in the second leg of the pattern and further rise might be seen. But upside should be capped by 3.483. It will take a while more to complete the whole pattern.

Dollar index continued up trend, but looks a bit stretched

Dollar index’s up trend continued last week but it’s looking a bit stretched close to medium term channel resistance. Considering that risk-off sentiment might recede while treasury yield stay steady, a pull back in DXY is no unrealistic. Break of 106.92 support should indicate the start of a correction back to 55 day EMA (now at 104.27).

But of course, before break of 106.92 support, recent up trend is still in favor to continue, towards long term channel resistance (now at around 113).

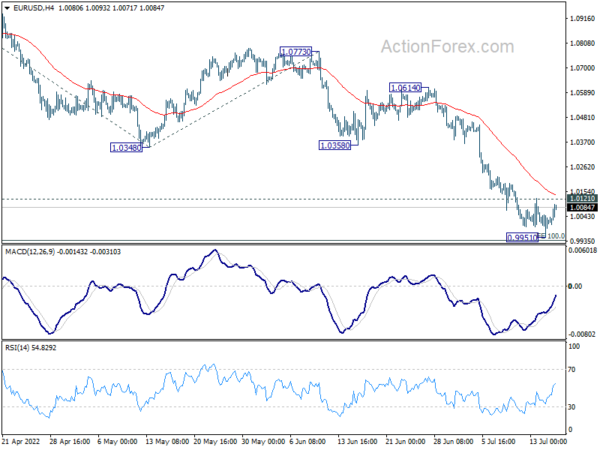

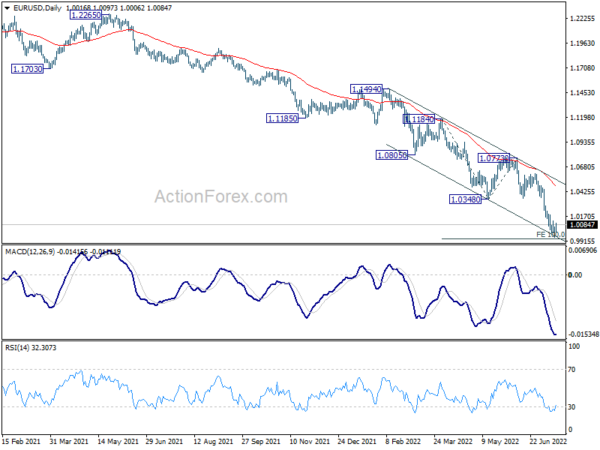

EUR/USD to rebound after defending parity? Gold to reverse?

To further assess the chance of a pull back in Dollar, some attention is paid to both EUR/USD and Gold. EUR/USD is still defending parity, despite dipping to 0.9951. Downside momentum has been diminishing, as seen in 4 hour MACD, as it approached 100% projection of 1.1184 to 1.0348 from 1.0773 at 0.9937. A break above 1.0121 minor resistance will indicate short term bottoming, and bring stronger rebound back to 1.0348 support turned resistance.

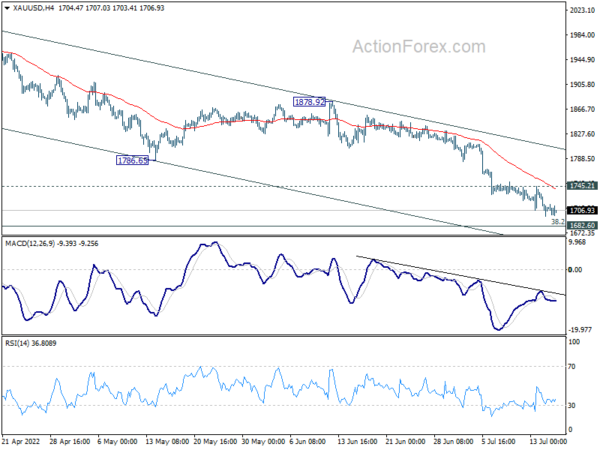

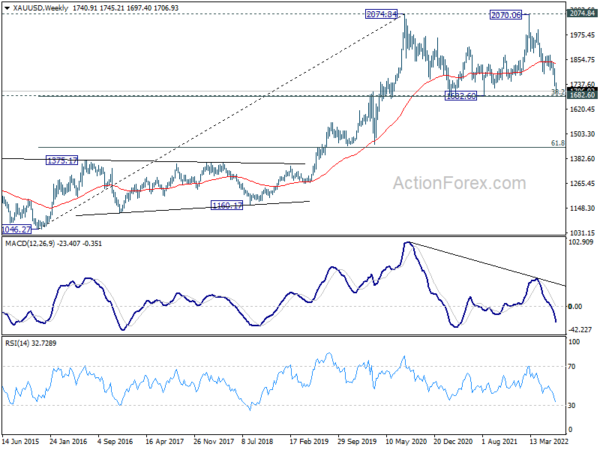

Gold is now close to an important long term support level at 1682.60, with 38.2% retracement of 1046.27 to 2074.84 at 1681.92. Strong support should be seen at this level to complete the three wave consolidation pattern from 2074.84 (2020 high). Break of 1745.21 minor resistance will be the first sign of reversal, and bring stronger rebound back to 1786.65/1878.92 resistance zone. If both EUR/USD and Gold manage to rebound, for the short term at least, Dollar should nautrally be starting a pull back.

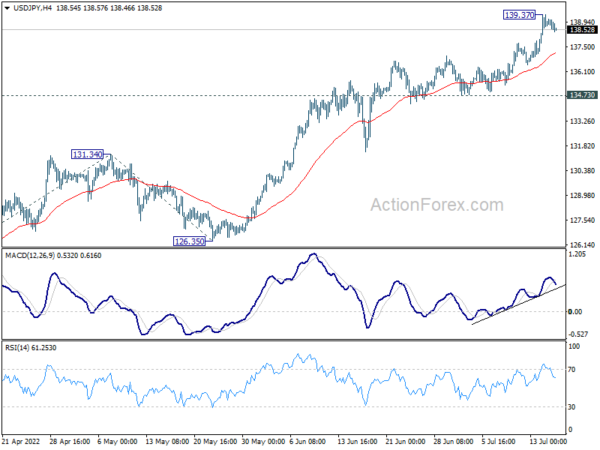

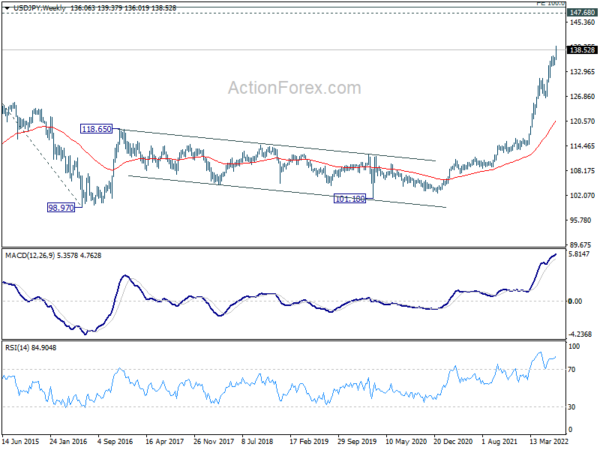

USD/JPY Weekly Outlook

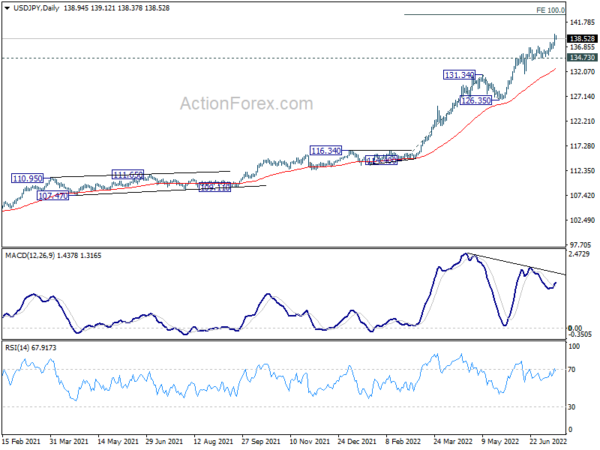

USD/JPY’s up trend resumed last week and hit as high as 139.37. With a temporary top in place, initial bias is turned neutral this week for consolidations. But downside of retreat should be contained by 134.73 support. On the upside, break of 139.37 will resume larger up trend to 100% projection of 114.40 to 131.34 from 126.35 at 143.29.

In the bigger picture, current rally is seen as part of the long term up trend from 75.56 (2011 low). Next target is 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, which is close to 147.68 (1998 high). This will remain the favored case as long as 126.35 support holds.

In the long term picture, the up trend from 75.56 (2011 low) long term bottom to 125.85 (2015 high) has just resumed. Next target is 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, which is close to 147.68 (1998 high).